Family of Five or Fewer Exempt Statement 2025-2026

What is the Family Of Five Or Fewer Exempt Statement

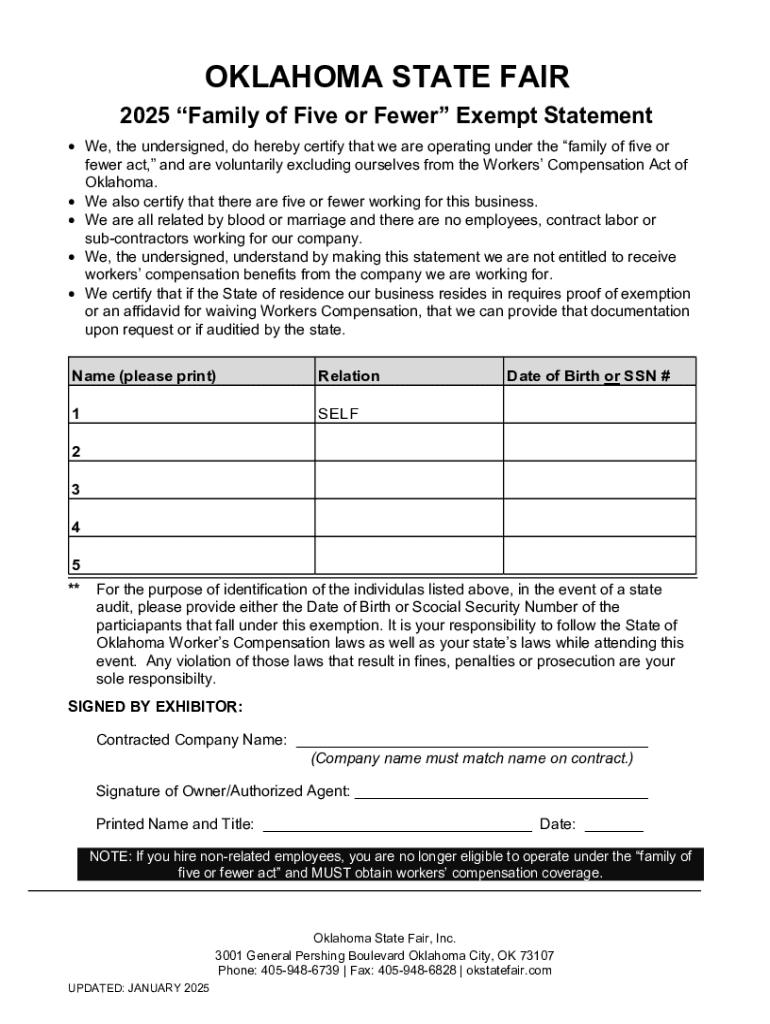

The Family Of Five Or Fewer Exempt Statement is a specific declaration used primarily for tax purposes. It allows individuals or families with five or fewer members to claim certain exemptions, which may reduce their overall tax liability. This statement is particularly relevant for those who qualify based on their household size and income level, enabling them to benefit from tax relief provisions set forth by the IRS.

How to use the Family Of Five Or Fewer Exempt Statement

To effectively use the Family Of Five Or Fewer Exempt Statement, individuals must first determine their eligibility based on household size and income criteria. Once eligibility is confirmed, the statement should be filled out accurately, ensuring all required information is provided. After completion, the statement can be submitted along with the relevant tax forms during the filing process, allowing for the appropriate exemptions to be applied.

Steps to complete the Family Of Five Or Fewer Exempt Statement

Completing the Family Of Five Or Fewer Exempt Statement involves several key steps:

- Gather necessary personal information, including names and Social Security numbers of all household members.

- Determine your eligibility based on the number of individuals in your household and your income level.

- Fill out the statement accurately, ensuring all fields are completed.

- Review the statement for any errors or omissions before submission.

- Submit the statement with your tax return or as directed by the IRS guidelines.

Legal use of the Family Of Five Or Fewer Exempt Statement

The Family Of Five Or Fewer Exempt Statement is legally recognized by the IRS and is essential for individuals seeking to claim exemptions based on their household size. Proper use of this statement ensures compliance with tax regulations and helps avoid potential penalties. It is crucial to adhere to the guidelines set forth by the IRS when completing and submitting this statement to maintain its legal validity.

Eligibility Criteria

Eligibility for the Family Of Five Or Fewer Exempt Statement is primarily based on household size and income. To qualify, the household must consist of five or fewer individuals. Additionally, the income level must fall within the limits established by the IRS for the relevant tax year. It is important for applicants to review the specific criteria outlined by the IRS to ensure they meet all necessary requirements before filing.

Required Documents

When preparing to submit the Family Of Five Or Fewer Exempt Statement, certain documents may be required. These typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Identification for all household members, including Social Security cards.

- Any previous tax documents that may support the claim for exemptions.

Form Submission Methods

The Family Of Five Or Fewer Exempt Statement can be submitted through various methods, depending on individual preferences and requirements. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy of the statement along with the tax return.

- In-person submission at designated IRS offices or authorized agents.

Create this form in 5 minutes or less

Find and fill out the correct family of five or fewer exempt statement

Create this form in 5 minutes!

How to create an eSignature for the family of five or fewer exempt statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Family Of Five Or Fewer Exempt Statement?

The Family Of Five Or Fewer Exempt Statement is a declaration that allows eligible families to claim exemptions based on their size. This statement is particularly useful for tax purposes and can simplify the filing process for families with five or fewer members.

-

How can airSlate SignNow help with the Family Of Five Or Fewer Exempt Statement?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning the Family Of Five Or Fewer Exempt Statement. Our user-friendly interface ensures that you can complete the necessary documentation quickly and securely, streamlining your administrative tasks.

-

Is there a cost associated with using airSlate SignNow for the Family Of Five Or Fewer Exempt Statement?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features for handling the Family Of Five Or Fewer Exempt Statement. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for managing the Family Of Five Or Fewer Exempt Statement?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Family Of Five Or Fewer Exempt Statement. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for the Family Of Five Or Fewer Exempt Statement?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage the Family Of Five Or Fewer Exempt Statement alongside your existing workflows. This flexibility enhances productivity and ensures a smooth document handling process.

-

What are the benefits of using airSlate SignNow for the Family Of Five Or Fewer Exempt Statement?

Using airSlate SignNow for the Family Of Five Or Fewer Exempt Statement provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, making it easier for families to manage their documentation.

-

Is airSlate SignNow secure for handling sensitive documents like the Family Of Five Or Fewer Exempt Statement?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Family Of Five Or Fewer Exempt Statement and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your information throughout the signing process.

Get more for Family Of Five Or Fewer Exempt Statement

- Nursery application form

- Blow the lid off reading 310212460 form

- Tchart form

- Parental consent to share health information for the ohio medicaid bb loganhocking k12 oh

- Sace educator profile form

- Divorce financial agreement template form

- Divorce financial settlement draft consent order agreement template form

- Divorce mediation agreement template form

Find out other Family Of Five Or Fewer Exempt Statement

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe