Sba Form 148

What is the SBA Form 148?

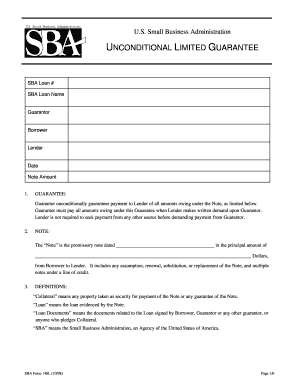

The SBA Form 148, also known as the 148L Payment Document, is a crucial form used by small businesses to apply for payment under specific programs administered by the Small Business Administration (SBA). This form is often utilized in scenarios involving loan guarantees and financial assistance. It serves to document the terms and conditions of the payment, ensuring compliance with federal regulations and providing a clear framework for both the lender and the borrower.

Steps to Complete the SBA Form 148

Completing the SBA Form 148 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including business details, loan amounts, and the purpose of the payment. Next, carefully fill out each section of the form, ensuring that all required fields are completed. It is essential to review the form for any errors or omissions before submission. Finally, sign and date the form, and keep a copy for your records.

Legal Use of the SBA Form 148

The SBA Form 148 is legally binding when completed correctly and submitted according to SBA guidelines. To ensure its legal standing, the form must be signed by an authorized representative of the business. Additionally, compliance with relevant laws, such as the ESIGN Act, is necessary for electronic submissions. This ensures that the form is recognized as a valid legal document in the event of disputes or audits.

How to Obtain the SBA Form 148

The SBA Form 148 can be obtained directly from the official SBA website or through authorized lending institutions that participate in SBA programs. It is available in both digital and printable formats, allowing users to choose the method that best suits their needs. Ensure that you are using the most current version of the form to avoid any issues during the application process.

Examples of Using the SBA Form 148

Common scenarios for using the SBA Form 148 include applying for loan guarantees under the SBA's 7(a) loan program or requesting payments related to disaster relief loans. For instance, a small business seeking financial assistance for recovery after a natural disaster may complete the form to document their request for funds. This form helps streamline the process, ensuring that all parties are aware of the terms and conditions associated with the payment.

Required Documents for SBA Form 148 Submission

When submitting the SBA Form 148, certain supporting documents are typically required. These may include financial statements, tax returns, and any previous loan agreements. It is important to check with the specific lender or the SBA for a complete list of required documents to ensure a smooth application process. Having all necessary documentation ready can expedite the review and approval of your request.

Quick guide on how to complete sba form 148

Complete Sba Form 148 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and eSign your documents quickly without hold-ups. Manage Sba Form 148 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Sba Form 148 with ease

- Obtain Sba Form 148 and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to preserve your changes.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns over lost or misplaced documents, exhausting form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Sba Form 148 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 148

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 148l signnow?

The form 148l signnow is a specific template designed for eSigning documents securely. It streamlines the signing process, making it easy for users to complete and manage their agreements digitally, enhancing overall efficiency.

-

How can I access the form 148l signnow?

You can easily access the form 148l signnow by signing up for an airSlate SignNow account. Once registered, you can navigate to our templates section to find the form and start utilizing its features.

-

Is there a cost associated with using the form 148l signnow?

Yes, using the form 148l signnow involves subscription pricing based on your selected plan. airSlate SignNow offers various pricing tiers to fit different budgets, ensuring cost-effective eSigning solutions for all users.

-

What features does the form 148l signnow offer?

The form 148l signnow includes multiple features such as customizable fields, templates for repetitive use, and robust security measures to protect your documents. These features optimize your workflow and guarantee a seamless signing experience.

-

Can the form 148l signnow integrate with other software?

Absolutely! The form 148l signnow integrates smoothly with various third-party applications including cloud storage, CRMs, and project management tools. This enhances your workflow by connecting all your crucial tools in one place.

-

What are the benefits of using the form 148l signnow for my business?

Using the form 148l signnow offers numerous benefits, such as improved turnaround times for contracts and increased document security. Businesses can also reduce paper usage and streamline their signing process, leading to higher productivity.

-

Is the form 148l signnow user-friendly for beginners?

Yes, the form 148l signnow is designed with user experience in mind, boasting an intuitive interface that is easy for beginners to navigate. With simple step-by-step guides, you can start signing documents without any hassle.

Get more for Sba Form 148

Find out other Sba Form 148

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed