Mi Gov Installmentagreement 2014

What is the Mi Gov Installment Agreement?

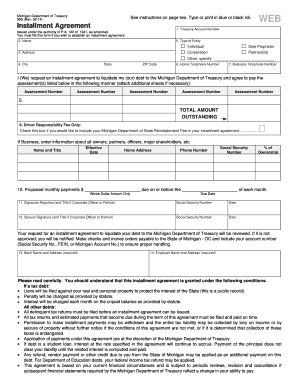

The Mi Gov Installment Agreement is a formal arrangement between taxpayers and the Michigan Department of Treasury that allows individuals or businesses to pay their tax liabilities over time. This agreement is particularly beneficial for those who may struggle to pay their taxes in a lump sum. By entering into this agreement, taxpayers can manage their financial obligations while avoiding penalties and interest that accrue on unpaid taxes.

Steps to Complete the Mi Gov Installment Agreement

Completing the Mi Gov Installment Agreement involves several key steps:

- Gather all necessary financial documentation, including income statements and tax returns.

- Determine the total amount owed to the Michigan Department of Treasury.

- Complete the Mi Gov Installment Agreement form, ensuring all information is accurate and complete.

- Submit the form either online or via mail, depending on your preference.

- Await confirmation from the Department of Treasury regarding the acceptance of your agreement.

How to Obtain the Mi Gov Installment Agreement

To obtain the Mi Gov Installment Agreement, taxpayers can visit the Michigan Department of Treasury's official website. The form is typically available for download or can be filled out online. It is important to ensure that you are using the most current version of the form to avoid any processing delays.

Required Documents for the Mi Gov Installment Agreement

When applying for the Mi Gov Installment Agreement, you may need to provide various documents to support your request. Commonly required documents include:

- Recent pay stubs or proof of income.

- Tax returns for the previous year.

- Documentation of any other income sources.

- Details of monthly expenses to demonstrate your financial situation.

Legal Use of the Mi Gov Installment Agreement

The Mi Gov Installment Agreement is legally binding once accepted by the Michigan Department of Treasury. Taxpayers must adhere to the terms outlined in the agreement, which typically include making regular payments on time. Failure to comply with these terms can result in penalties, including the possibility of the agreement being revoked.

Eligibility Criteria for the Mi Gov Installment Agreement

Eligibility for the Mi Gov Installment Agreement generally requires that the taxpayer has a valid tax liability with the Michigan Department of Treasury. Additionally, individuals must demonstrate a genuine inability to pay the full amount owed at once. Factors such as income level, expenses, and overall financial situation will be taken into consideration during the application process.

Create this form in 5 minutes or less

Find and fill out the correct mi gov installmentagreement

Create this form in 5 minutes!

How to create an eSignature for the mi gov installmentagreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mi gov installmentagreement and how does it work?

The mi gov installmentagreement is a payment plan option offered by the Michigan government that allows individuals to pay their taxes in installments. This program is designed to ease the financial burden by breaking down larger payments into manageable amounts. By using airSlate SignNow, you can easily eSign and submit your installment agreement documents online.

-

How can airSlate SignNow help with the mi gov installmentagreement process?

airSlate SignNow streamlines the mi gov installmentagreement process by providing a user-friendly platform for eSigning and sending necessary documents. With its intuitive interface, you can quickly complete your installment agreement paperwork without the hassle of printing or mailing. This saves time and ensures your documents are securely submitted.

-

What are the costs associated with using airSlate SignNow for mi gov installmentagreement?

Using airSlate SignNow for your mi gov installmentagreement is cost-effective, with various pricing plans to suit different needs. The platform offers a free trial, allowing you to explore its features before committing. Once you choose a plan, you can enjoy unlimited eSigning and document management at a competitive rate.

-

Are there any features specifically beneficial for mi gov installmentagreement users?

Yes, airSlate SignNow includes features that are particularly beneficial for mi gov installmentagreement users, such as customizable templates and automated reminders. These tools help ensure that you never miss a payment deadline and that your documents are always up to date. Additionally, the platform allows for easy collaboration with tax professionals.

-

Can I integrate airSlate SignNow with other tools for managing my mi gov installmentagreement?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This means you can manage your mi gov installmentagreement alongside other business processes, enhancing efficiency and organization. Integrating these tools can help streamline your workflow.

-

What benefits does airSlate SignNow provide for businesses handling mi gov installmentagreement?

For businesses managing mi gov installmentagreement, airSlate SignNow provides signNow benefits such as increased efficiency and reduced paperwork. The ability to eSign documents quickly means faster processing times and improved cash flow. Additionally, the platform enhances security and compliance, ensuring your sensitive information is protected.

-

Is airSlate SignNow secure for handling mi gov installmentagreement documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling mi gov installmentagreement documents. The platform uses advanced encryption and complies with industry standards to protect your data. You can confidently eSign and share sensitive information, knowing it is secure.

Get more for Mi Gov Installmentagreement

Find out other Mi Gov Installmentagreement

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement