IA 148 Tax Credits Schedule IA 148 Tax Credits Schedule 2013-2026

Understanding the IA 148 Tax Credits Schedule

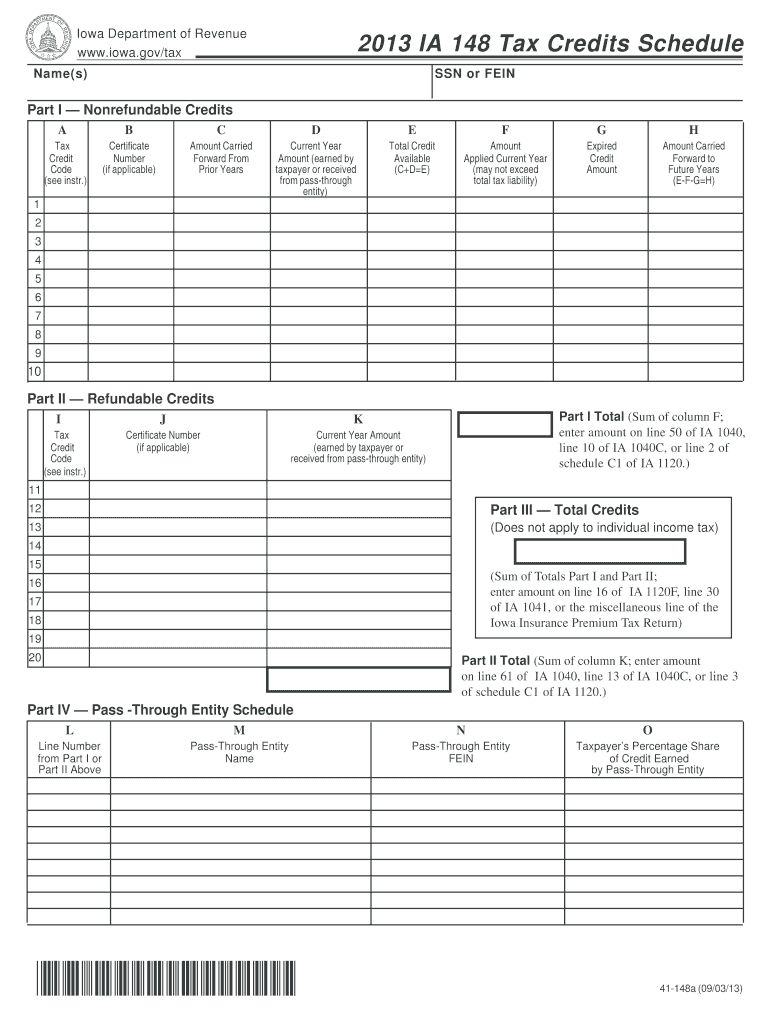

The IA 148 Tax Credits Schedule is a form used by taxpayers in Iowa to claim various tax credits. This schedule allows individuals and businesses to report their eligibility for specific tax benefits, which can significantly reduce their overall tax liability. Understanding this form is essential for maximizing potential savings and ensuring compliance with state tax regulations.

Steps to Complete the IA 148 Tax Credits Schedule

Completing the IA 148 requires careful attention to detail. Here are the key steps involved:

- Gather Required Information: Collect all necessary financial documents, including income statements and previous tax returns.

- Review Eligibility Criteria: Ensure you meet the qualifications for the credits you intend to claim.

- Fill Out the Form: Accurately enter your information, following the instructions provided with the form.

- Attach Supporting Documents: Include any required documentation that verifies your eligibility for the credits.

- Review and Submit: Double-check your entries for accuracy before submitting the form to the appropriate state agency.

Key Elements of the IA 148 Tax Credits Schedule

The IA 148 includes several important sections that taxpayers must complete. These sections typically cover:

- Personal Information: Name, address, and Social Security number.

- Credit Information: Specific tax credits being claimed, such as those for renewable energy or low-income housing.

- Income Details: Total income and any adjustments that may affect credit eligibility.

- Signature: Required signature to certify the accuracy of the information provided.

Eligibility Criteria for the IA 148 Tax Credits Schedule

To qualify for the credits listed on the IA 148, taxpayers must meet specific criteria, which may include:

- Residency: Must be a resident of Iowa for the tax year in question.

- Income Limits: Certain credits may have income thresholds that must not be exceeded.

- Property Ownership: Some credits may require ownership of specific types of property or investments.

Filing Deadlines for the IA 148 Tax Credits Schedule

It is crucial to be aware of the filing deadlines associated with the IA 148. Generally, the form must be submitted by the same deadline as your Iowa state income tax return. For most taxpayers, this is typically April 30 of the following year. However, extensions may apply, so it is advisable to check the latest guidelines from the Iowa Department of Revenue.

Examples of Using the IA 148 Tax Credits Schedule

Understanding practical applications of the IA 148 can help clarify its importance. For instance:

- A homeowner who installed solar panels may use the IA 148 to claim a renewable energy tax credit.

- A low-income family could apply for credits designed to assist with housing costs, thereby reducing their tax burden.

Create this form in 5 minutes or less

Find and fill out the correct ia 148 tax credits schedule ia 148 tax credits schedule

Create this form in 5 minutes!

How to create an eSignature for the ia 148 tax credits schedule ia 148 tax credits schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ia 148 and how does it relate to airSlate SignNow?

ia 148 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, ensuring that documents are signed quickly and efficiently. By utilizing ia 148, businesses can improve their overall productivity and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost with the ia 148 feature?

The pricing for airSlate SignNow varies based on the plan you choose, but the ia 148 feature is included in all tiers. This means that regardless of your budget, you can access the powerful capabilities of ia 148 to enhance your document signing process. For detailed pricing information, visit our pricing page.

-

What are the key features of airSlate SignNow's ia 148?

The ia 148 feature includes advanced eSigning options, customizable templates, and real-time tracking of document status. These features are designed to simplify the signing process and provide users with a comprehensive solution for managing their documents. With ia 148, you can also integrate with various third-party applications to further enhance your workflow.

-

What benefits does ia 148 offer for businesses?

By implementing ia 148, businesses can signNowly reduce the time spent on document management and signing processes. This feature not only speeds up transactions but also enhances security and compliance with electronic signatures. Overall, ia 148 helps businesses operate more efficiently and effectively.

-

Can I integrate airSlate SignNow with other tools using ia 148?

Yes, ia 148 supports integration with a variety of third-party applications, including CRM systems and cloud storage services. This allows users to seamlessly incorporate airSlate SignNow into their existing workflows. The integration capabilities of ia 148 make it a versatile choice for businesses looking to enhance their document management processes.

-

Is training available for using the ia 148 feature in airSlate SignNow?

Absolutely! airSlate SignNow offers comprehensive training resources for users to get the most out of the ia 148 feature. These resources include tutorials, webinars, and customer support to ensure that you can effectively utilize all the capabilities of ia 148. Our goal is to help you maximize your investment in our solution.

-

How secure is the ia 148 feature in airSlate SignNow?

The ia 148 feature is built with security in mind, employing advanced encryption and compliance with industry standards. This ensures that your documents and signatures are protected throughout the signing process. With airSlate SignNow, you can trust that your sensitive information is safe and secure.

Get more for IA 148 Tax Credits Schedule IA 148 Tax Credits Schedule

Find out other IA 148 Tax Credits Schedule IA 148 Tax Credits Schedule

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure