Form 3922 Rev April 2025-2026

What is the Form 3922 Rev April

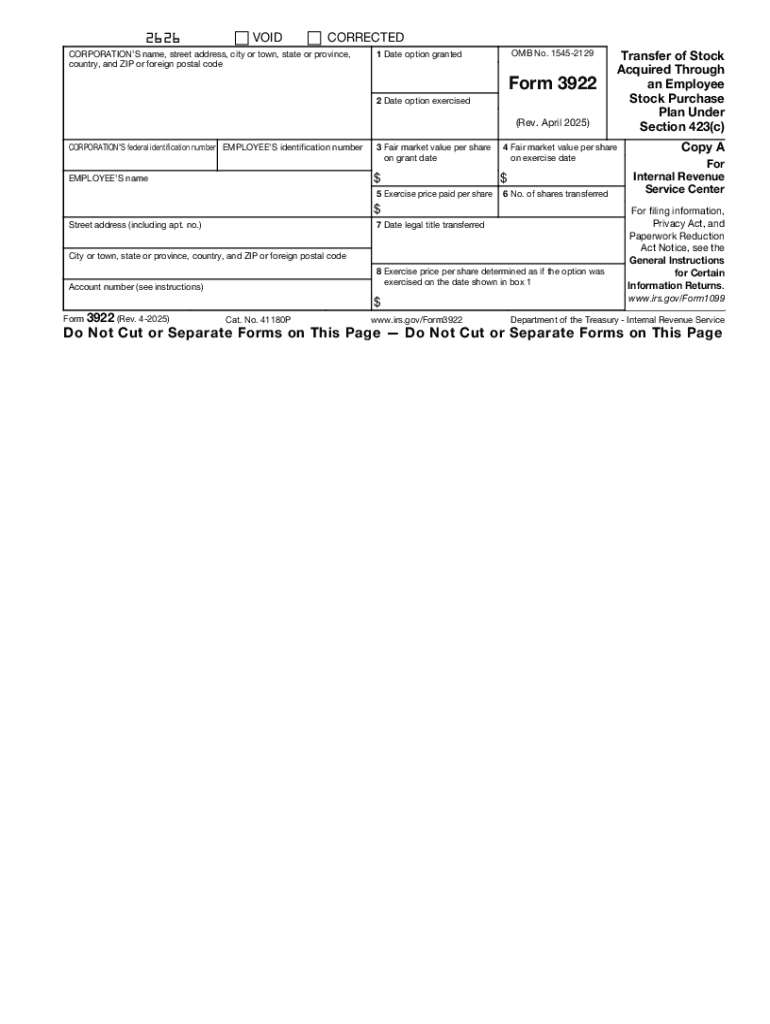

The Form 3922 Rev April is a tax form used in the United States to report the transfer of stock acquired through an employee stock purchase plan (ESPP). This form is essential for both employers and employees to ensure accurate reporting of stock transactions to the Internal Revenue Service (IRS). It provides details about the stock transferred, including the fair market value at the time of transfer, the purchase price, and any applicable adjustments. Understanding this form is crucial for compliance with tax regulations and for employees to accurately report income from stock transactions.

How to use the Form 3922 Rev April

To effectively use the Form 3922 Rev April, both employers and employees must understand their roles in the reporting process. Employers need to complete the form when they issue stock to employees under an ESPP. They must provide accurate information regarding the stock's purchase price and fair market value. Employees should use the information from the form to report any income or capital gains on their tax returns. It is important to retain a copy of the form for personal records, as it may be needed for future tax filings or audits.

Steps to complete the Form 3922 Rev April

Completing the Form 3922 Rev April involves several key steps:

- Gather necessary information, including the employee's name, address, and Social Security number.

- Provide details about the stock transfer, including the number of shares, purchase price, and fair market value at the time of transfer.

- Indicate the date the stock was transferred to the employee.

- Ensure all information is accurate and complete before submission to avoid penalties.

Once completed, the form should be submitted to the IRS and a copy provided to the employee for their records.

Legal use of the Form 3922 Rev April

The legal use of the Form 3922 Rev April is governed by IRS regulations regarding employee stock purchase plans. Employers are required to accurately report stock transfers to ensure compliance with tax laws. Failure to provide correct information can result in penalties for both the employer and employee. It is essential to understand the legal implications of the form to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3922 Rev April are critical for compliance. Employers must submit the form to the IRS by the last day of February if filing on paper, or by March 31 if filing electronically. Employees should receive their copy of the form by January 31 of the following year. Keeping track of these deadlines helps ensure timely reporting and reduces the risk of penalties.

Who Issues the Form

The Form 3922 Rev April is typically issued by employers who offer employee stock purchase plans. These employers are responsible for completing the form accurately and providing it to the employees who receive stock under the plan. It is important for employers to familiarize themselves with the requirements for issuing this form to ensure compliance with IRS regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 3922 rev april

Create this form in 5 minutes!

How to create an eSignature for the form 3922 rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3922 Rev April and why is it important?

Form 3922 Rev April is a tax form used to report the transfer of stock acquired through an employee stock purchase plan. It is important for both employers and employees to ensure compliance with IRS regulations and to accurately report income for tax purposes.

-

How can airSlate SignNow help with Form 3922 Rev April?

airSlate SignNow provides a seamless platform for businesses to send, eSign, and manage Form 3922 Rev April efficiently. With our user-friendly interface, you can easily prepare and distribute this form to employees, ensuring timely compliance and accurate record-keeping.

-

What are the pricing options for using airSlate SignNow for Form 3922 Rev April?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solutions allow you to manage Form 3922 Rev April and other documents without breaking the bank, ensuring you get the best value for your investment.

-

Are there any features specifically designed for handling Form 3922 Rev April?

Yes, airSlate SignNow includes features tailored for handling Form 3922 Rev April, such as customizable templates, automated workflows, and secure eSigning. These features streamline the process, making it easier for businesses to manage their documentation efficiently.

-

Can I integrate airSlate SignNow with other software for Form 3922 Rev April?

Absolutely! airSlate SignNow offers integrations with various software platforms, allowing you to connect your existing systems for managing Form 3922 Rev April. This ensures a smooth workflow and enhances productivity by reducing manual data entry.

-

What benefits does airSlate SignNow provide for managing Form 3922 Rev April?

Using airSlate SignNow for managing Form 3922 Rev April offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies the eSigning process, ensuring that your documents are signed and stored securely.

-

Is airSlate SignNow compliant with regulations for Form 3922 Rev April?

Yes, airSlate SignNow is designed to comply with all relevant regulations for handling Form 3922 Rev April. Our platform adheres to industry standards for security and data protection, giving you peace of mind when managing sensitive information.

Get more for Form 3922 Rev April

- Understanding property deeds investopedia form

- Notice of completion corporation 490209954 form

- Understanding nh property taxes town of wolfeboro form

- Waiver to the complaint form

- Hoa liens ampamp foreclosures an overviewnolo form

- Oregon for the county of cause number wherein form

- Chapter 109 oregon state legislature form

- Date of marriagedomestic partnership form

Find out other Form 3922 Rev April

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF