Sterling Mobile Home Financing 2005

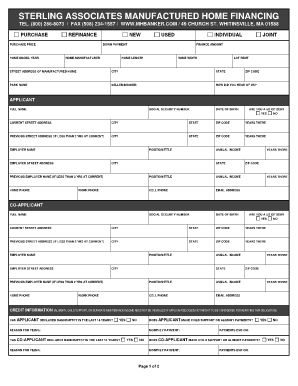

What is the Sterling Mobile Home Financing

The sterling mobile home financing is a financial product designed to assist individuals and families in purchasing mobile homes. This financing option typically includes various loan types, such as personal loans and chattel loans, tailored specifically for mobile home purchases. Unlike traditional mortgages, which are secured by real estate, mobile home financing often focuses on the value of the home itself, making it accessible for a broader range of buyers.

How to Obtain the Sterling Mobile Home Financing

To obtain sterling mobile home financing, prospective buyers should follow a series of steps. First, it is essential to assess your financial situation, including credit score and income. Next, research various lenders that offer mobile home financing options, comparing interest rates and terms. After selecting a lender, gather necessary documentation, such as proof of income, credit history, and identification. Finally, submit your application, and await approval, which may involve an appraisal of the mobile home.

Key Elements of the Sterling Mobile Home Financing

Several key elements define sterling mobile home financing. These include:

- Loan Amount: The maximum amount you can borrow, often determined by the mobile home's value.

- Interest Rate: The cost of borrowing, which can be fixed or variable, impacting monthly payments.

- Loan Term: The duration over which the loan must be repaid, typically ranging from five to twenty years.

- Down Payment: The initial payment made when purchasing the mobile home, which may vary depending on the lender.

- Fees: Additional costs associated with the loan, such as origination fees or closing costs.

Steps to Complete the Sterling Mobile Home Financing

Completing the sterling mobile home financing process involves several steps:

- Research: Investigate different lenders and their financing options.

- Application: Fill out the financing application with accurate information.

- Documentation: Provide required documents, including financial statements and identification.

- Approval: Wait for the lender's decision, which may require an appraisal of the mobile home.

- Closing: Finalize the loan agreement and complete the purchase of the mobile home.

Legal Use of the Sterling Mobile Home Financing

Using sterling mobile home financing legally requires compliance with federal and state regulations. It is crucial to ensure that all documentation is accurate and complete. Additionally, borrowers must understand their rights and responsibilities under the financing agreement. This includes adhering to payment schedules and being aware of any penalties for late payments. Legal protections, such as the Truth in Lending Act, may also apply, ensuring transparency in lending practices.

Eligibility Criteria

Eligibility for sterling mobile home financing typically includes several criteria that potential borrowers must meet. These may involve:

- Credit Score: A minimum credit score requirement, often around six hundred, is common.

- Income Verification: Proof of stable income to demonstrate the ability to repay the loan.

- Debt-to-Income Ratio: A ratio that compares monthly debt payments to monthly income, usually not exceeding forty-three percent.

- Age of Mobile Home: Some lenders may have restrictions on the age of the mobile home being financed.

Quick guide on how to complete sterling mobile home financing

Effortlessly Prepare Sterling Mobile Home Financing on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Sterling Mobile Home Financing across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Modify and eSign Sterling Mobile Home Financing with Minimal Effort

- Find Sterling Mobile Home Financing and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign Sterling Mobile Home Financing and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sterling mobile home financing

Create this form in 5 minutes!

How to create an eSignature for the sterling mobile home financing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sterling mobile home financing?

Sterling mobile home financing refers to loan options tailored for purchasing mobile homes, ensuring that buyers can secure affordable payments while enjoying the benefits of home ownership. This financing can cover both new and used mobile homes, providing flexibility for potential homeowners in various financial situations.

-

How does airSlate SignNow facilitate sterling mobile home financing?

AirSlate SignNow streamlines the signing process for loan agreements related to sterling mobile home financing by allowing users to easily send, receive, and electronically sign documents. This removes the hassle of paperwork and ensures that the process is quick and efficient, helping prospective homeowners finalize their loans faster.

-

Are there any fees associated with sterling mobile home financing?

Fees for sterling mobile home financing can vary depending on the lender, but generally, there may be loan origination fees, closing costs, and service charges involved. It's crucial to review all terms and conditions related to the financing agreement to understand the full cost associated with obtaining your mobile home loan.

-

What are the benefits of choosing sterling mobile home financing?

Choosing sterling mobile home financing can provide numerous benefits, such as lower down payments, competitive interest rates, and flexible loan terms. Additionally, financing a mobile home can make home ownership more accessible for individuals, allowing families to invest in real estate without the high costs of traditional homes.

-

What documents are needed for sterling mobile home financing?

When applying for sterling mobile home financing, you'll typically need to submit proof of income, employment verification, credit history, and personal identification. This documentation helps lenders evaluate your financial stability and determine your eligibility for a mobile home loan.

-

Can I use airSlate SignNow for my sterling mobile home financing transactions?

Yes, airSlate SignNow can be used to handle all documents related to your sterling mobile home financing transactions. This includes loan agreements, disclosures, and any necessary paperwork, all of which can be eSigned securely and efficiently, making the process hassle-free.

-

Are there different types of sterling mobile home financing available?

Yes, there are several types of sterling mobile home financing available, including FHA loans, conventional loans, and personal loans. Each type offers different terms and conditions, allowing borrowers to choose the best fit for their financial situation and mobile home purchasing needs.

Get more for Sterling Mobile Home Financing

- Pr 1851 order setting time to hear petition for special form

- Special administration wisconsin court system circuit form

- Chapter 2113 executors and ohio revised code form

- Pr 1833 petition for extension of time wisconsin court form

- Pr 1905 order for formal administration wisconsin court

- Pr 1909 judgment on claims wisconsin court system form

- I am the personal representative in this estate form

- Pr 1903 order setting time to hear petition for form

Find out other Sterling Mobile Home Financing

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online