Instructions for Form 706 Rev October Instructions for Form 706, United States Estate and Generation Skipping Transfer Tax Retur 2024-2026

Understanding Form

Form 706, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a crucial document for estate tax purposes. This form is used to report the transfer of assets upon an individual's death and to calculate the estate tax owed to the federal government. The 2016 version of Form 706 is specifically designed for estates of decedents who passed away in that year, and it includes detailed instructions to help executors and administrators accurately report the estate's value and any applicable deductions.

Key Elements of Form

Several key elements are essential when completing Form. These include:

- Gross Estate Value: This is the total value of all assets owned by the decedent at the time of death.

- Deductions: The form allows for various deductions, including debts, funeral expenses, and certain taxes.

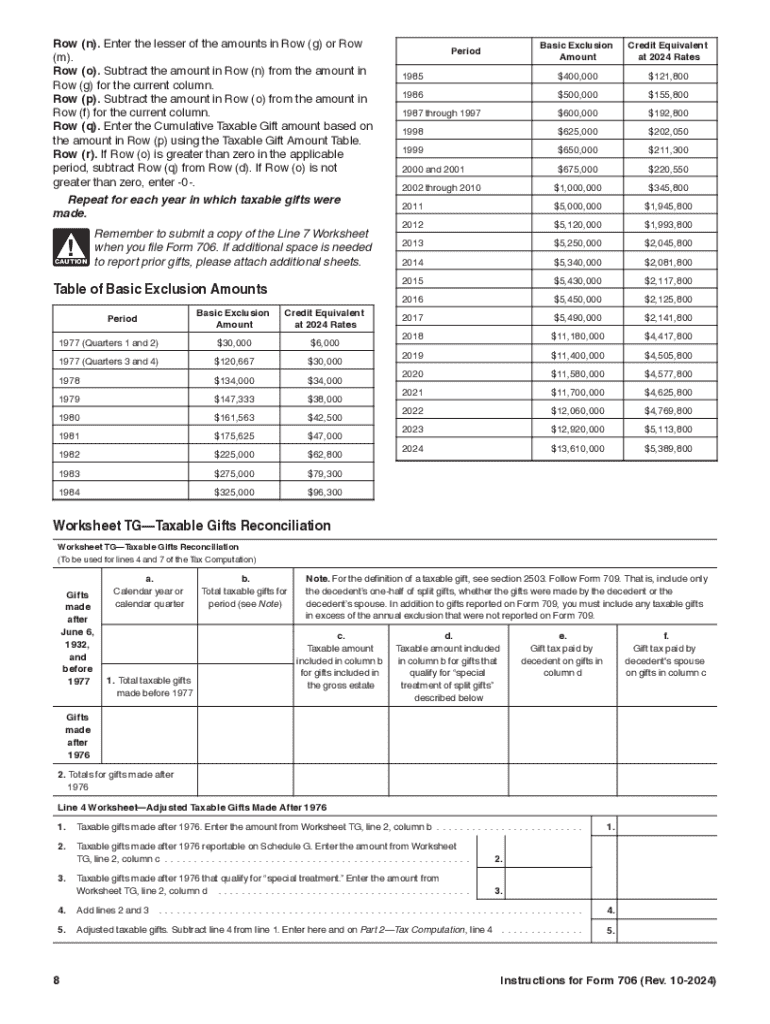

- Tax Computation: After calculating the gross estate and deductions, the form guides users through determining the estate tax owed.

- Generation-Skipping Transfer Tax: If applicable, this section addresses any taxes owed on transfers to beneficiaries who are two or more generations younger than the decedent.

Steps to Complete Form

Completing Form involves several steps to ensure accuracy and compliance with IRS guidelines:

- Gather all necessary documentation, including asset valuations and debts.

- Calculate the gross estate value by listing all assets owned by the decedent.

- Identify and apply any applicable deductions to arrive at the taxable estate value.

- Use the tax tables provided in the instructions to compute the estate tax owed.

- Complete the form by providing all required information and signatures.

Filing Deadlines for Form

Form 706 must be filed within nine months of the decedent's date of death. However, an extension can be requested, allowing for an additional six months to file. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. Executors should mark their calendars and ensure that all necessary information is gathered well in advance of the due date.

IRS Guidelines for Form

The IRS provides comprehensive guidelines for completing Form. These guidelines include detailed instructions on how to report various types of assets, deductions, and credits. It is important for filers to refer to the official IRS instructions to ensure compliance with all regulations and to avoid common mistakes that could lead to delays or penalties.

Required Documents for Form

When preparing to file Form, several key documents are necessary:

- Death certificate of the decedent.

- Documentation of all assets, including appraisals and bank statements.

- Records of debts and liabilities.

- Information regarding any prior gifts made by the decedent.

Having these documents organized and readily available can streamline the filing process and ensure that all required information is accurately reported.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 706 rev october instructions for form 706 united states estate and generation skipping transfer tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 706 rev october instructions for form 706 united states estate and generation skipping transfer tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 2016 and why is it important?

Form 706 2016 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is crucial for estate planning as it helps determine the tax liability of an estate. Understanding how to properly fill out Form 706 2016 can ensure compliance with federal tax laws and help avoid penalties.

-

How can airSlate SignNow assist with Form 706 2016?

airSlate SignNow provides a streamlined platform for electronically signing and sending Form 706 2016. With its user-friendly interface, you can easily manage your documents and ensure that all necessary signatures are obtained promptly, making the process more efficient.

-

What are the pricing options for using airSlate SignNow for Form 706 2016?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features to manage Form 706 2016 effectively.

-

Are there any integrations available for managing Form 706 2016?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for managing Form 706 2016. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management and eSigning.

-

What features does airSlate SignNow offer for Form 706 2016?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for Form 706 2016. These features help ensure that your documents are organized, secure, and easily accessible whenever needed.

-

Is airSlate SignNow secure for handling sensitive documents like Form 706 2016?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive documents like Form 706 2016. You can trust that your information is safe while using our platform.

-

Can I access Form 706 2016 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage Form 706 2016 on the go. This flexibility ensures that you can handle your documents anytime, anywhere, without any hassle.

Get more for Instructions For Form 706 Rev October Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Retur

- Mod 4 4 6 geu a c amap palermo form

- Worksheet 2 2 to be or not to be proportional form

- Naming inorganic compounds worksheet form

- What does a form for a step 1 grievance look like

- Solicitud de registro de marca form

- Cm 100 form

- Daycare emergency contact form

- Youth group registration form farringdon church

Find out other Instructions For Form 706 Rev October Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Retur

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online