John Hancock Rollover Form

What is the John Hancock Rollover Form

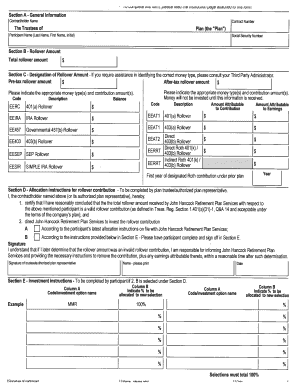

The John Hancock Rollover Form is a crucial document used by individuals to transfer funds from one retirement account to another. This form is specifically designed for those who wish to rollover their retirement savings, such as from a 401(k) or other qualified plans, into an Individual Retirement Account (IRA) or another employer-sponsored plan. The rollover process allows individuals to maintain the tax-deferred status of their retirement funds while changing the account's management or investment options.

How to use the John Hancock Rollover Form

Using the John Hancock Rollover Form involves several straightforward steps. First, individuals must gather necessary information about their current retirement account and the new account where the funds will be transferred. Next, the form requires personal identification details, including Social Security number and contact information. After completing the form, it should be submitted to the appropriate financial institution or plan administrator to initiate the rollover process. It is important to ensure that all information is accurate to avoid delays.

Steps to complete the John Hancock Rollover Form

Completing the John Hancock Rollover Form involves a series of steps:

- Gather your current account details, including account numbers and balances.

- Provide your personal information, such as name, address, and Social Security number.

- Indicate the type of rollover you are requesting, whether direct or indirect.

- Specify the receiving account details, including the financial institution and account number.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate party for processing.

Required Documents

When completing the John Hancock Rollover Form, certain documents may be required to support the rollover request. These typically include:

- A copy of your current retirement account statement.

- Identification documents, such as a driver's license or Social Security card.

- Any additional forms required by the receiving institution.

Having these documents ready can help streamline the rollover process and ensure compliance with any legal requirements.

Form Submission Methods

The John Hancock Rollover Form can be submitted through various methods, depending on the preferences of the individual and the policies of the receiving institution. Common submission methods include:

- Online submission through the financial institution's secure portal.

- Mailing the completed form to the designated address.

- In-person delivery at a local branch of the financial institution.

Choosing the appropriate method can facilitate a smoother and quicker processing of the rollover request.

Eligibility Criteria

To use the John Hancock Rollover Form, individuals must meet specific eligibility criteria. Generally, eligibility includes:

- Being a participant in a qualified retirement plan.

- Having a vested balance in the current retirement account.

- Meeting any age requirements set forth by the current plan.

Understanding these criteria is essential to ensure that the rollover process can be initiated without complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the john hancock rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the John Hancock Rollover Form?

The John Hancock Rollover Form is a document used to transfer retirement funds from one account to another, typically from a 401(k) to an IRA. This form ensures that your funds are moved securely and without incurring taxes or penalties. Using airSlate SignNow, you can easily eSign and send this form electronically.

-

How can I complete the John Hancock Rollover Form using airSlate SignNow?

To complete the John Hancock Rollover Form with airSlate SignNow, simply upload the document to our platform. You can then fill in the required fields, add your electronic signature, and send it directly to the necessary parties. Our user-friendly interface makes the process quick and efficient.

-

Is there a cost associated with using the John Hancock Rollover Form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing documents, including the John Hancock Rollover Form. Pricing plans vary based on features and usage, but we provide a free trial to help you explore our services. This allows you to assess the value of our platform before committing.

-

What features does airSlate SignNow offer for the John Hancock Rollover Form?

airSlate SignNow provides several features for the John Hancock Rollover Form, including customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process and enhance the security of your sensitive information. Additionally, you can integrate with various applications for seamless workflow management.

-

What are the benefits of using airSlate SignNow for the John Hancock Rollover Form?

Using airSlate SignNow for the John Hancock Rollover Form offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and send documents quickly, saving you time and effort. Plus, electronic signatures are legally binding, ensuring your transactions are valid.

-

Can I track the status of my John Hancock Rollover Form after sending it?

Yes, airSlate SignNow allows you to track the status of your John Hancock Rollover Form after sending it. You will receive notifications when the document is viewed, signed, or completed. This feature helps you stay informed and ensures that your rollover process is progressing smoothly.

-

Does airSlate SignNow integrate with other financial services for the John Hancock Rollover Form?

Absolutely! airSlate SignNow integrates with various financial services and applications, making it easier to manage your John Hancock Rollover Form alongside other financial documents. This integration helps streamline your workflow and ensures that all your important documents are in one place.

Get more for John Hancock Rollover Form

Find out other John Hancock Rollover Form

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe