Cdtfa 345 2017-2026

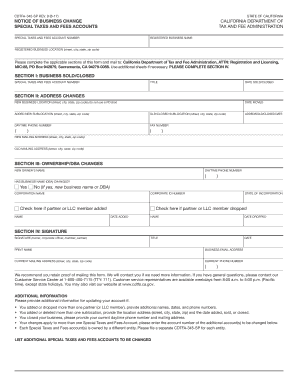

What is the CDTFA 345?

The CDTFA 345 is a form used by businesses in California to report and remit sales and use taxes to the California Department of Tax and Fee Administration (CDTFA). This form is essential for ensuring compliance with state tax regulations, allowing businesses to accurately report their taxable sales and any use tax owed. The CDTFA 345 serves as a crucial tool for maintaining transparency in financial dealings and ensuring that the state receives the appropriate tax revenue.

How to Use the CDTFA 345

Using the CDTFA 345 involves several steps to ensure accurate reporting. First, businesses must gather all relevant sales data, including total sales, exempt sales, and any returns. Next, they will need to calculate the total tax owed based on the applicable sales tax rate. After completing the calculations, the form can be filled out, detailing the necessary information, including business identification and sales figures. Finally, the completed form must be submitted to the CDTFA, either online or via mail, depending on the business's preference.

Steps to Complete the CDTFA 345

Completing the CDTFA 345 requires careful attention to detail. Here are the steps to follow:

- Gather all sales records for the reporting period.

- Calculate total taxable sales, exempt sales, and any returns.

- Determine the appropriate sales tax rate based on the location of sales.

- Fill out the CDTFA 345 form with accurate figures.

- Review the completed form for any errors or omissions.

- Submit the form to the CDTFA by the specified deadline.

Legal Use of the CDTFA 345

The CDTFA 345 is legally mandated for businesses that engage in taxable sales within California. It is crucial for compliance with state tax laws. Failure to submit this form or inaccuracies in reporting can lead to penalties and interest charges. Therefore, businesses must ensure that they understand the legal implications of their reporting obligations and maintain accurate records to support their submissions.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 345 vary depending on the reporting period. Generally, businesses are required to file the form quarterly, but some may qualify for annual or monthly filing based on their sales volume. It is important for businesses to be aware of these deadlines to avoid late fees and potential penalties. Keeping a calendar of important dates related to tax submissions can help ensure timely compliance.

Required Documents

To complete the CDTFA 345, businesses must have several documents on hand. These include:

- Sales records for the reporting period.

- Documentation of exempt sales.

- Records of any returns or refunds issued.

- Previous CDTFA 345 submissions, if applicable.

Having these documents readily available will streamline the process of filling out the form and ensure that all information is accurate and complete.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 345

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 345

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cdtfa 345 and how does it relate to airSlate SignNow?

The cdtfa 345 refers to a specific form used for tax purposes in California. airSlate SignNow simplifies the process of completing and submitting the cdtfa 345 by allowing users to eSign and send documents securely. This ensures compliance while saving time and reducing paperwork.

-

How much does airSlate SignNow cost for managing cdtfa 345 forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring the management of cdtfa 345 forms. The cost-effective solution allows businesses to choose a plan that fits their budget while providing essential features for document management and eSigning.

-

What features does airSlate SignNow offer for handling cdtfa 345 documents?

airSlate SignNow provides a range of features for handling cdtfa 345 documents, including customizable templates, secure eSigning, and real-time tracking. These features enhance efficiency and ensure that all necessary steps are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software for cdtfa 345 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage cdtfa 345 processing alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all documents are handled in one place.

-

What are the benefits of using airSlate SignNow for cdtfa 345 submissions?

Using airSlate SignNow for cdtfa 345 submissions provides numerous benefits, including faster processing times, reduced errors, and enhanced security. The platform's user-friendly interface allows businesses to streamline their document workflows, ensuring compliance and timely submissions.

-

Is airSlate SignNow secure for handling sensitive cdtfa 345 information?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive cdtfa 345 information. The platform employs advanced encryption and security protocols to protect your data, ensuring that your documents remain confidential and secure.

-

How can I get started with airSlate SignNow for cdtfa 345?

Getting started with airSlate SignNow for cdtfa 345 is easy. Simply sign up for an account, choose a pricing plan that suits your needs, and start creating or uploading your cdtfa 345 documents. The intuitive interface guides you through the process of eSigning and sending documents effortlessly.

Get more for Cdtfa 345

- Lausd tb test form

- Ui28 form

- 8100 professional level exam form

- Ct fdrm form

- New york member enrollment form ohi

- Letter of financial support from husband to wife form

- I800a supplement 3 form

- Instructions for form 706 rev october instructions for form 706 united states estate and generation skipping transfer tax return

Find out other Cdtfa 345

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template