Form 540 2ez

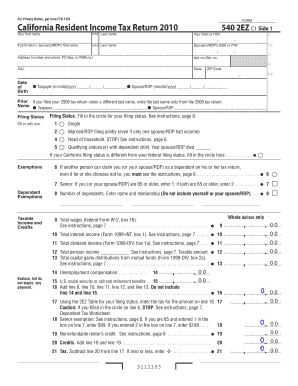

What is the Form 540 2ez

The 540 2ez form, officially known as the California Resident Income Tax Return, is a simplified tax form designed for California residents. It is intended for individuals with straightforward tax situations, allowing them to report their income and calculate their tax liability efficiently. This form is typically used by single or married taxpayers filing jointly, who do not have complex deductions or credits. The 540 2ez form streamlines the filing process, making it easier for eligible taxpayers to meet their state tax obligations.

How to use the Form 540 2ez

Using the 540 2ez form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully read the instructions provided with the form to ensure you understand the requirements. Fill out the form by entering your personal information, income details, and any applicable deductions. After completing the form, review it for accuracy before submitting it to the California Franchise Tax Board. The 540 2ez form can be filed either electronically or by mail, depending on your preference.

Steps to complete the Form 540 2ez

Completing the 540 2ez form involves a series of straightforward steps:

- Collect all relevant income documentation, such as W-2 forms and 1099s.

- Fill in your personal details, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any applicable standard deductions or credits as outlined in the form instructions.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for using the 540 2ez form, taxpayers must meet specific eligibility criteria. Typically, this form is suitable for individuals who:

- Are residents of California for the entire tax year.

- Have a total income below a certain threshold, which is updated annually.

- Do not claim any dependents.

- Are not filing as head of household or married filing separately.

- Do not have income from business activities or rental properties.

Required Documents

When preparing to file the 540 2ez form, certain documents are essential. These include:

- W-2 forms from employers detailing wages and withholdings.

- 1099 forms for any additional income, such as freelance work.

- Records of any other income sources, including interest or dividends.

- Documentation for any deductions or credits you plan to claim.

Form Submission Methods

The 540 2ez form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Electronic filing through tax preparation software, which is often the fastest method.

- Mailing a paper copy of the completed form to the California Franchise Tax Board.

- In-person submission at designated tax offices, if preferred.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 2ez 100010428

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540 2ez form?

The 540 2ez form is a simplified tax return form used by California residents to file their state income taxes. It is designed for individuals with straightforward tax situations, making it easier to complete and submit. Using airSlate SignNow, you can easily eSign and send your 540 2ez form securely.

-

How can airSlate SignNow help with the 540 2ez form?

airSlate SignNow provides a user-friendly platform to eSign and manage your 540 2ez form efficiently. With our solution, you can quickly upload your form, add signatures, and send it to recipients without hassle. This streamlines the filing process and ensures your documents are securely handled.

-

Is there a cost associated with using airSlate SignNow for the 540 2ez form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are cost-effective, ensuring you get the best value while managing your 540 2ez form and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the 540 2ez form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which enhance the process of handling your 540 2ez form. Additionally, our platform allows for real-time tracking and notifications, ensuring you stay updated on the status of your documents.

-

Can I integrate airSlate SignNow with other applications for the 540 2ez form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when managing the 540 2ez form. Whether you use CRM systems, cloud storage, or accounting software, our integrations help you maintain efficiency and organization.

-

What are the benefits of using airSlate SignNow for my 540 2ez form?

Using airSlate SignNow for your 540 2ez form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the signing process, reduces paperwork, and minimizes the risk of errors, making tax filing a breeze. Plus, you can access your documents anytime, anywhere.

-

Is airSlate SignNow secure for handling the 540 2ez form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 540 2ez form and other documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust us to handle your documents with the utmost care.

Get more for Form 540 2ez

- Fictitious name images california form

- Sea cadet badges in india pdf form

- City of glendale zoning use certificate form

- Imm 1295 fillable form

- Idaho practioner credential verification application 2016 form 14957919

- Snarfs applicationpdffillercom form

- Chesterfield nh building permit form

- To release my medical information to

Find out other Form 540 2ez

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form