Form 3921 2013

What is the Form 3921

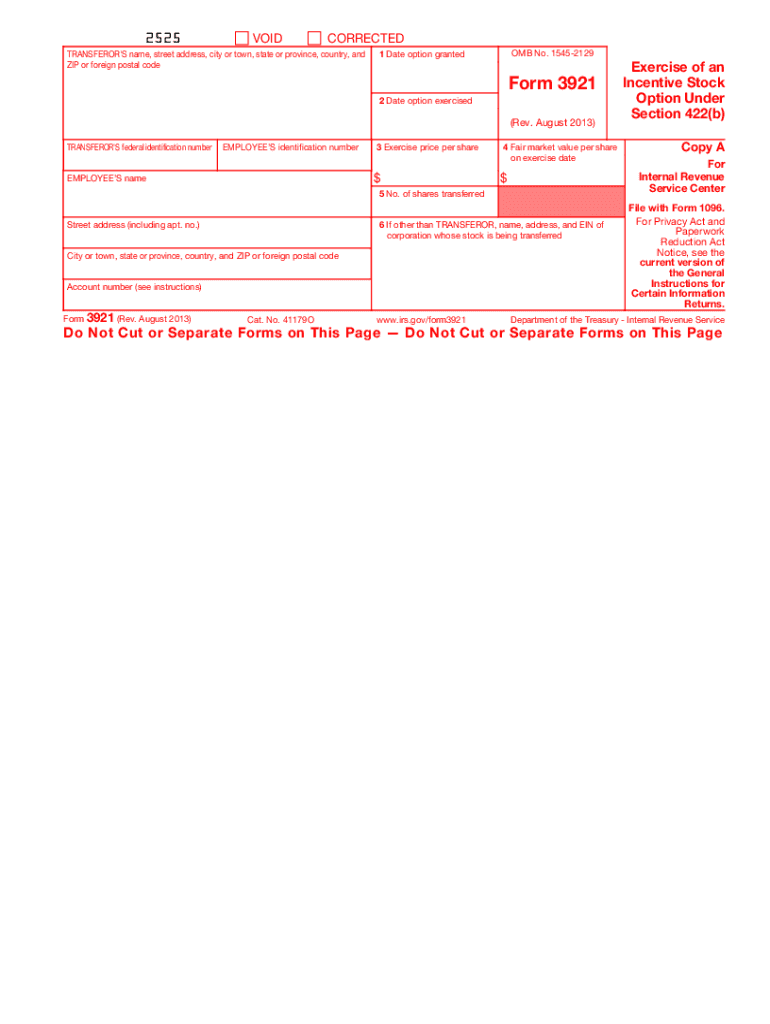

The Form 3921 is a tax document used in the United States, primarily for reporting the transfer of stock acquired through an employee stock purchase plan (ESPP). This form is crucial for both employers and employees, as it provides essential information regarding the stock options exercised by employees during the tax year. The IRS requires this form to ensure that employees accurately report their income from stock options on their tax returns.

How to use the Form 3921

Using the Form 3921 involves several key steps. First, employers must complete the form for each employee who exercised stock options during the tax year. The form requires details such as the employee's name, address, and Social Security number, along with information about the stock, including the number of shares acquired and the exercise price. Once completed, the employer must provide a copy to the employee and submit it to the IRS.

Steps to complete the Form 3921

Completing the Form 3921 involves a systematic approach:

- Gather necessary information, including employee details and stock option specifics.

- Fill in the employee's name, address, and Social Security number accurately.

- Provide details about the stock, including the number of shares acquired, exercise price, and fair market value at the time of exercise.

- Review the form for accuracy before submission.

- Distribute copies to the employee and file the form with the IRS by the deadline.

Legal use of the Form 3921

The legal use of the Form 3921 is governed by IRS regulations. It is essential for both employers and employees to ensure that the information reported is accurate and complete. Failure to comply with IRS guidelines can result in penalties for both parties. The form must be filed by the specified deadlines to avoid late fees and complications during tax filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 3921 is crucial for compliance. Employers must provide the completed form to employees by January 31 of the year following the tax year in which the stock options were exercised. Additionally, the form must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically.

Who Issues the Form

The Form 3921 is issued by employers who offer stock options to their employees. It is the responsibility of the employer to accurately complete and distribute the form to ensure compliance with IRS requirements. Employees do not issue this form; rather, they receive it as part of their tax documentation for reporting income from exercised stock options.

Quick guide on how to complete form 3921 2013

Effortlessly complete Form 3921 on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 3921 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 3921 effortlessly

- Locate Form 3921 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 3921 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3921 2013

Create this form in 5 minutes!

How to create an eSignature for the form 3921 2013

How to make an eSignature for the Form 3921 2013 in the online mode

How to create an electronic signature for your Form 3921 2013 in Google Chrome

How to generate an electronic signature for signing the Form 3921 2013 in Gmail

How to make an electronic signature for the Form 3921 2013 from your smartphone

How to make an electronic signature for the Form 3921 2013 on iOS

How to create an eSignature for the Form 3921 2013 on Android

People also ask

-

What is Form 3921, and why is it important?

Form 3921 is a tax form used to report the transfer of stock acquired through an incentive stock option (ISO) plan. It is important for both employees and employers to ensure accurate reporting for tax purposes. Using airSlate SignNow can streamline the eSigning process for Form 3921, making compliance easier.

-

How does airSlate SignNow simplify the completion of Form 3921?

airSlate SignNow simplifies the completion of Form 3921 by offering an intuitive interface that allows users to fill out and eSign documents quickly. The platform provides templates specifically designed for Form 3921, ensuring all necessary fields are included. This reduces errors and speeds up the filing process.

-

Is there a cost associated with using airSlate SignNow for Form 3921?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling Form 3921. These plans are designed to be cost-effective, providing essential features for document management and eSigning. You can choose a plan that best fits your budget and volume of transactions.

-

Can I integrate airSlate SignNow with other software for managing Form 3921?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow for managing Form 3921. Whether you use CRM systems, accounting software, or other tools, integration options are available to enhance your productivity.

-

What features does airSlate SignNow offer specifically for Form 3921 management?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning specifically for Form 3921 management. These features enhance accuracy and efficiency, ensuring that your documents are processed promptly and securely.

-

How secure is airSlate SignNow when handling Form 3921?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form 3921. The platform utilizes advanced encryption and secure data storage practices to protect your information. You can confidently eSign and share Form 3921, knowing that your data is safe.

-

What benefits does airSlate SignNow provide for businesses processing Form 3921?

Businesses using airSlate SignNow to process Form 3921 benefit from increased efficiency, reduced errors, and faster turnaround times. The easy-to-use interface and automation features help teams manage their documents effectively, ultimately saving time and resources.

Get more for Form 3921

- Fergray android form

- Death certificate form

- Dl dppa 1 2011 form

- Novus bexar county form

- What is a representstive payee opm form

- Eta 750b fillable form uscis

- Administrative regulations for court reporting services in the illinois courts form

- Medically supervised weight loss visit 1 month 1 mybrandnewlife form

Find out other Form 3921

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy