Form 3921 Rev April 2025-2026

What is the Form 3921 Rev April

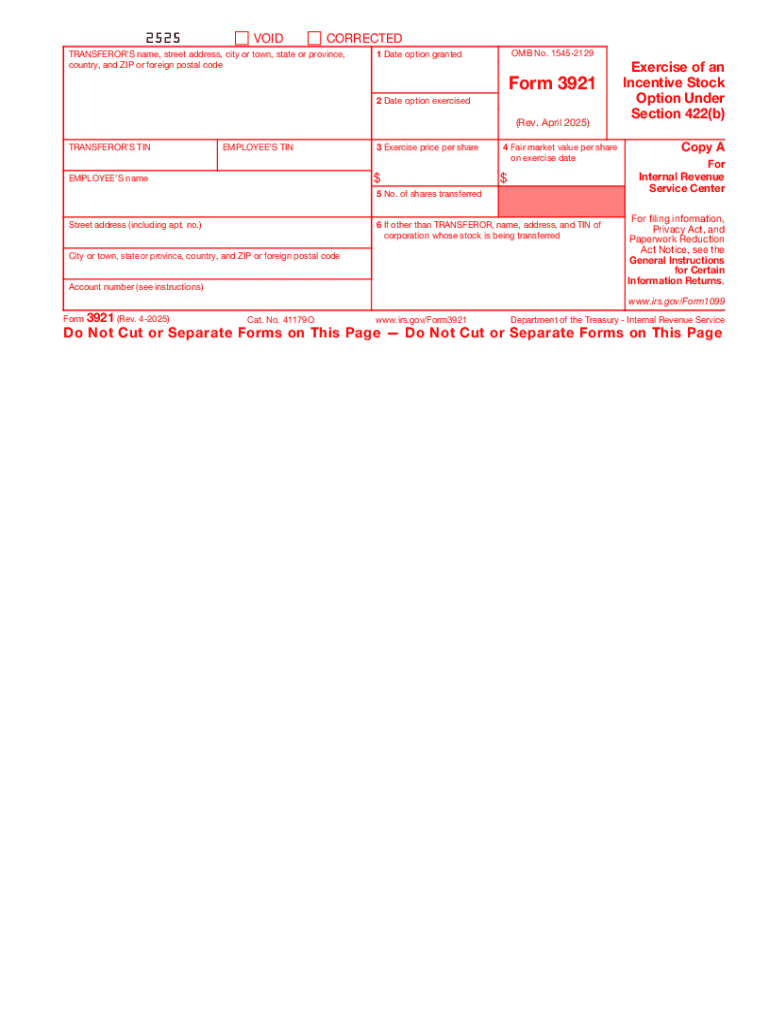

Form 3921 Rev April is a tax form used in the United States to report the exercise of an incentive stock option (ISO) by an employee. This form is essential for both the employer and employee, as it provides necessary information regarding the stock options exercised during the tax year. It includes details such as the number of shares acquired, the exercise price, and the fair market value of the shares on the exercise date. Proper completion and submission of this form help ensure compliance with IRS regulations and accurate tax reporting.

How to Obtain the Form 3921 Rev April

To obtain Form 3921 Rev April, individuals can visit the official IRS website or contact their employer if they need a copy related to their stock options. Employers are responsible for providing this form to employees who have exercised ISOs. Additionally, tax preparation software may include the form as part of their offerings, allowing users to fill it out digitally. It is advisable to ensure that the form is the most current version, as the IRS occasionally updates its forms.

Steps to Complete the Form 3921 Rev April

Completing Form 3921 Rev April involves several key steps:

- Begin by entering the name, address, and taxpayer identification number of the employer.

- Provide the employee's name, address, and taxpayer identification number.

- Fill in the number of shares acquired through the exercise of the stock option.

- Indicate the exercise price per share.

- Report the fair market value of the shares on the exercise date.

- Sign and date the form to certify that the information provided is accurate.

Double-check all entries for accuracy before submission to avoid potential issues with the IRS.

Legal Use of the Form 3921 Rev April

The legal use of Form 3921 Rev April is primarily tied to compliance with IRS regulations regarding incentive stock options. Employers must issue this form to employees who exercise ISOs, ensuring that all necessary information is reported accurately. Failure to provide this form can result in penalties for the employer, and employees may face complications when filing their taxes. It is crucial to adhere to the guidelines set forth by the IRS to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Form 3921 Rev April must be filed by the employer by January 31 of the year following the exercise of the stock options. This deadline ensures that employees receive the necessary information in a timely manner for their tax filings. Additionally, employees should be aware of the overall tax filing deadline, which is typically April 15, to ensure they include the information from Form 3921 when filing their personal tax returns. Staying informed about these deadlines is essential for compliance.

Examples of Using the Form 3921 Rev April

Form 3921 Rev April is commonly used in various scenarios involving incentive stock options. For example, if an employee exercises their stock options in 2023, the employer must complete and provide Form 3921 by January 31, 2024. This form will report the number of shares exercised, the exercise price, and the fair market value at the time of exercise. Employees can then use this information to accurately report their capital gains or losses when they sell the shares in the future, ensuring they comply with IRS tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 3921 rev april

Create this form in 5 minutes!

How to create an eSignature for the form 3921 rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3921 Rev April and why is it important?

Form 3921 Rev April is a tax form used to report the transfer of stock acquired through an employee stock option plan. It is important for both employers and employees to ensure compliance with IRS regulations and to accurately report income for tax purposes.

-

How can airSlate SignNow help with Form 3921 Rev April?

airSlate SignNow provides a seamless solution for electronically signing and sending Form 3921 Rev April. Our platform ensures that the form is securely signed and delivered, making the process efficient and compliant with legal standards.

-

What features does airSlate SignNow offer for managing Form 3921 Rev April?

With airSlate SignNow, you can easily create, edit, and send Form 3921 Rev April. Our features include customizable templates, automated workflows, and real-time tracking, which streamline the document management process.

-

Is there a cost associated with using airSlate SignNow for Form 3921 Rev April?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that simplify the handling of Form 3921 Rev April, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for Form 3921 Rev April?

Absolutely! airSlate SignNow integrates with a variety of applications, allowing you to streamline your workflow for Form 3921 Rev April. This integration capability enhances productivity by connecting with tools you already use.

-

What are the benefits of using airSlate SignNow for Form 3921 Rev April?

Using airSlate SignNow for Form 3921 Rev April offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and comply with all necessary regulations.

-

How secure is airSlate SignNow when handling Form 3921 Rev April?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Form 3921 Rev April. You can trust that your sensitive information is safe while using our platform.

Get more for Form 3921 Rev April

Find out other Form 3921 Rev April

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors