Form 355S S Corporation Excise Return Mass Gov Mass 2021-2026

What is the Form 355S S Corporation Excise Return?

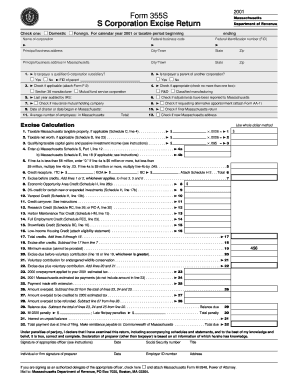

The Form 355S S Corporation Excise Return is a tax form used by S corporations in Massachusetts to report their income, deductions, and tax liabilities. This form is essential for compliance with state tax regulations and is specifically designed for S corporations, which are a special type of corporation that meets specific Internal Revenue Code requirements. By filing this form, S corporations ensure they are accurately reporting their financial activities and fulfilling their tax obligations to the state of Massachusetts.

How to use the Form 355S S Corporation Excise Return

Using the Form 355S involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by providing details such as total income, deductions, and any applicable credits. It's important to review the form for accuracy before submission. Once completed, the form can be filed electronically or mailed to the appropriate state tax authority, ensuring compliance with Massachusetts tax laws.

Steps to complete the Form 355S S Corporation Excise Return

Completing the Form 355S requires careful attention to detail. Follow these steps:

- Gather financial records, including profit and loss statements and balance sheets.

- Fill in the corporation's name, address, and federal identification number at the top of the form.

- Report total income on the designated lines, including all sources of revenue.

- List allowable deductions, ensuring to include all eligible expenses.

- Calculate the excise tax based on the corporation's net income as per Massachusetts tax regulations.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail to the Massachusetts Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the Form 355S is crucial to avoid penalties. The deadline for submitting this form typically aligns with the federal tax return due date, which is usually the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. It's advisable to check for any updates or changes to the filing schedule each tax year.

Penalties for Non-Compliance

Failure to file the Form 355S on time can result in significant penalties. Massachusetts imposes fines for late submissions, which can accumulate quickly. Additionally, interest may accrue on any unpaid taxes. To mitigate these risks, it is essential for S corporations to adhere to filing deadlines and ensure that the form is completed accurately. Regular consultation with a tax professional can help maintain compliance and avoid potential penalties.

Who Issues the Form

The Form 355S S Corporation Excise Return is issued by the Massachusetts Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. The form is made available on their official website, where S corporations can access the latest version and any related instructions for completion and submission.

Create this form in 5 minutes or less

Find and fill out the correct form 355s s corporation excise return mass gov mass

Create this form in 5 minutes!

How to create an eSignature for the form 355s s corporation excise return mass gov mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 355S S Corporation Excise Return Mass Gov Mass?

The Form 355S S Corporation Excise Return Mass Gov Mass is a tax form required for S corporations operating in Massachusetts. It reports the corporation's income, deductions, and tax liability to the state. Understanding this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Form 355S S Corporation Excise Return Mass Gov Mass?

airSlate SignNow simplifies the process of preparing and submitting the Form 355S S Corporation Excise Return Mass Gov Mass. With our eSignature capabilities, you can easily sign and send documents securely, ensuring timely submission to the Massachusetts government.

-

What features does airSlate SignNow offer for managing the Form 355S S Corporation Excise Return Mass Gov Mass?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage, all of which are beneficial for managing the Form 355S S Corporation Excise Return Mass Gov Mass. These tools streamline the filing process and enhance organization.

-

Is there a cost associated with using airSlate SignNow for the Form 355S S Corporation Excise Return Mass Gov Mass?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can efficiently manage the Form 355S S Corporation Excise Return Mass Gov Mass without breaking the bank.

-

What are the benefits of using airSlate SignNow for the Form 355S S Corporation Excise Return Mass Gov Mass?

Using airSlate SignNow for the Form 355S S Corporation Excise Return Mass Gov Mass provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other software for filing the Form 355S S Corporation Excise Return Mass Gov Mass?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Form 355S S Corporation Excise Return Mass Gov Mass. This integration helps streamline your workflow and ensures that all your documents are in one place.

-

How secure is airSlate SignNow when handling the Form 355S S Corporation Excise Return Mass Gov Mass?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling the Form 355S S Corporation Excise Return Mass Gov Mass, you can trust that your sensitive information is safe and secure.

Get more for Form 355S S Corporation Excise Return Mass Gov Mass

- Lab assignment 7 1 case abstract form delmar

- Form vat 351

- Royal mail keepsafe application form

- What is the cap for list of allowances in virginia form

- Form pa 1796

- Superior court of washington for state of forms

- Denial of petition from oz technology inc this is in response to the petition dated may 1 requesting that the environmental epa form

- Form int 3 savings loan association building loan association tax return

Find out other Form 355S S Corporation Excise Return Mass Gov Mass

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later