6729 Protected B When CompletedDisability Tax Cred 2023-2026

What is the 6729 Protected B When Completed Disability Tax Cred

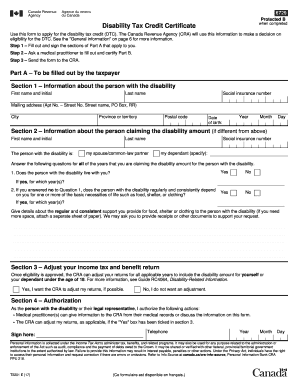

The 6729 Protected B When Completed Disability Tax Cred is a specific form used in the United States to apply for the Disability Tax Credit. This form is designed to assist individuals with disabilities in claiming tax benefits that can alleviate some financial burdens. It is crucial for applicants to understand that this form must be filled out accurately to ensure the proper processing of their claims. The information provided on this form is used by the IRS to evaluate eligibility for the tax credit, which can significantly impact the financial situation of those living with disabilities.

How to use the 6729 Protected B When Completed Disability Tax Cred

Using the 6729 Protected B When Completed Disability Tax Cred involves several steps to ensure that the application is completed correctly. Applicants should begin by gathering all necessary personal information and documentation related to their disability. This includes medical records, proof of income, and any other relevant documentation that supports the claim. Once the form is filled out, it can be submitted to the IRS either electronically or via mail, depending on the preferred method of submission. It is essential to keep copies of all submitted documents for personal records.

Steps to complete the 6729 Protected B When Completed Disability Tax Cred

Completing the 6729 Protected B When Completed Disability Tax Cred requires careful attention to detail. The following steps outline the process:

- Gather all required documents, including medical evidence and financial statements.

- Fill out the form accurately, ensuring that all sections are completed as instructed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS through the chosen method, either electronically or by mail.

- Retain copies of the submitted form and all supporting documents for future reference.

Eligibility Criteria

To qualify for the Disability Tax Credit using the 6729 Protected B When Completed Disability Tax Cred, applicants must meet specific eligibility criteria. These criteria typically include having a recognized disability that significantly impairs daily activities. Additionally, the applicant's income level may be considered, as the tax credit is designed to assist those with financial needs. It is important for applicants to provide thorough documentation to support their claims, as this will be critical in the evaluation process by the IRS.

Required Documents

When completing the 6729 Protected B When Completed Disability Tax Cred, several documents are required to substantiate the claim. Key documents include:

- Medical records that detail the nature and extent of the disability.

- Proof of income, such as pay stubs or tax returns, to demonstrate financial need.

- Any additional documentation that supports the claim, such as letters from healthcare providers.

Having these documents ready will facilitate a smoother application process and help ensure that the IRS has all necessary information to assess eligibility.

Form Submission Methods

The 6729 Protected B When Completed Disability Tax Cred can be submitted to the IRS through various methods. Applicants can choose to file electronically, which is often faster and allows for immediate confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is essential to check the latest IRS guidelines for submission methods, as these can change over time. Regardless of the method chosen, applicants should ensure that they keep copies of all submitted materials for their records.

Create this form in 5 minutes or less

Find and fill out the correct 6729 protected b when completeddisability tax cred

Create this form in 5 minutes!

How to create an eSignature for the 6729 protected b when completeddisability tax cred

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 6729 Protected B When Completed Disability Tax Cred?

The 6729 Protected B When Completed Disability Tax Cred is a form used in Canada to claim the Disability Tax Credit. This form helps individuals with disabilities or their caregivers to receive tax benefits. Understanding this form is crucial for maximizing your tax savings.

-

How can airSlate SignNow help with the 6729 Protected B When Completed Disability Tax Cred?

airSlate SignNow provides an efficient platform for completing and signing the 6729 Protected B When Completed Disability Tax Cred. Our solution simplifies the document management process, ensuring that you can easily fill out and submit your forms securely.

-

Is there a cost associated with using airSlate SignNow for the 6729 Protected B When Completed Disability Tax Cred?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solution ensures that you can manage your 6729 Protected B When Completed Disability Tax Cred without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the 6729 Protected B When Completed Disability Tax Cred?

airSlate SignNow includes features such as eSignature, document templates, and secure storage, all tailored for the 6729 Protected B When Completed Disability Tax Cred. These features streamline the process, making it easier to complete and manage your tax documents.

-

Can I integrate airSlate SignNow with other software for the 6729 Protected B When Completed Disability Tax Cred?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for the 6729 Protected B When Completed Disability Tax Cred. This allows you to connect with your existing tools and streamline your document management process.

-

What are the benefits of using airSlate SignNow for the 6729 Protected B When Completed Disability Tax Cred?

Using airSlate SignNow for the 6729 Protected B When Completed Disability Tax Cred provides numerous benefits, including time savings and increased accuracy. Our platform ensures that your documents are completed correctly and submitted on time, maximizing your potential tax credits.

-

Is airSlate SignNow secure for handling the 6729 Protected B When Completed Disability Tax Cred?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the 6729 Protected B When Completed Disability Tax Cred. We utilize advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for 6729 Protected B When CompletedDisability Tax Cred

Find out other 6729 Protected B When CompletedDisability Tax Cred

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form