Michigan Installment Agreement Form 990US Legal Forms 2018-2026

What is the Michigan Installment Agreement Form 990US Legal Forms

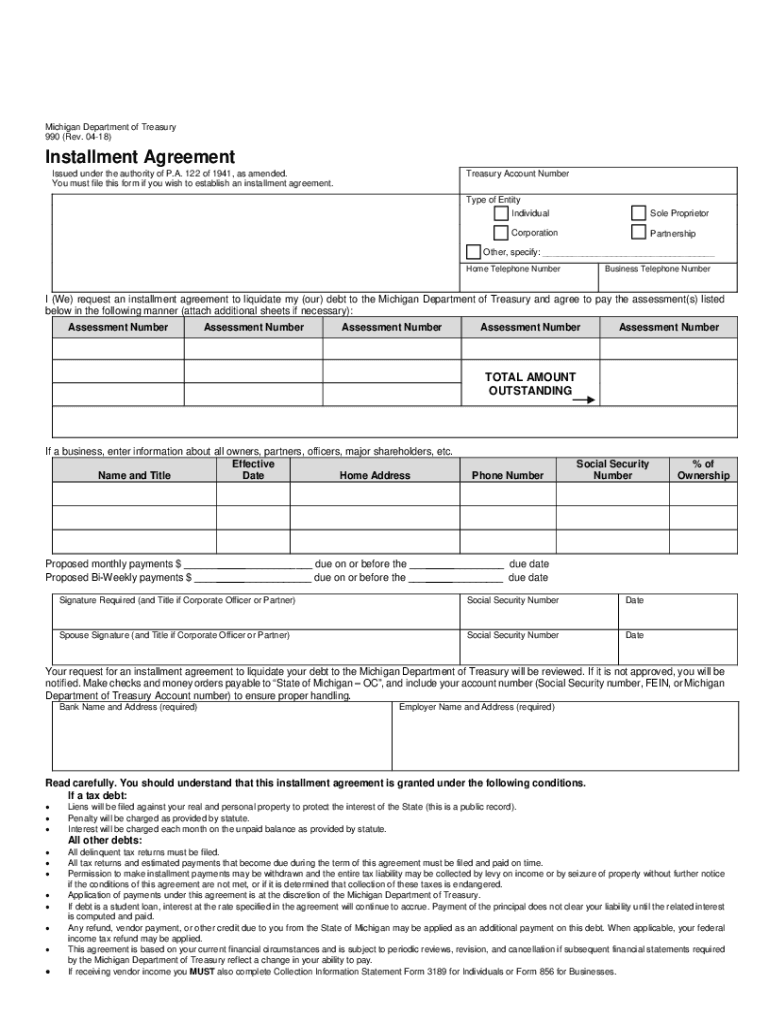

The Michigan Installment Agreement Form 990US Legal Forms is a legal document that allows taxpayers in Michigan to request a payment plan for settling their tax liabilities. This form is essential for individuals who are unable to pay their taxes in full by the due date and wish to avoid penalties associated with late payments. By using this form, taxpayers can propose a structured payment schedule to the state, making it easier to manage their financial obligations.

How to use the Michigan Installment Agreement Form 990US Legal Forms

To effectively use the Michigan Installment Agreement Form 990US Legal Forms, individuals should first gather all necessary financial information, including income, expenses, and existing debts. This information will help in determining a realistic monthly payment amount. After completing the form, it is important to review it for accuracy before submission. The form can be submitted either online or by mail, depending on the preferences of the taxpayer and the guidelines provided by the state.

Steps to complete the Michigan Installment Agreement Form 990US Legal Forms

Completing the Michigan Installment Agreement Form 990US Legal Forms involves several key steps:

- Gather financial documents, such as pay stubs, bank statements, and tax returns.

- Fill out the form with accurate personal and financial information.

- Propose a payment plan that reflects your ability to pay.

- Review the form for completeness and accuracy.

- Submit the form according to the specified submission methods.

Legal use of the Michigan Installment Agreement Form 990US Legal Forms

The legal use of the Michigan Installment Agreement Form 990US Legal Forms is crucial for taxpayers seeking to formalize their payment arrangements with the state. This form serves as a binding agreement between the taxpayer and the Michigan Department of Treasury, outlining the terms of the payment plan. It is important to adhere to the agreed-upon payment schedule to avoid penalties or further legal action.

Eligibility Criteria

To be eligible for the Michigan Installment Agreement Form 990US Legal Forms, taxpayers must meet specific criteria, including:

- Having outstanding tax liabilities owed to the state of Michigan.

- Demonstrating an inability to pay the full amount due by the deadline.

- Providing accurate and complete financial information on the form.

Form Submission Methods

The Michigan Installment Agreement Form 990US Legal Forms can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission via the Michigan Department of Treasury's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, if available.

Create this form in 5 minutes or less

Find and fill out the correct michigan installment agreement form 990us legal forms

Create this form in 5 minutes!

How to create an eSignature for the michigan installment agreement form 990us legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Installment Agreement Form 990US Legal Forms?

The Michigan Installment Agreement Form 990US Legal Forms is a legal document that allows individuals to set up a payment plan for their tax obligations. This form is essential for taxpayers who need to manage their payments over time, ensuring compliance with state regulations.

-

How can I access the Michigan Installment Agreement Form 990US Legal Forms?

You can easily access the Michigan Installment Agreement Form 990US Legal Forms through the airSlate SignNow platform. Our user-friendly interface allows you to find and fill out the form quickly, ensuring a smooth process for your tax payment arrangements.

-

What are the benefits of using airSlate SignNow for the Michigan Installment Agreement Form 990US Legal Forms?

Using airSlate SignNow for the Michigan Installment Agreement Form 990US Legal Forms offers several benefits, including ease of use, cost-effectiveness, and secure electronic signatures. Our platform streamlines the document signing process, making it faster and more efficient for users.

-

Is there a cost associated with the Michigan Installment Agreement Form 990US Legal Forms?

Yes, there is a nominal fee for accessing the Michigan Installment Agreement Form 990US Legal Forms through airSlate SignNow. This fee provides you with a comprehensive solution that includes document management, eSigning capabilities, and customer support.

-

Can I integrate the Michigan Installment Agreement Form 990US Legal Forms with other software?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can easily connect the Michigan Installment Agreement Form 990US Legal Forms with your existing tools for a more efficient document management experience.

-

How secure is the Michigan Installment Agreement Form 990US Legal Forms on airSlate SignNow?

Security is a top priority at airSlate SignNow. The Michigan Installment Agreement Form 990US Legal Forms is protected with advanced encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

What features does airSlate SignNow offer for the Michigan Installment Agreement Form 990US Legal Forms?

airSlate SignNow provides a variety of features for the Michigan Installment Agreement Form 990US Legal Forms, including customizable templates, automated workflows, and real-time tracking of document status. These features help streamline the signing process and improve overall efficiency.

Get more for Michigan Installment Agreement Form 990US Legal Forms

- View your communitys preliminary flood hazard data fema gov form

- Ct 5 1 form

- Dividing fences act nsw pdf form

- General information this application is for use in claiming property tax exemptions pursuant to tax code section 11

- Celebrity endorsement contract template form

- Confidential conservatorship questionnaire form

- Plaintiffs mandatory cover sheet and supplemental form

- Contractors travel expense request form

Find out other Michigan Installment Agreement Form 990US Legal Forms

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document