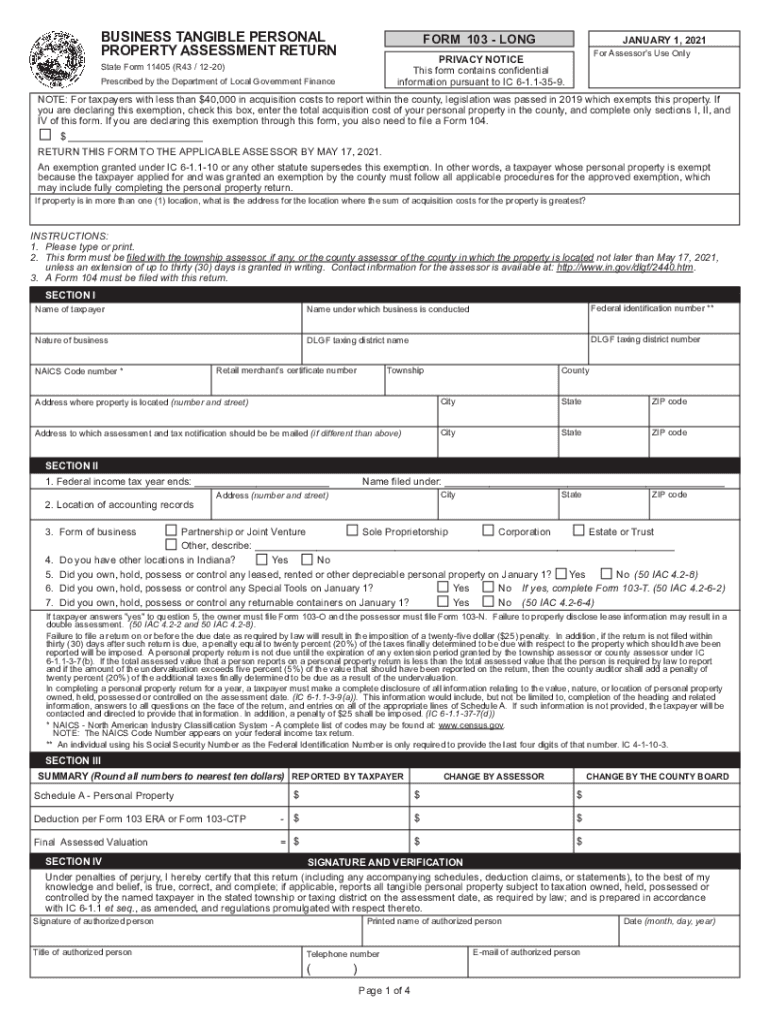

DLGF Personal Property Forms in Gov 2020

Understanding the SC 40 Indiana Elderly Tax Form

The SC 40 Indiana Elderly Tax Form is a crucial document for eligible seniors in Indiana seeking property tax deductions. This form allows elderly homeowners to apply for tax relief based on their age and income level. Understanding the eligibility criteria and the purpose of this form can help seniors maximize their benefits and ensure they are not overpaying on property taxes.

Eligibility Criteria for the SC 40 Form

To qualify for the SC 40 Indiana Elderly Tax Form, applicants must meet specific requirements. Generally, applicants must be at least sixty-five years old by the end of the tax year. Additionally, they must have an adjusted gross income that falls below a certain threshold. This income limit is updated annually, so it is essential to check the latest guidelines. Homeownership is also a prerequisite, as the form applies exclusively to property taxes on primary residences.

Steps to Complete the SC 40 Form

Filling out the SC 40 form involves several key steps:

- Gather necessary documents, including proof of age, income statements, and property tax information.

- Carefully fill out the form, ensuring all personal information is accurate and complete.

- Calculate the eligible deductions based on the provided income and property details.

- Review the form for any errors or omissions before submission.

Completing the form accurately is vital for ensuring that the application is processed without delays.

Form Submission Methods

The SC 40 form can be submitted through various methods to accommodate different preferences. Seniors can choose to file the form online through the Indiana Department of Local Government Finance website. Alternatively, they may submit the form via mail by sending it to their local county assessor’s office. In-person submissions are also possible, allowing applicants to receive immediate assistance if needed.

Important Dates and Filing Deadlines

Staying informed about filing deadlines is crucial for a successful application. The SC 40 form typically has a submission deadline that aligns with property tax assessment dates. Applicants should ensure they submit their forms before this deadline to avoid missing out on potential tax benefits. It is advisable to check the Indiana Department of Local Government Finance website for the most current dates and any changes in the process.

Legal Use of the SC 40 Form

The SC 40 Indiana Elderly Tax Form is legally binding once completed and submitted. It is essential for applicants to understand that providing false information or failing to meet eligibility requirements can lead to penalties. Therefore, ensuring that all information is accurate and truthful is crucial for compliance with state tax laws.

Quick guide on how to complete dlgf personal property forms ingov 536073131

Easily Prepare DLGF Personal Property Forms IN gov on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle DLGF Personal Property Forms IN gov on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

How to Edit and Electronically Sign DLGF Personal Property Forms IN gov Effortlessly

- Find DLGF Personal Property Forms IN gov and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign DLGF Personal Property Forms IN gov to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dlgf personal property forms ingov 536073131

Create this form in 5 minutes!

How to create an eSignature for the dlgf personal property forms ingov 536073131

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the SC 40 Indiana elderly tax form?

The SC 40 Indiana elderly tax form is a tax form that allows eligible elderly residents of Indiana to receive a property tax credit. This form is specifically designed to help those aged 65 or older manage their property taxes effectively. Completing the SC 40 form can signNowly reduce the tax burden for elderly homeowners.

-

Who is eligible to file the SC 40 Indiana elderly tax form?

Eligibility for the SC 40 Indiana elderly tax form typically includes individuals who are 65 years of age or older and have an annual income that meets the specified limits. Additionally, applicants must own a home or have a qualifying property to qualify for the property tax credit. It's important to review specific requirements to ensure eligibility.

-

How can I complete the SC 40 Indiana elderly tax form?

To complete the SC 40 Indiana elderly tax form, you need to gather necessary documentation including proof of age and income. Once you have all required information, you can use a reliable eSignature solution, like airSlate SignNow, to fill out and electronically sign your form for ease of submission. This streamlines the process and helps ensure accuracy.

-

What are the benefits of using airSlate SignNow for the SC 40 Indiana elderly tax form?

Using airSlate SignNow for the SC 40 Indiana elderly tax form allows you to easily fill out, sign, and send your documents electronically. This platform not only saves time but also reduces errors associated with manual processing. Additionally, it provides a secure way to manage your sensitive information.

-

Is there a cost associated with using airSlate SignNow for the SC 40 Indiana elderly tax form?

Yes, airSlate SignNow offers various pricing plans that include features suited for managing documents like the SC 40 Indiana elderly tax form. Depending on your needs, you can choose a plan that fits your budget, providing you with a cost-effective solution for all your document signing needs. It's worth exploring the plans to find the best match for your requirements.

-

Can I integrate airSlate SignNow with other software for the SC 40 Indiana elderly tax form?

Absolutely! airSlate SignNow provides integrations with various software tools which can enhance your experience while completing the SC 40 Indiana elderly tax form. This includes tools for document management, CRM systems, and more, allowing for a seamless workflow that improves efficiency.

-

How secure is airSlate SignNow for handling the SC 40 Indiana elderly tax form?

AirSlate SignNow utilizes state-of-the-art encryption and security measures to ensure that your SC 40 Indiana elderly tax form and other sensitive documents are protected. With robust security protocols in place, you can have peace of mind knowing that your information is safe throughout the signing process.

Get more for DLGF Personal Property Forms IN gov

- Wpf dv 8020 order modifying order for protection washington form

- Wa emancipation form

- Wpf em 01020 notice of hearing nthg washington form

- Appointing ad litem form

- Wpf em 010400 decree of emancipation dce washington form

- Order denying petition form

- Acquittal 497429530 form

- Washington domestic violence form

Find out other DLGF Personal Property Forms IN gov

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe