Lien Holder Form

What is the lien holder agreement?

A lien holder agreement is a legal document that establishes the rights of a lender or financial institution over a borrower's property. This agreement is crucial in situations where the property serves as collateral for a loan. It outlines the terms under which the lien holder can claim the property if the borrower defaults on their obligations. The lien holder agreement typically includes details such as the amount borrowed, interest rates, payment schedules, and the specific property involved.

How to use the lien holder agreement

The lien holder agreement is used primarily in financing transactions, particularly in real estate and vehicle loans. To utilize this agreement, both parties—the borrower and the lien holder—must review and sign the document. This formalizes the lender's claim to the property until the loan is fully repaid. It is important for borrowers to understand the implications of the agreement, including the potential loss of the property in case of default.

Steps to complete the lien holder agreement

Completing a lien holder agreement involves several key steps:

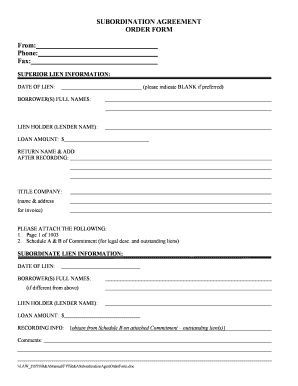

- Gather necessary information, including borrower and lender details, property description, and loan terms.

- Draft the agreement, ensuring all terms are clearly stated and understood by both parties.

- Review the document for accuracy and completeness.

- Both parties should sign the agreement in the presence of a notary or witness, if required by state law.

- Distribute copies of the signed agreement to all parties involved.

Key elements of the lien holder agreement

A comprehensive lien holder agreement should include the following key elements:

- Parties involved: Names and contact information of the borrower and lien holder.

- Property description: Detailed information about the property being used as collateral.

- Loan amount: The total amount borrowed and the terms of repayment.

- Interest rate: The rate at which interest will accrue on the loan.

- Default terms: Conditions under which the lien holder can take possession of the property.

Legal use of the lien holder agreement

The lien holder agreement is legally binding and must comply with state laws governing secured transactions. It is essential for both parties to understand their rights and obligations under the agreement. Failure to adhere to the terms may result in legal consequences, including foreclosure or repossession of the property by the lien holder. It is advisable to seek legal counsel when drafting or signing a lien holder agreement to ensure that it meets all legal requirements.

State-specific rules for the lien holder agreement

Each state in the U.S. may have specific rules and regulations regarding lien holder agreements. These can include requirements for notarization, filing with state authorities, and specific language that must be included in the agreement. It is important for both borrowers and lenders to familiarize themselves with their state’s laws to ensure compliance and protect their interests. Consulting with a legal professional can provide clarity on these state-specific requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lien holder form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lien holder agreement?

A lien holder agreement is a legal document that outlines the rights and responsibilities of a lien holder in relation to a property or asset. It ensures that the lien holder has a claim to the asset until the debt is satisfied. Understanding this agreement is crucial for both lenders and borrowers.

-

How can airSlate SignNow help with lien holder agreements?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning lien holder agreements. With its user-friendly interface, you can easily customize templates and ensure that all parties can sign the document securely and efficiently. This saves time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan includes features that support the creation and management of lien holder agreements, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for lien holder agreements?

Yes, airSlate SignNow integrates with numerous applications, making it easy to manage lien holder agreements alongside your existing workflows. Popular integrations include CRM systems, cloud storage services, and productivity tools. This flexibility allows you to enhance your document management process.

-

What features does airSlate SignNow offer for lien holder agreements?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for lien holder agreements. These tools help streamline the signing process and ensure that all parties are informed and engaged. Additionally, you can automate reminders to keep the process moving smoothly.

-

How secure is the signing process for lien holder agreements?

The signing process for lien holder agreements on airSlate SignNow is highly secure, utilizing encryption and authentication measures to protect sensitive information. This ensures that only authorized individuals can access and sign the documents. You can trust that your agreements are safe and compliant with industry standards.

-

Can I customize lien holder agreement templates?

Absolutely! airSlate SignNow allows you to customize lien holder agreement templates to fit your specific needs. You can add your branding, adjust clauses, and include necessary fields for signatures. This flexibility ensures that your agreements are tailored to your business requirements.

Get more for Lien Holder Form

- Liability for defects in construction contracts form

- The air force journal of indo pacific affairs form

- Tx deed general warranty cash 12009 6formswww

- This arbitration submission agreement this agreementquot is made this form

- I have received your letter of resignation form

- Of shareholders on the day of 20 at form

- Irs tax lien help request right to redeem property pub 4235 form

- Dictionarycom form

Find out other Lien Holder Form

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe