Understanding Property Deeds Investopedia Form

What is the Understanding Property Deeds Investopedia

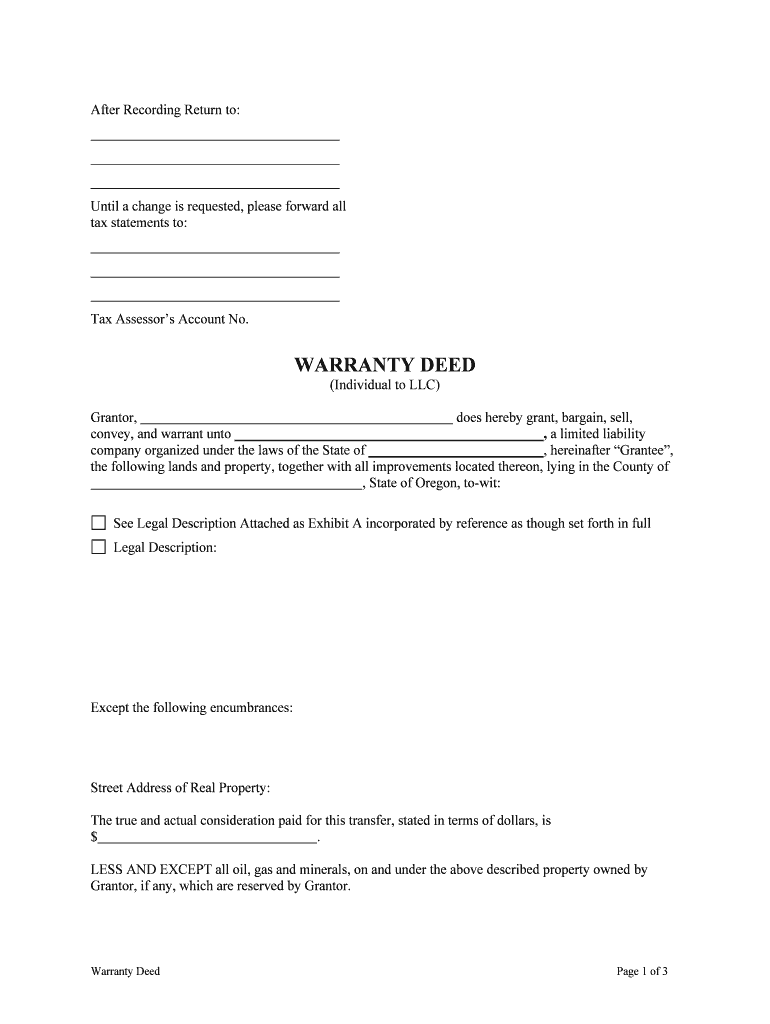

The Understanding Property Deeds Investopedia form is a crucial document that outlines the ownership and rights associated with a property. This form serves as a legal record, detailing the transfer of property from one party to another. It typically includes essential information such as the names of the parties involved, the legal description of the property, and any encumbrances or liens that may exist. Understanding this form is vital for anyone involved in real estate transactions, as it helps clarify ownership rights and responsibilities.

Key elements of the Understanding Property Deeds Investopedia

Several key elements are essential for the Understanding Property Deeds Investopedia form to be valid and effective. These include:

- Parties Involved: The full names and addresses of the grantor (seller) and grantee (buyer) must be clearly stated.

- Legal Description: A precise legal description of the property, often including parcel numbers or lot descriptions, is necessary to avoid ambiguity.

- Consideration: The amount paid for the property or other forms of consideration must be documented.

- Signatures: Both parties need to sign the document, and in some cases, notarization may be required to validate the deed.

Steps to complete the Understanding Property Deeds Investopedia

Completing the Understanding Property Deeds Investopedia form involves several steps to ensure accuracy and legality. Here are the steps to follow:

- Gather necessary information about the property, including its legal description and any existing liens.

- Identify the parties involved in the transaction, ensuring their names are spelled correctly.

- Fill out the form, including all required details such as consideration and signatures.

- Review the completed form for any errors or omissions before finalizing.

- Consider having the document notarized if required by state law.

- File the completed deed with the appropriate local government office to make it a matter of public record.

Legal use of the Understanding Property Deeds Investopedia

The Understanding Property Deeds Investopedia form is legally binding once it is properly executed and recorded. It serves as proof of ownership and can be used in various legal contexts, such as resolving disputes over property rights or in the event of a sale. Compliance with state-specific laws regarding property deeds is crucial to ensure that the document holds up in court. Failure to adhere to these legal requirements may result in disputes or challenges to the validity of the deed.

How to obtain the Understanding Property Deeds Investopedia

Obtaining the Understanding Property Deeds Investopedia form can typically be done through several channels. Most states provide access to property deed forms through their official government websites or local county clerk offices. Additionally, legal forms may be available at local libraries or through real estate professionals. It is essential to ensure that the version of the form used complies with the specific regulations of the state where the property is located.

State-specific rules for the Understanding Property Deeds Investopedia

Each state in the U.S. has its own rules and regulations regarding property deeds. These state-specific rules may dictate the format of the deed, the required information, and the process for recording the document. Understanding these regulations is critical for ensuring that the Understanding Property Deeds Investopedia form is valid. It is advisable to consult with a local real estate attorney or the county clerk’s office to ensure compliance with state laws.

Quick guide on how to complete understanding property deeds investopedia

Accomplish Understanding Property Deeds Investopedia seamlessly on any gadget

Virtual document management has become increasingly favored by companies and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Understanding Property Deeds Investopedia on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Understanding Property Deeds Investopedia effortlessly

- Find Understanding Property Deeds Investopedia and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Understanding Property Deeds Investopedia and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are property deeds and why are they important?

Understanding Property Deeds Investopedia is vital for anyone dealing with real estate. Property deeds serve as legal documents that transfer ownership from one party to another, making them essential for property transactions. Knowing their types and uses can help you avoid legal issues and ensure smooth property transfers.

-

How does airSlate SignNow facilitate the signing of property deeds?

airSlate SignNow simplifies the process of signing property deeds with its user-friendly electronic signature solution. Understanding Property Deeds Investopedia is easier when you can digitally sign documents anywhere, anytime. Our platform ensures compliance with legal standards, making document signing secure and efficient.

-

What features does airSlate SignNow offer for managing property deeds?

With airSlate SignNow, you can easily create, send, and manage property deeds digitally. Understanding Property Deeds Investopedia becomes much more manageable with features like templates, document tracking, and integration with popular business tools. This helps streamline the entire process of property transactions.

-

What is the pricing model for airSlate SignNow?

airSlate SignNow offers cost-effective pricing plans tailored to fit various business needs. Understanding Property Deeds Investopedia can also enlighten you on how investing in a solid eSigning solution can save you time and resources in the long run. Our plans are competitively priced to deliver excellent value.

-

Can airSlate SignNow integrate with other software for better property deed management?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications to enhance property deed management. Understanding Property Deeds Investopedia will equip you with knowledge on how these integrations can offer more streamlined workflows. This allows you to use SignNow alongside your existing tools for maximum efficiency.

-

Is it legal to use electronic signatures for property deeds?

Absolutely! Using electronic signatures for property deeds is legal in many jurisdictions, provided they meet certain criteria. Understanding Property Deeds Investopedia reinforces the importance of using compliant platforms like airSlate SignNow that adhere to these regulations, ensuring your documents are valid.

-

What are the benefits of using airSlate SignNow for property deeds?

The primary benefits of using airSlate SignNow for property deeds include improved efficiency, reduced turnaround times, and cost savings. Understanding Property Deeds Investopedia can highlight how digitizing this process eliminates paperwork and aids in maintaining organized records. This leads to a hassle-free experience for all parties involved.

Get more for Understanding Property Deeds Investopedia

- Annual filing affidavit texas commission on environmental quality tceq texas form

- Ga form registration 2015 2019

- Initial treatment provider application substance abuse clinics dhcs 6002 rev 0616 initial treatment provider application form

- Aetna better health prior authorization form

- Republican party of texas gop data center access request form williamsoncountygop

- Account options form new covenant funds

- Superior court of washington probate form

- Form 990n epostcard online view and print return 1 of 1 httpsepostcard losangeles goldenrulelodge35ioof

Find out other Understanding Property Deeds Investopedia

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document