Sc 40 Indiana Elderly Tax Form 2024

What is the SC 40 Indiana Elderly Tax Form

The SC 40 Indiana Elderly Tax Form is a specific tax document designed for seniors in Indiana. This form allows eligible elderly residents to apply for property tax deductions, which can significantly reduce their tax burden. The SC 40 form is particularly beneficial for those aged sixty-five and older, helping them manage their finances during retirement. By completing this form, seniors can take advantage of state-provided tax relief, ensuring they retain more of their income for essential expenses.

Eligibility Criteria for the SC 40 Indiana Elderly Tax Form

To qualify for the SC 40 Indiana Elderly Tax Form, applicants must meet certain criteria. Primarily, the individual must be at least sixty-five years old by December thirty-first of the tax year for which the deduction is claimed. Additionally, applicants must own the property for which they are seeking the deduction, and it must be their primary residence. Income limits may also apply, which are determined annually by the state. Meeting these eligibility requirements is crucial for successfully obtaining tax relief through this form.

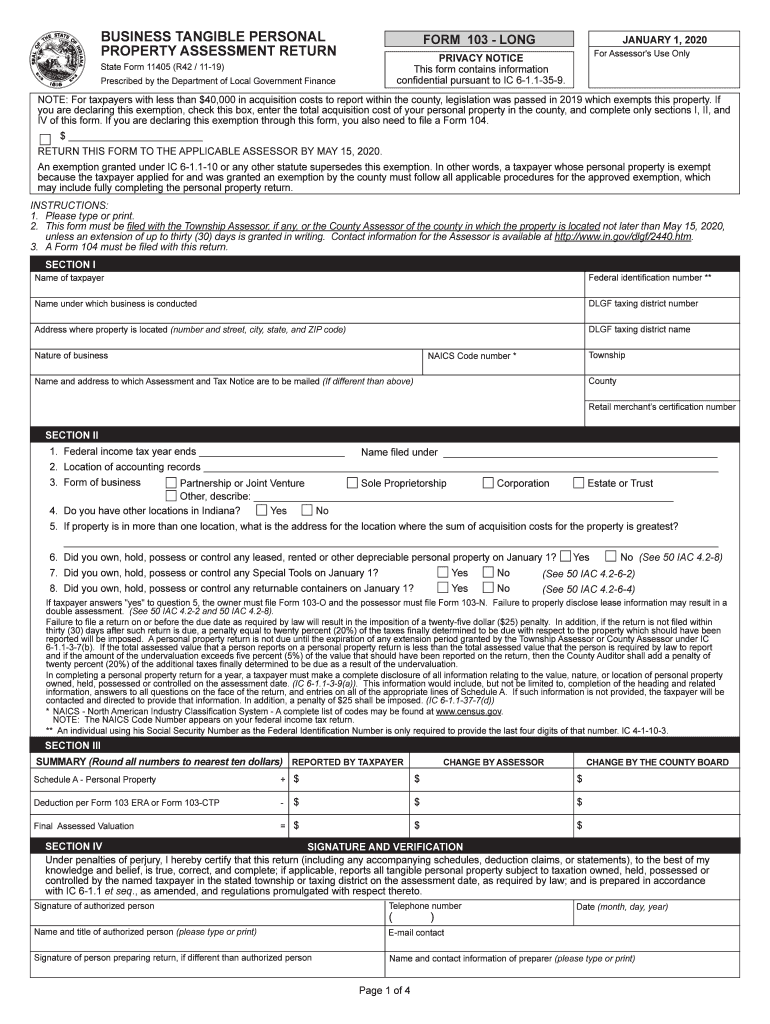

Steps to Complete the SC 40 Indiana Elderly Tax Form

Completing the SC 40 Indiana Elderly Tax Form involves several straightforward steps:

- Gather necessary documents, including proof of age, property ownership, and income statements.

- Obtain the SC 40 form from the Indiana Department of Local Government Finance or local county assessor's office.

- Fill out the form accurately, providing all required information, such as personal details and property information.

- Review the completed form for accuracy and ensure all supporting documents are attached.

- Submit the form to the local county assessor's office by the specified deadline.

Required Documents for the SC 40 Indiana Elderly Tax Form

When applying for the SC 40 Indiana Elderly Tax Form, several documents are required to verify eligibility. These typically include:

- A copy of the applicant's birth certificate or another form of age verification.

- Proof of property ownership, such as a deed or tax bill.

- Income documentation, which may include recent tax returns or Social Security statements.

Providing these documents ensures a smooth application process and helps prevent delays in receiving the tax deduction.

Form Submission Methods for the SC 40 Indiana Elderly Tax Form

The SC 40 Indiana Elderly Tax Form can be submitted through various methods to accommodate applicants' preferences. These methods include:

- Online Submission: Some counties may allow electronic submissions through their official websites.

- Mail: Applicants can send the completed form and supporting documents via postal service to their local county assessor's office.

- In-Person: Submitting the form in person at the county assessor's office is also an option, allowing for immediate confirmation of receipt.

Key Elements of the SC 40 Indiana Elderly Tax Form

The SC 40 form contains several key elements that applicants must complete accurately. These include:

- Applicant Information: Personal details such as name, address, and date of birth.

- Property Details: Information about the property for which the deduction is being claimed, including its location and assessed value.

- Income Information: Details regarding the applicant's income, which may affect eligibility for the deduction.

Understanding these elements is essential for ensuring that the form is filled out correctly and all necessary information is provided.

Create this form in 5 minutes or less

Find and fill out the correct sc 40 indiana elderly tax form

Create this form in 5 minutes!

How to create an eSignature for the sc 40 indiana elderly tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 40 Indiana elderly tax form?

The SC 40 Indiana elderly tax form is a tax credit application for eligible elderly residents in Indiana. This form allows seniors to claim a property tax deduction, helping to reduce their overall tax burden. Understanding how to fill out this form can signNowly benefit elderly taxpayers.

-

How can airSlate SignNow help with the SC 40 Indiana elderly tax form?

airSlate SignNow provides a seamless platform for electronically signing and sending the SC 40 Indiana elderly tax form. With our user-friendly interface, you can easily complete and submit your tax documents without the hassle of printing or mailing. This saves time and ensures your forms are submitted securely.

-

Is there a cost associated with using airSlate SignNow for the SC 40 Indiana elderly tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring that you can manage your SC 40 Indiana elderly tax form without breaking the bank. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for managing tax forms like the SC 40 Indiana elderly tax form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to manage your SC 40 Indiana elderly tax form efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the SC 40 Indiana elderly tax form?

Absolutely! airSlate SignNow integrates with various applications, allowing you to streamline your workflow when handling the SC 40 Indiana elderly tax form. Whether you use accounting software or document management systems, our integrations enhance your productivity.

-

What are the benefits of using airSlate SignNow for the SC 40 Indiana elderly tax form?

Using airSlate SignNow for the SC 40 Indiana elderly tax form offers numerous benefits, including increased efficiency and reduced paperwork. Our platform ensures that your documents are securely signed and stored, minimizing the risk of errors. This allows you to focus on what matters most—your financial well-being.

-

Is airSlate SignNow secure for submitting the SC 40 Indiana elderly tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your SC 40 Indiana elderly tax form is submitted safely. We use advanced encryption and secure servers to protect your sensitive information. You can trust us to handle your tax documents with the utmost care.

Get more for Sc 40 Indiana Elderly Tax Form

- Pellissippi transcript request form

- Liberty dental referral form

- Home loan application form for individual sole bdo unibank inc

- Dhs 1273c form

- Kane county illinois raffle license form

- Jd cv 40 form

- Death benefits information for participants and beneficiaries a compact guide that provides information about the distribution

- Fillable online u s department of justice omb1125 0012 form

Find out other Sc 40 Indiana Elderly Tax Form

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple