IA 148 Tax Credits Schedule 41 148 Iowa Department of Revenue 2011

What is the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

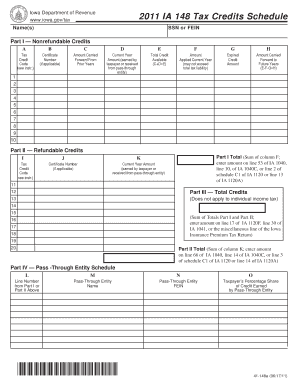

The IA 148 Tax Credits Schedule 41 148 is a form issued by the Iowa Department of Revenue. It is primarily used by taxpayers to claim various tax credits available in the state of Iowa. This schedule allows individuals and businesses to report their eligibility for specific credits, which can significantly reduce their overall tax liability. Understanding this form is essential for anyone looking to maximize their tax benefits in Iowa.

How to use the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

Using the IA 148 Tax Credits Schedule 41 148 involves several steps. Taxpayers must first determine their eligibility for the available credits. After gathering the necessary information, they should complete the form accurately, ensuring all required fields are filled out. Once completed, the form should be submitted along with the taxpayer's Iowa income tax return to ensure proper processing of the credits claimed.

Steps to complete the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

Completing the IA 148 Tax Credits Schedule 41 148 requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, including income statements and previous tax returns.

- Review the list of available tax credits to identify which ones you qualify for.

- Fill out the form, providing accurate information in each section.

- Double-check all entries for accuracy to prevent delays in processing.

- Attach the completed form to your Iowa income tax return before submission.

Key elements of the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

Several key elements are essential when filling out the IA 148 Tax Credits Schedule 41 148. These include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Credit Types: Specific credits being claimed, each with its own eligibility criteria.

- Calculation Section: Areas where taxpayers calculate the total credits based on their eligibility.

- Signature: A declaration that the information provided is accurate and complete.

Eligibility Criteria

To qualify for the credits on the IA 148 Tax Credits Schedule 41 148, taxpayers must meet specific eligibility criteria. These criteria vary depending on the type of credit being claimed. Generally, factors such as income level, filing status, and residency in Iowa play significant roles in determining eligibility. It is crucial for taxpayers to review these criteria thoroughly to ensure they qualify before completing the form.

Form Submission Methods

The IA 148 Tax Credits Schedule 41 148 can be submitted through various methods. Taxpayers have the option to file their forms online, which is often the quickest method. Alternatively, they can mail the completed form along with their Iowa income tax return. In-person submissions may also be possible at designated Iowa Department of Revenue offices, providing a direct way to ensure the form is received and processed.

Create this form in 5 minutes or less

Find and fill out the correct ia 148 tax credits schedule 41 148 iowa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the ia 148 tax credits schedule 41 148 iowa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue?

The IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue is a form used by taxpayers in Iowa to claim various tax credits. It provides detailed information about the credits being claimed and ensures compliance with state tax regulations. Understanding this schedule is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue?

airSlate SignNow simplifies the process of preparing and submitting the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue. Our platform allows you to easily eSign and send documents securely, ensuring that your tax credits are claimed accurately and efficiently. This can save you time and reduce the risk of errors.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue. These tools help streamline your workflow and ensure that all necessary documents are completed and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses handling the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With affordable pricing plans, you can access essential features to manage the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue without breaking the bank. This makes it an ideal choice for businesses looking to optimize their tax processes.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly manage the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue alongside your other financial documents, enhancing your overall efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for tax credit documentation?

Using airSlate SignNow for tax credit documentation, including the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue, provides numerous benefits. You gain access to a user-friendly interface, secure document handling, and the ability to track the status of your submissions, ensuring a smooth and reliable process.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information. When dealing with documents like the IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue, you can trust that your data is safe and secure throughout the entire process.

Get more for IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

- Self declaration format for address proof pdf

- Erosion rates gizmo answer key form

- Prudential change of ownership form

- Cvac consent form 46946639

- Woodforest voided check form

- Personal information card

- Mobile home inspection checklist pdf 413943396 form

- Individual underpayment of estimated tax 764319263 form

Find out other IA 148 Tax Credits Schedule 41 148 Iowa Department Of Revenue

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement