Canadian Disability Tax Credit Form 2010

What is the Canadian Disability Tax Credit Form

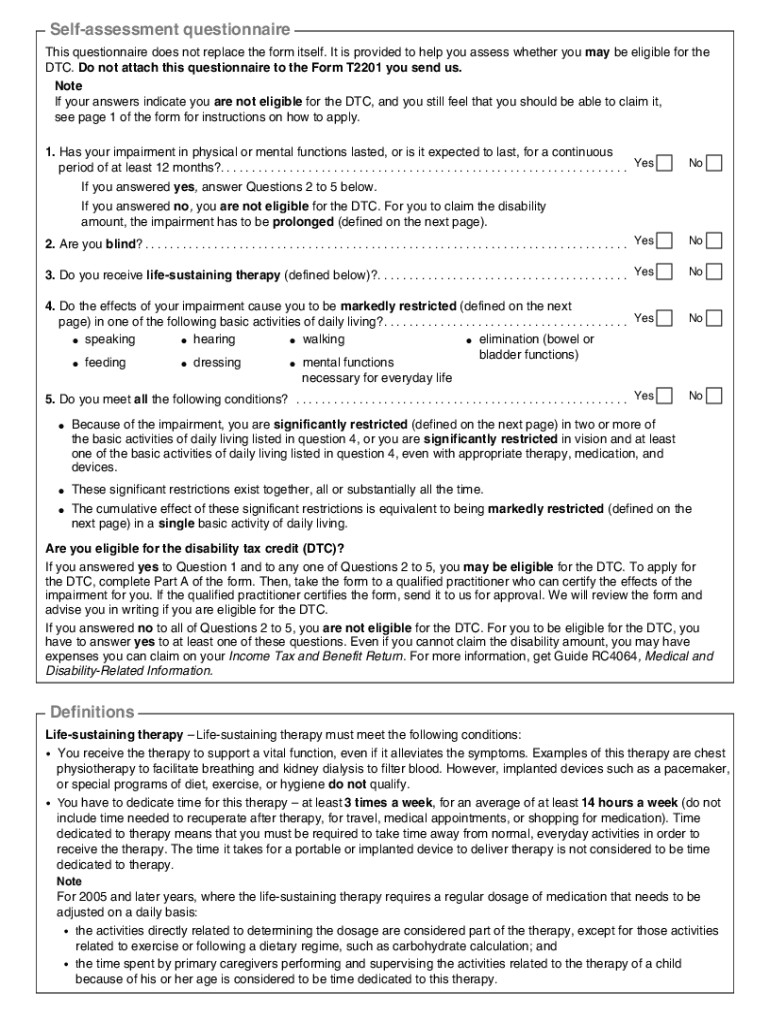

The Canadian Disability Tax Credit Form is a crucial document used to apply for the Disability Tax Credit (DTC) in Canada. This tax credit is designed to assist individuals with disabilities by reducing their tax burden, thereby providing financial relief. The form requires detailed information about the applicant's disability and its impact on daily living activities. It is essential for individuals seeking to claim this credit to understand the form's purpose and the benefits it offers.

How to obtain the Canadian Disability Tax Credit Form

To obtain the Canadian Disability Tax Credit Form, individuals can visit the official website of the Canada Revenue Agency (CRA). The form is typically available for download as a PDF. Alternatively, applicants can request a physical copy by contacting the CRA directly. It is important to ensure that the most current version of the form is used to avoid any complications during submission.

Steps to complete the Canadian Disability Tax Credit Form

Completing the Canadian Disability Tax Credit Form involves several key steps:

- Gather necessary documentation, including medical records and details about the disability.

- Fill out the personal information section accurately, ensuring all names and addresses are correct.

- Provide detailed information about the disability, including how it affects daily activities.

- Have a qualified medical practitioner complete the certification section of the form.

- Review the form thoroughly for any errors or omissions before submission.

Eligibility Criteria

To qualify for the Disability Tax Credit, applicants must meet specific eligibility criteria. These include having a severe and prolonged impairment in physical or mental functions, which significantly restricts the ability to perform basic daily activities. The impairment must be certified by a qualified medical professional. Additionally, individuals must be Canadian residents and may need to provide proof of their disability and its impact on their daily life.

Required Documents

When submitting the Canadian Disability Tax Credit Form, several documents are required to support the application. These typically include:

- Medical documentation that outlines the nature of the disability.

- Proof of residency in Canada.

- Any previous tax returns that may be relevant to the claim.

- Identification documents, such as a driver's license or passport.

Form Submission Methods

The Canadian Disability Tax Credit Form can be submitted through various methods. Applicants have the option to submit the form online through the CRA's secure portal, which is the fastest method. Alternatively, individuals may choose to mail the completed form to the CRA or visit a local tax office to submit it in person. It is advisable to keep a copy of the submitted form for personal records.

Quick guide on how to complete canadian disability tax credit form

A brief guide on how to create your Canadian Disability Tax Credit Form

Finding the correct template can turn into a hurdle when you need to submit official international paperwork. Even if you possess the form required, it might be tedious to promptly fill it out according to all specifications if you rely on paper copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature service that assists you in navigating these issues. It allows you to obtain your Canadian Disability Tax Credit Form and swiftly fill it in and sign it on-site without the need for reprinting documents if you enter something incorrectly.

Here are the actions you need to take to create your Canadian Disability Tax Credit Form using airSlate SignNow:

- Press the Get Form button to upload your document to our editor immediately.

- Begin with the first vacant field, enter your information, and proceed with the Next feature.

- Complete the empty fields with the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the key details.

- Click on Image and upload one if your Canadian Disability Tax Credit Form requires it.

- Use the right-side panel to add additional fields for you or others to fill out if necessary.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the modifications by clicking the Done button and selecting your file-sharing preferences.

Once your Canadian Disability Tax Credit Form is finalized, you can share it in any manner you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely store all your completed documents in your account, organized in folders based on your preferences. Don’t waste time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct canadian disability tax credit form

FAQs

-

How can you get your family doctor to fill out a disability form?

Definitely ask for a psychologist referral! You want someone on your side who can understand your issues and be willing and eager to advocate for you with the beancounters because disability can be rather hard to get some places, like just south of the border in America.Having a psychologist means you have a more qualified specialist filling out your papers (which is a positive for you and for the government), and it means you can be seeing someone who can get to know your issues in greater depth and expertise for further government and non-profit organization provided aid.If seeing a psychologist on a regular basis is still too difficult for you, start with your initial appointment and then perhaps build up a rapport with a good therapist through distanced appointments (like via telephone, if that is easier) until you can be going into a physical office. It would probably look good on the form if your psychologist can truthfully state that you are currently seeking regular treatment for your disorders because of how serious and debilitating they are.I don't know how disability in Canada works, but I have gone through the process in the US, and specifically for anxiety and depression, like you. Don't settle for a reluctant or wishywashy doctor or psychologist, especially when it comes to obtaining the resources for basic survival. I also advise doing some internet searches on how to persuasively file for disability in Canada. Be prepared to fight for your case through an appeal, if it should come to that, and understand the requirements and processes involved in applying for disability by reading government literature and reviewing success stories on discussion websites.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Some large USA institutions want me to fill a W8 Form. I am a Canadian. What tax implications does this have for me? Would it affect me in the future? What happens after I fill it out?

That is dependent upon if you are working as an employee for that company(/ies). It’s similar to a W-4 form, which most American’s are more familiar with but designed for non-US Citizens who are working in the US or a nation that has a tax treaty with the US.This is a more indepth link from the IRS. Who needs to fill out IRS tax form W-8?

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the canadian disability tax credit form

How to generate an electronic signature for your Canadian Disability Tax Credit Form online

How to create an electronic signature for your Canadian Disability Tax Credit Form in Chrome

How to make an electronic signature for putting it on the Canadian Disability Tax Credit Form in Gmail

How to create an eSignature for the Canadian Disability Tax Credit Form straight from your smartphone

How to make an electronic signature for the Canadian Disability Tax Credit Form on iOS devices

How to generate an eSignature for the Canadian Disability Tax Credit Form on Android devices

People also ask

-

What is the Canadian Disability Tax Credit Form?

The Canadian Disability Tax Credit Form is a government document that allows individuals with disabilities to apply for tax benefits. This form is crucial for obtaining financial support, making it essential for eligible persons seeking relief. You can complete this form using airSlate SignNow for a hassle-free eSigning experience.

-

How can airSlate SignNow assist me with the Canadian Disability Tax Credit Form?

airSlate SignNow streamlines the process of filling out and submitting the Canadian Disability Tax Credit Form. Our user-friendly interface allows you to easily input necessary information and electronically sign the document. This ensures that your application is completed efficiently and submitted in a timely manner.

-

Is there a cost associated with using airSlate SignNow for the Canadian Disability Tax Credit Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to different user needs. While there is a cost to use our platform, the convenience and efficiency it provides for managing the Canadian Disability Tax Credit Form can be well worth the investment. Visit our pricing page for more details on the available plans.

-

What features does airSlate SignNow offer for the Canadian Disability Tax Credit Form?

AirSlate SignNow offers various features for the Canadian Disability Tax Credit Form, including electronic signatures, document templates, and cloud storage. These features simplify the process of preparing, signing, and sending your form, ensuring that everything is secure and easily accessible. Our platform is designed to enhance your document management experience.

-

Can I track the status of my Canadian Disability Tax Credit Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your documents, including the Canadian Disability Tax Credit Form. You can easily monitor when the document is viewed, signed, and completed. This visibility helps you stay informed throughout the application process.

-

Are there integrations available for handling the Canadian Disability Tax Credit Form?

Absolutely! airSlate SignNow integrates with various productivity applications, allowing you to manage the Canadian Disability Tax Credit Form seamlessly across different platforms. These integrations enhance your workflow and ensure that you can easily access all tools necessary to complete your application.

-

What are the benefits of using airSlate SignNow for the Canadian Disability Tax Credit Form?

Using airSlate SignNow for the Canadian Disability Tax Credit Form comes with several benefits, including increased efficiency, better organization, and enhanced security. Our platform simplifies the signing process, reducing time spent on paperwork. Additionally, your documents are stored securely, giving you peace of mind.

Get more for Canadian Disability Tax Credit Form

Find out other Canadian Disability Tax Credit Form

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template