Transfer of Assets Instructions 2024-2026

Understanding the Transfer of Assets Instructions

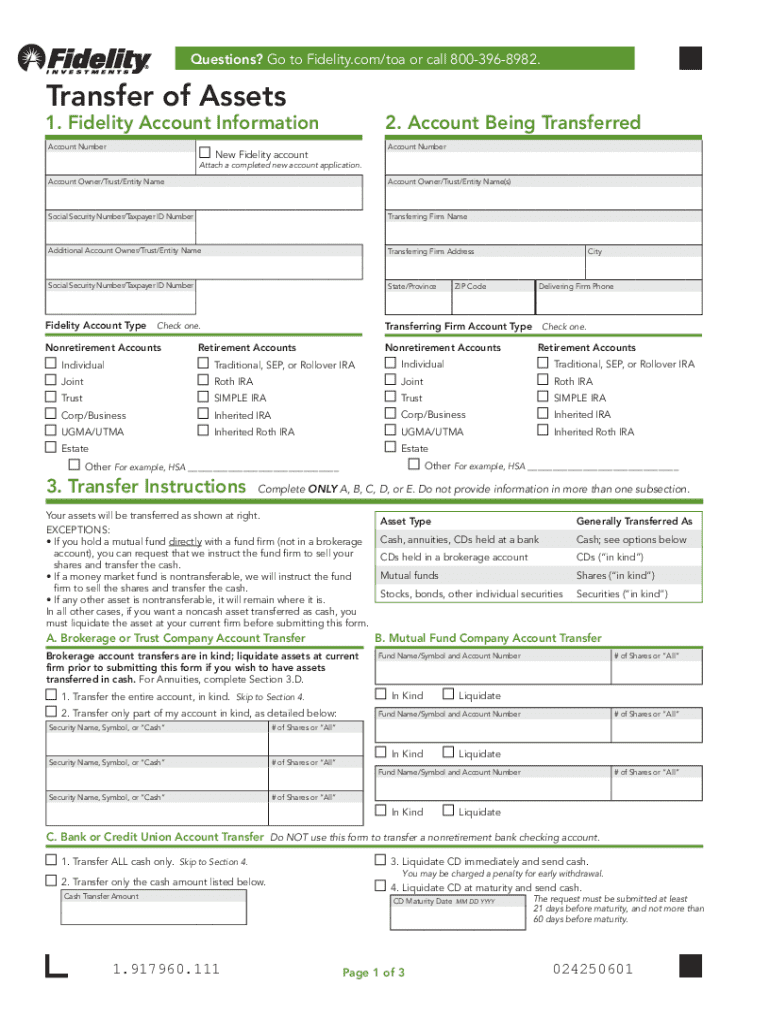

The transfer of assets instructions provide a clear framework for moving assets from one Fidelity account to another. This process is essential for individuals looking to consolidate their investments or manage their portfolios more effectively. Understanding these instructions ensures that the transfer is executed smoothly and complies with all necessary regulations.

Steps to Complete the Transfer of Assets Instructions

Completing the transfer of assets involves several key steps:

- Gather necessary account information, including account numbers and types of assets.

- Obtain the transfer assets form from Fidelity, which outlines the required details.

- Fill out the form accurately, ensuring all asset types are listed.

- Submit the completed form to Fidelity through the preferred submission method.

- Monitor the transfer process to confirm that all assets have been moved successfully.

Required Documents for Asset Transfer

To facilitate a seamless transfer of assets, certain documents are typically required. These may include:

- Completed transfer assets form.

- Proof of identity, such as a government-issued ID.

- Account statements from both the sending and receiving accounts.

- Any additional documentation requested by Fidelity to verify asset ownership.

Form Submission Methods

Fidelity offers various methods for submitting the transfer assets form, allowing users to choose the most convenient option. These methods include:

- Online submission through the Fidelity website.

- Mailing the completed form to the designated Fidelity address.

- In-person submission at a local Fidelity branch.

Legal Considerations for Asset Transfers

It is vital to understand the legal implications of transferring assets. Ensure that all transfers comply with IRS regulations and state laws. This includes verifying that the assets being transferred are eligible and that all necessary disclosures are made. Non-compliance can lead to penalties or delays in the transfer process.

Examples of Asset Transfer Scenarios

Various scenarios may necessitate the transfer of assets, such as:

- Consolidating multiple investment accounts into a single Fidelity account.

- Transferring assets due to a change in financial advisors.

- Moving assets in preparation for retirement or other financial planning strategies.

Eligibility Criteria for Asset Transfers

Before initiating a transfer, it is important to check the eligibility criteria. Generally, the following conditions apply:

- Both accounts must be valid and active within Fidelity.

- The assets to be transferred must be eligible for transfer according to Fidelity's policies.

- Account holders must be in good standing with no outstanding issues.

Create this form in 5 minutes or less

Find and fill out the correct transfer of assets instructions

Create this form in 5 minutes!

How to create an eSignature for the transfer of assets instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to transfer assets from a Fidelity account?

To transfer assets from a Fidelity account, you need to initiate a transfer request through your new brokerage or financial institution. They will guide you through the necessary steps, including filling out a transfer form and providing your Fidelity account details. Ensure you have all required documentation ready to facilitate a smooth transfer of assets.

-

Are there any fees associated with transferring assets from a Fidelity account?

Fidelity typically does not charge fees for transferring assets to another brokerage. However, it's essential to check with both Fidelity and your new brokerage for any potential fees that may apply during the transfer process. Understanding these costs can help you make an informed decision when transferring assets from a Fidelity account.

-

How long does it take to transfer assets from a Fidelity account?

The time it takes to transfer assets from a Fidelity account can vary, but it generally takes between 5 to 10 business days. Factors such as the type of assets being transferred and the efficiency of both financial institutions can affect the timeline. It's advisable to stay in contact with both parties for updates during the transfer process.

-

Can I transfer my retirement assets from a Fidelity account?

Yes, you can transfer retirement assets from a Fidelity account to another qualified retirement account, such as an IRA or 401(k). This process is often referred to as a rollover. Be sure to follow the specific guidelines for rollovers to avoid any tax implications when transferring assets from a Fidelity account.

-

What documents do I need to transfer assets from a Fidelity account?

To transfer assets from a Fidelity account, you will typically need to provide a completed transfer form, your Fidelity account number, and any additional documentation required by your new brokerage. It's important to check with both Fidelity and the receiving institution for any specific requirements to ensure a smooth transfer process.

-

Is it safe to transfer assets from a Fidelity account?

Yes, transferring assets from a Fidelity account is generally safe, as both Fidelity and the receiving institution have protocols in place to protect your information. Ensure that you are following secure methods for submitting your transfer request and verify the legitimacy of the receiving institution. This will help safeguard your assets during the transfer process.

-

What are the benefits of transferring assets from a Fidelity account?

Transferring assets from a Fidelity account can provide several benefits, including access to better investment options, lower fees, or improved customer service at your new brokerage. Additionally, consolidating your accounts can simplify your financial management. Evaluating your options can help you make the best decision for your financial goals.

Get more for Transfer Of Assets Instructions

Find out other Transfer Of Assets Instructions

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service