STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE 2018-2026

Understanding the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

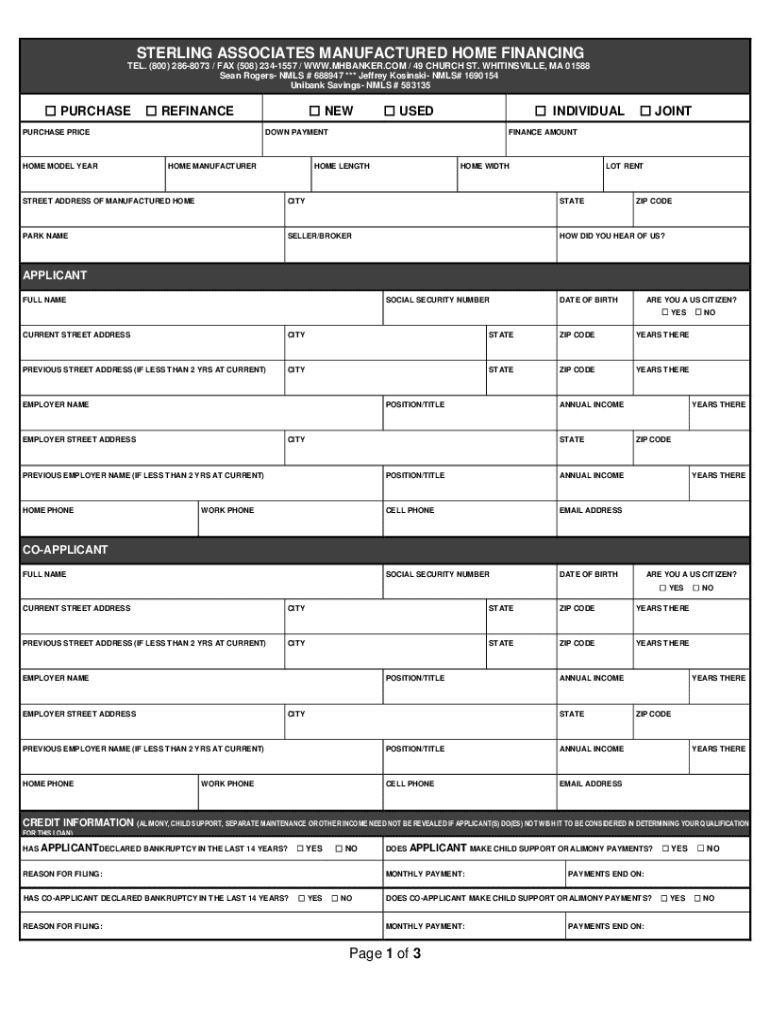

The STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE is a specialized financial document designed to facilitate the financing of manufactured homes. This form is essential for individuals seeking loans or financing options specifically tailored for manufactured housing. It outlines the terms and conditions of the financing arrangement, including interest rates, repayment schedules, and eligibility criteria.

This financing option is particularly relevant for those looking to purchase or refinance a manufactured home, providing a structured approach to securing necessary funds. Understanding the details of this form can help potential borrowers make informed financial decisions.

Steps to Complete the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

Completing the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE involves several key steps to ensure accuracy and compliance. Begin by gathering essential information, such as personal identification details, financial history, and specifics about the manufactured home.

Next, fill out the form carefully, ensuring that all sections are completed. Pay attention to the financial details, including income, expenses, and any existing debts. Once the form is filled out, review it for any errors or omissions. Finally, submit the form through the designated channels, whether online, by mail, or in person, as specified by Sterling Associates.

Required Documents for the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

To successfully complete the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE, several documents are typically required. These may include:

- Proof of income, such as pay stubs or tax returns

- Identification documents, including a driver's license or Social Security card

- Information about the manufactured home, including purchase agreement and property details

- Credit history or score reports to assess eligibility

Having these documents ready can streamline the application process and increase the likelihood of approval.

Eligibility Criteria for the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

Eligibility for the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE typically depends on several factors. These may include:

- Credit score requirements, which can vary based on the lender's policies

- Income verification to ensure the borrower can meet repayment obligations

- Debt-to-income ratio assessments to evaluate financial stability

- Specific criteria related to the manufactured home, such as age and condition

Understanding these criteria can help potential borrowers prepare their applications more effectively.

Application Process & Approval Time for the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

The application process for the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE involves submitting the completed form along with the required documents. After submission, the processing time can vary based on several factors, including the lender's workload and the completeness of the application.

Typically, borrowers can expect a response within a few days to a few weeks. During this time, the lender may conduct a review of the submitted information and perform necessary background checks. Keeping communication open with the lender can help expedite the process.

Legal Use of the STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

The STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE is legally binding once signed by all parties involved. It is crucial for borrowers to understand the terms outlined in the document, as it governs the financial relationship between the borrower and the lender.

Compliance with the terms of the financing agreement is essential to avoid penalties or legal issues. Borrowers should ensure they fully comprehend their rights and responsibilities as stipulated in the form before signing.

Create this form in 5 minutes or less

Find and fill out the correct sterling associates manufactured home financing te

Create this form in 5 minutes!

How to create an eSignature for the sterling associates manufactured home financing te

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE?

STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE is a specialized financing solution designed to help individuals secure loans for manufactured homes. This program offers flexible terms and competitive rates, making it easier for buyers to invest in their dream homes.

-

How does STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE work?

The STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE process involves a straightforward application where potential borrowers provide their financial information. Once approved, customers can access funds to purchase or refinance their manufactured homes, streamlining the entire financing experience.

-

What are the benefits of using STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE?

Using STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE offers numerous benefits, including lower interest rates, flexible repayment options, and a quick approval process. This financing solution is tailored to meet the unique needs of manufactured home buyers, ensuring a smooth transaction.

-

Are there any fees associated with STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE?

While STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE aims to keep costs low, there may be some fees involved, such as application fees or closing costs. It's essential to review the terms and conditions to understand any potential charges before proceeding with your financing.

-

Can I use STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE for refinancing?

Yes, STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE can be utilized for refinancing existing loans on manufactured homes. This option allows homeowners to take advantage of better rates or terms, potentially lowering their monthly payments and overall financial burden.

-

What types of manufactured homes qualify for STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE?

STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE typically qualifies a variety of manufactured homes, including single-section and multi-section units. However, it's important to check specific eligibility criteria to ensure your home meets the necessary standards for financing.

-

How long does the approval process take for STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE?

The approval process for STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE is designed to be efficient, often taking just a few days. Factors such as the completeness of your application and the verification of your financial information can influence the timeline.

Get more for STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

Find out other STERLING ASSOCIATES MANUFACTURED HOME FINANCING TE

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter