BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT 2024-2026

Understanding the Business Tangible Personal Property Assessment

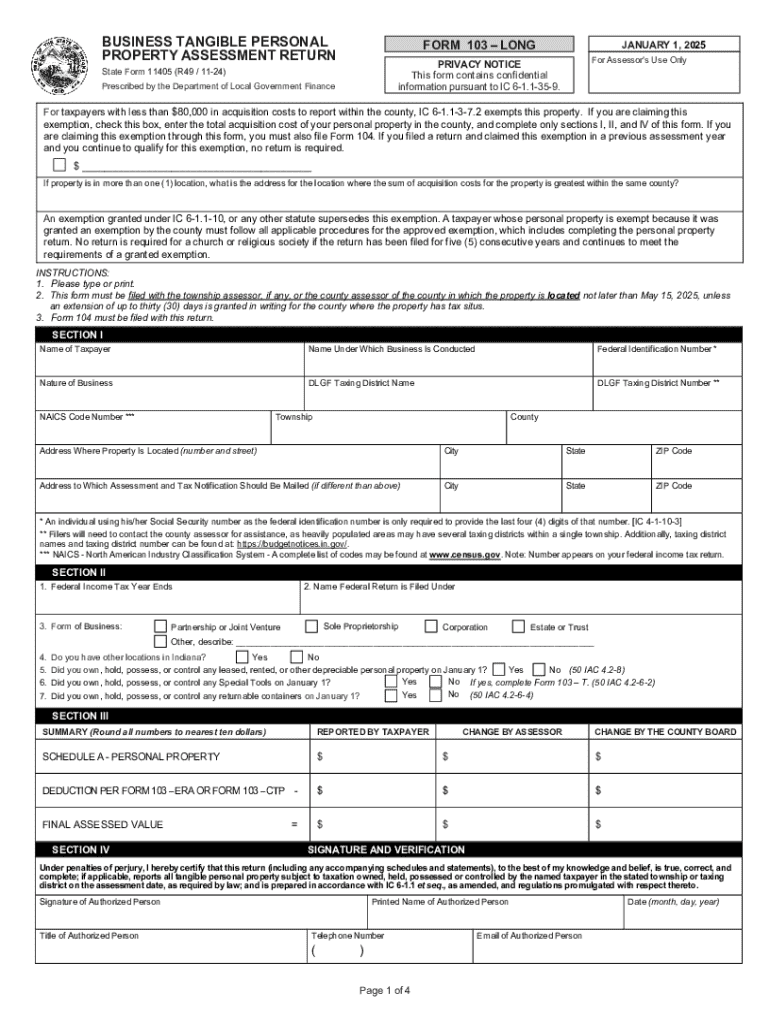

The Business Tangible Personal Property Assessment is a crucial form used by businesses to report their tangible personal property to local tax authorities. This assessment includes items such as machinery, equipment, furniture, and fixtures that are essential for business operations. Accurate reporting is vital as it directly impacts property tax calculations and compliance with state regulations.

Steps to Complete the Business Tangible Personal Property Assessment

Completing the Business Tangible Personal Property Assessment involves several key steps:

- Gather all relevant information regarding your tangible personal property, including purchase dates, costs, and current values.

- Fill out the assessment form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Business Tangible Personal Property Assessment

This assessment form is legally required for businesses to report their tangible assets. Failure to file can result in penalties, including fines or increased tax assessments. Understanding the legal implications of the assessment ensures compliance with state laws and helps businesses avoid potential legal issues.

Filing Deadlines and Important Dates

Each state has specific deadlines for submitting the Business Tangible Personal Property Assessment. Typically, these deadlines fall on or around April 15th of each year. It is essential for businesses to be aware of these dates to ensure timely filing and avoid any late fees or penalties.

Required Documents for the Business Tangible Personal Property Assessment

When completing the Business Tangible Personal Property Assessment, businesses must provide certain documents, including:

- A detailed list of all tangible personal property owned as of January 1st of the assessment year.

- Purchase invoices or receipts for significant assets.

- Any previous assessment forms, if applicable.

Examples of Using the Business Tangible Personal Property Assessment

Businesses can utilize the Business Tangible Personal Property Assessment in various scenarios. For instance:

- A manufacturing company must report its machinery and equipment to ensure proper tax assessment.

- A retail store needs to account for its furniture and fixtures to comply with local tax regulations.

Who Issues the Form

The Business Tangible Personal Property Assessment form is typically issued by the local tax assessor's office or the state department of revenue. It is essential for businesses to obtain the correct form from the appropriate authority to ensure compliance with local regulations.

Create this form in 5 minutes or less

Find and fill out the correct business tangible personal property assessment

Create this form in 5 minutes!

How to create an eSignature for the business tangible personal property assessment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 40 2024 feature in airSlate SignNow?

The SC 40 2024 feature in airSlate SignNow enhances document signing efficiency by providing advanced eSignature capabilities. This feature allows users to streamline their workflows, ensuring that documents are signed quickly and securely. With SC 40 2024, businesses can improve their overall productivity and reduce turnaround times.

-

How does pricing work for SC 40 2024 in airSlate SignNow?

Pricing for SC 40 2024 in airSlate SignNow is designed to be cost-effective, catering to businesses of all sizes. Users can choose from various subscription plans that offer different features and levels of support. This flexibility ensures that you can find a plan that fits your budget while still accessing the benefits of SC 40 2024.

-

What are the key benefits of using SC 40 2024?

The key benefits of using SC 40 2024 include enhanced security, improved compliance, and increased efficiency in document management. By leveraging this feature, businesses can ensure that their documents are not only signed but also securely stored and easily retrievable. SC 40 2024 helps organizations save time and reduce errors in their signing processes.

-

Can SC 40 2024 integrate with other software?

Yes, SC 40 2024 in airSlate SignNow offers seamless integrations with various third-party applications. This allows businesses to connect their existing tools and streamline their workflows further. Whether you use CRM systems, project management tools, or cloud storage services, SC 40 2024 can enhance your overall productivity.

-

Is SC 40 2024 suitable for small businesses?

Absolutely! SC 40 2024 is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. With its intuitive interface and robust features, small businesses can easily manage their document signing needs without the complexity often associated with larger solutions.

-

What types of documents can be signed using SC 40 2024?

SC 40 2024 supports a wide range of document types, including contracts, agreements, and forms. This versatility allows businesses to use airSlate SignNow for various signing needs, ensuring that all essential documents can be processed efficiently. Whether it's legal documents or internal memos, SC 40 2024 has you covered.

-

How secure is the SC 40 2024 signing process?

The SC 40 2024 signing process in airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods. This ensures that all signed documents are protected against unauthorized access and tampering. Businesses can trust that their sensitive information remains confidential and secure throughout the signing process.

Get more for BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT

Find out other BUSINESS TANGIBLE PERSONAL PROPERTY ASSESSMENT

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast