After Tax Super Contributions 2022-2026

What are after-tax super contributions?

After-tax super contributions refer to additional contributions made to a retirement superannuation fund after income tax has been deducted. These contributions can help individuals boost their retirement savings beyond the standard pre-tax limits. In the United States, these contributions may not receive the same tax benefits as traditional pre-tax contributions, but they can still play a crucial role in retirement planning. By using after-tax contributions, individuals can potentially take advantage of tax-free growth within their super fund, depending on the specific regulations governing their retirement accounts.

How to use after-tax super contributions

Using after-tax super contributions involves a few straightforward steps. First, individuals should assess their current retirement savings strategy and determine how much they wish to contribute after taxes. Next, they need to ensure that their superannuation fund allows for after-tax contributions, as not all funds may offer this option. Once confirmed, individuals can make contributions directly to their super fund, ensuring they keep accurate records of these transactions for future reference. It is also beneficial to consult with a financial advisor to understand the implications of these contributions on overall retirement goals.

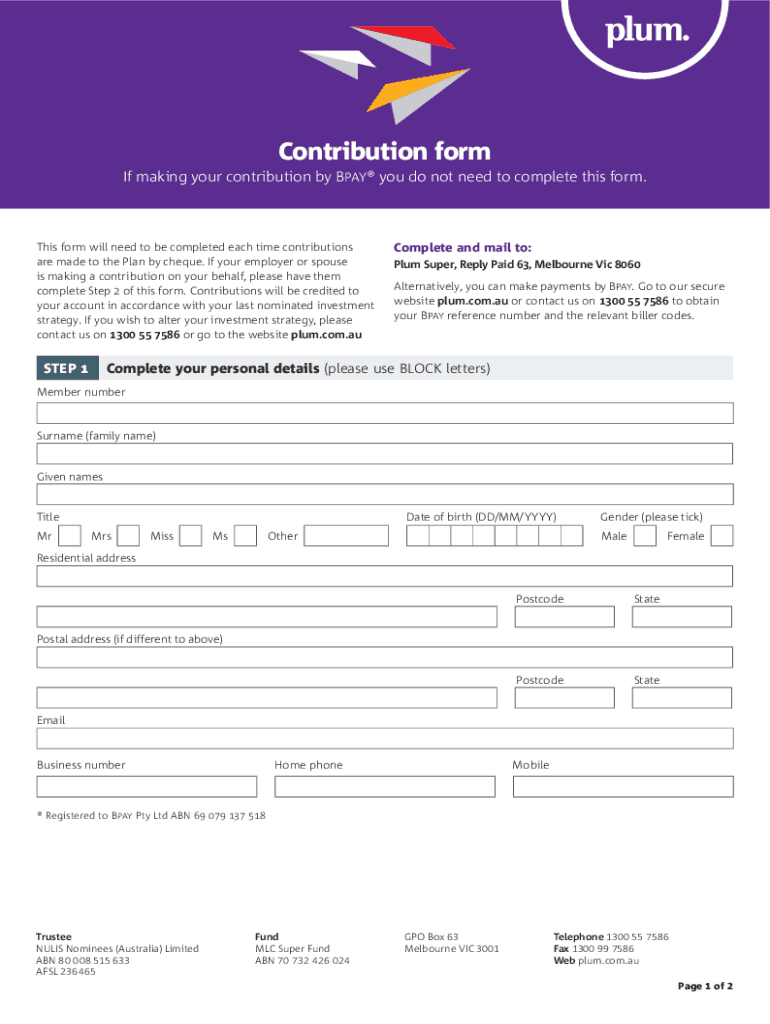

Steps to complete after-tax super contributions

Completing after-tax super contributions involves several key steps:

- Evaluate your financial situation to determine how much you can afford to contribute.

- Check with your superannuation fund to confirm that they accept after-tax contributions.

- Make the contribution directly to your super fund, ensuring to follow any specific guidelines provided by the fund.

- Keep detailed records of your contributions for tax purposes and future reference.

- Review your retirement strategy regularly to ensure that your contributions align with your long-term goals.

Legal use of after-tax super contributions

After-tax super contributions must comply with specific legal guidelines to ensure they are valid and beneficial. In the U.S., individuals should adhere to the contribution limits set by the IRS for retirement accounts. Contributions exceeding these limits may incur penalties. It is essential to understand the tax implications of these contributions, as they may not be tax-deductible. Consulting with a tax professional can provide clarity on how to navigate the legal landscape surrounding after-tax contributions and ensure compliance with all regulations.

Eligibility criteria for after-tax super contributions

Eligibility for making after-tax super contributions typically includes being an employee or self-employed individual with earned income. However, specific criteria may vary based on the retirement plan in question. Generally, individuals must be under the age of seventy and a half to make contributions. Additionally, some plans may have income limits or other restrictions that affect eligibility. It is advisable to check with the super fund or a financial advisor to confirm eligibility before proceeding with contributions.

IRS guidelines for after-tax super contributions

The IRS provides guidelines that govern after-tax super contributions, primarily focusing on contribution limits and tax implications. Individuals must ensure that their contributions do not exceed the annual limit set by the IRS for retirement accounts. Additionally, understanding how these contributions affect overall tax liability is crucial. The IRS allows for tax-free growth on contributions made to certain retirement accounts, but the rules can be complex. Staying informed about IRS guidelines can help individuals maximize their retirement savings while minimizing potential tax liabilities.

Create this form in 5 minutes or less

Find and fill out the correct after tax super contributions

Create this form in 5 minutes!

How to create an eSignature for the after tax super contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are After tax Super Contributions?

After tax Super Contributions refer to additional contributions made to your superannuation fund from your post-tax income. These contributions can help boost your retirement savings and may offer tax benefits depending on your financial situation. Understanding After tax Super Contributions is essential for effective retirement planning.

-

How do After tax Super Contributions work?

After tax Super Contributions are made after you have paid income tax on your earnings. You can choose to contribute a portion of your salary or any additional funds to your superannuation. This method allows you to increase your super balance while potentially benefiting from lower tax rates on earnings within the fund.

-

What are the benefits of making After tax Super Contributions?

Making After tax Super Contributions can signNowly enhance your retirement savings. These contributions can grow tax-free within your super fund, and you may also benefit from the government co-contribution scheme if you meet certain income thresholds. This strategy is a smart way to maximize your retirement funds.

-

Are there limits on After tax Super Contributions?

Yes, there are limits on After tax Super Contributions, which are part of the overall contribution cap set by the government. Exceeding these limits may result in additional tax penalties. It's important to stay informed about the current caps to ensure compliance and optimize your retirement savings.

-

How can airSlate SignNow assist with After tax Super Contributions documentation?

airSlate SignNow provides an easy-to-use platform for managing and eSigning documents related to After tax Super Contributions. Our solution streamlines the process, ensuring that all necessary paperwork is completed efficiently and securely. This helps you focus on maximizing your contributions without the hassle of paperwork.

-

What features does airSlate SignNow offer for managing After tax Super Contributions?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to simplify the management of After tax Super Contributions. These tools enhance your workflow, making it easier to handle contributions and related documentation. Our platform is designed to be user-friendly and efficient.

-

Is airSlate SignNow cost-effective for managing After tax Super Contributions?

Yes, airSlate SignNow is a cost-effective solution for managing After tax Super Contributions. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can access essential features without breaking the bank. Investing in our platform can save you time and resources in the long run.

Get more for After tax Super Contributions

- Alt service motion and memo for alt service cad rra form

- Mvc accident report state of new jersey state nj form

- Napolcom form 1a pdf

- Form non canadian

- Dwelling lease conyers housing authority form

- 911 open records form dekalb county georgia web dekalbcountyga

- Aaa tow reimbursement nc form

- K1 waiver form

Find out other After tax Super Contributions

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later