Family on Five or Fewer Exempt Statement 2015

What is the Family On Five Or Fewer Exempt Statement

The Family On Five Or Fewer Exempt Statement is a specific tax form used in the United States to declare certain exemptions for families with five or fewer members. This form helps taxpayers clarify their eligibility for exemptions that may reduce their taxable income. It is particularly relevant for families who may qualify for specific tax benefits based on their size and income level. Understanding this form is essential for ensuring compliance with tax regulations while maximizing potential tax benefits.

How to Use the Family On Five Or Fewer Exempt Statement

Using the Family On Five Or Fewer Exempt Statement involves several key steps. First, gather all necessary information about your family members, including names, Social Security numbers, and any relevant income details. Next, accurately complete the form by filling in the required fields, ensuring that all information is correct and up to date. Once completed, the form should be submitted according to the instructions provided, either electronically or via mail, depending on the specific requirements of your tax situation.

Steps to Complete the Family On Five Or Fewer Exempt Statement

Completing the Family On Five Or Fewer Exempt Statement involves a systematic approach:

- Gather necessary documents, including Social Security cards and income statements for each family member.

- Fill out the form carefully, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided, ensuring it is sent to the correct address or submitted through the appropriate online portal.

Legal Use of the Family On Five Or Fewer Exempt Statement

The Family On Five Or Fewer Exempt Statement is legally recognized for tax purposes in the United States. It is essential for taxpayers to understand the legal implications of this form, as it serves as a declaration of eligibility for specific tax exemptions. Accurate completion and timely submission are crucial to avoid potential legal issues or penalties associated with misrepresentation of family size or income.

Key Elements of the Family On Five Or Fewer Exempt Statement

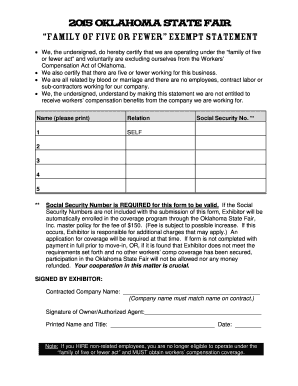

Key elements of the Family On Five Or Fewer Exempt Statement include:

- Identification of family members, including names and Social Security numbers.

- Income details that may affect exemption eligibility.

- Signature of the taxpayer, affirming the accuracy of the information provided.

- Any additional documentation required to support the claims made on the form.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Family On Five Or Fewer Exempt Statement. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding eligibility criteria, filing deadlines, and any changes to tax laws that may affect the form's use. Adhering to IRS guidelines helps prevent issues during tax filing and ensures that taxpayers receive any benefits they are entitled to.

Create this form in 5 minutes or less

Find and fill out the correct family on five or fewer exempt statement

Create this form in 5 minutes!

How to create an eSignature for the family on five or fewer exempt statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a family on five or fewer exempt statement?

A family on five or fewer exempt statement is a declaration that allows certain families to qualify for exemptions based on their size. This statement is essential for ensuring compliance with various regulations and can simplify the process of managing documentation. Understanding this statement can help families navigate their eligibility for benefits.

-

How can airSlate SignNow help with the family on five or fewer exempt statement?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning the family on five or fewer exempt statement. Our user-friendly interface allows you to manage documents seamlessly, ensuring that you can focus on what matters most. With our solution, you can streamline the process and reduce the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for the family on five or fewer exempt statement?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring the family on five or fewer exempt statement. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget while still accessing all necessary features.

-

Are there any specific features for managing the family on five or fewer exempt statement?

Yes, airSlate SignNow includes features specifically designed for managing the family on five or fewer exempt statement. These features include customizable templates, automated workflows, and secure eSigning capabilities. This ensures that your documents are handled efficiently and securely.

-

What benefits does airSlate SignNow offer for families needing the family on five or fewer exempt statement?

Using airSlate SignNow for the family on five or fewer exempt statement provides numerous benefits, including time savings and enhanced accuracy. Our platform minimizes the risk of errors and ensures that your documents are compliant with regulations. Additionally, you can access your documents anytime, anywhere, making it convenient for busy families.

-

Can I integrate airSlate SignNow with other tools for the family on five or fewer exempt statement?

Absolutely! airSlate SignNow offers integrations with various tools and applications that can enhance your experience with the family on five or fewer exempt statement. Whether you use CRM systems, cloud storage, or other business applications, our platform can seamlessly connect to improve your workflow.

-

Is airSlate SignNow secure for handling sensitive family on five or fewer exempt statements?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like the family on five or fewer exempt statement. We implement industry-standard encryption and security protocols to protect your data. You can trust that your information is safe with us.

Get more for Family On Five Or Fewer Exempt Statement

- Membership application form pirates sports amp rugby club

- Lpl corporate resolution instructions form

- Double elimination bracket excel form

- Mv2323 1000454 form

- Versus drug regimen review form

- Fmcsa amp hivaids world economic forum members weforum form

- Rare report final doc journal of tropical medicine form

- Live perance agreement template form

Find out other Family On Five Or Fewer Exempt Statement

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer