Eligibility for the DTC 2018

Eligibility Criteria for the Disability Tax Credit

The eligibility for the disability tax credit form is primarily based on the severity of the disability and its impact on daily activities. To qualify, individuals must demonstrate that they have a physical or mental impairment that significantly restricts their ability to perform basic activities of daily living. This includes tasks such as walking, speaking, and performing personal care. Additionally, the impairment must be expected to last for a prolonged period, typically over 12 months.

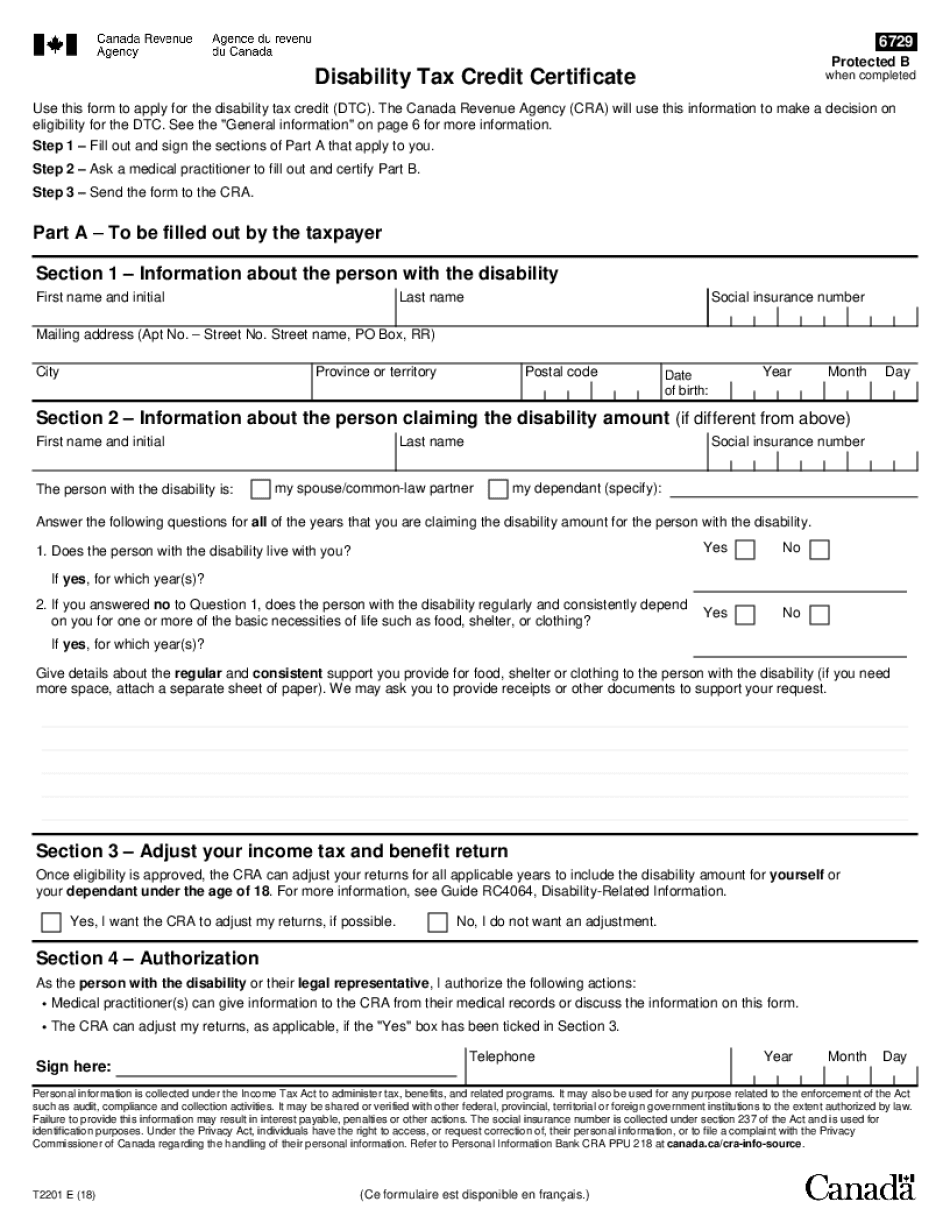

It is essential to gather comprehensive medical documentation to support the claim. This documentation should detail the nature of the disability, the limitations it imposes, and any treatments or therapies being pursued. The disability tax credit certificate, often referred to as the T2201 form, must be completed and signed by a qualified medical practitioner to validate the claim.

Steps to Complete the Disability Tax Credit Form

Completing the disability tax credit form requires careful attention to detail to ensure all necessary information is provided. Start by downloading the T2201 disability tax credit form from the appropriate government website or obtaining a printable version. Ensure you have all required personal information, including your Social Security number and details about your disability.

Next, fill out the first section of the form, which includes your personal details. In the subsequent sections, provide comprehensive information about your disability, including how it affects your daily life. The medical practitioner must complete and sign the certification section, confirming your eligibility. Once completed, review the form for accuracy before submission.

Required Documents for the Disability Tax Credit

When applying for the disability tax credit, specific documents are necessary to support your claim. These typically include:

- The completed T2201 disability tax credit form.

- Medical documentation detailing your disability.

- Any additional records that demonstrate the impact of your disability on daily activities.

- Proof of identity, such as a government-issued ID.

Having these documents ready will streamline the application process and help ensure that your claim is processed efficiently.

Form Submission Methods

Submitting the disability tax credit form can be done through various methods, depending on your preference. You can choose to submit the T2201 form electronically, which is often faster and more convenient. Alternatively, you may opt to mail a printed version of the form to the appropriate tax authority. Ensure that you keep a copy of the submitted form for your records.

In-person submission is also an option, allowing you to receive immediate confirmation of receipt. Regardless of the method chosen, be mindful of any deadlines associated with the submission to ensure your claim is processed in a timely manner.

IRS Guidelines for the Disability Tax Credit

The Internal Revenue Service (IRS) provides specific guidelines regarding the disability tax credit. It is crucial to familiarize yourself with these guidelines to ensure compliance. The IRS outlines the eligibility criteria, documentation requirements, and the process for claiming the credit on your tax return. Understanding these guidelines can help avoid potential issues during the application process.

Additionally, the IRS updates its regulations periodically. Staying informed about any changes will help ensure that your application remains valid and compliant with current laws.

Application Process & Approval Time

The application process for the disability tax credit can vary in duration based on several factors, including the completeness of your application and the current workload of the processing agency. Generally, once the T2201 form is submitted, it may take several weeks to receive a response regarding your eligibility.

To expedite the process, ensure that all documentation is complete and accurate before submission. If additional information is requested, respond promptly to avoid delays. Understanding the typical timelines can help manage expectations as you await approval.

Quick guide on how to complete eligibility for the dtc

Effortlessly prepare Eligibility For The DTC on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Eligibility For The DTC on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The easiest way to edit and eSign Eligibility For The DTC without hassle

- Find Eligibility For The DTC and click Get Form to commence.

- Utilize the tools provided to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Eligibility For The DTC while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct eligibility for the dtc

Create this form in 5 minutes!

How to create an eSignature for the eligibility for the dtc

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the disability tax credit form?

The disability tax credit form is a specialized document used in Canada that allows individuals with disabilities to claim tax credits. Completing the disability tax credit form accurately is crucial for ensuring that you receive the financial benefits you are entitled to. airSlate SignNow provides an efficient way to sign and send this form electronically, streamlining the process.

-

How can airSlate SignNow help with the disability tax credit form?

airSlate SignNow simplifies the process of completing and submitting the disability tax credit form by enabling users to eSign documents securely. With its user-friendly interface, you can easily fill out necessary fields and send the form directly to the relevant authorities. This helps you save time while ensuring accuracy.

-

Is there a cost associated with using the disability tax credit form feature?

Using airSlate SignNow for the disability tax credit form involves a subscription fee, which varies based on the plan. However, the investment is often worthwhile, as it enhances efficiency and reduces paperwork. You can explore different pricing plans on our website to find one that suits your needs.

-

What features does airSlate SignNow offer for managing the disability tax credit form?

airSlate SignNow offers features like templates, eSignatures, and document tracking specifically for the disability tax credit form. These tools enable you to create and manage your forms in one platform. Additionally, you can store previously submitted forms for easy access in the future.

-

Can I integrate airSlate SignNow with other applications for the disability tax credit form?

Yes, airSlate SignNow supports various integrations with popular applications that enhance your workflow for the disability tax credit form. You can connect it with CRM, cloud storage, and more, enabling seamless management of documents. This ensures that you can easily access and manage your forms across platforms.

-

What are the benefits of using airSlate SignNow for the disability tax credit form?

Using airSlate SignNow for the disability tax credit form offers numerous benefits, including increased efficiency and reduced turnaround time. The ability to eSign documents means you can finalize your forms without delays from physical mail. Additionally, electronic storage reduces the risk of losing important papers.

-

How secure is the signing process for the disability tax credit form with airSlate SignNow?

The signing process for the disability tax credit form using airSlate SignNow is highly secure. We utilize industry-standard encryption and compliance protocols to protect your sensitive information. You can confidently eSign your documents knowing that your data is safe and secure.

Get more for Eligibility For The DTC

- Residential landlord tenant rental lease forms and agreements package virginia

- Name change instructions and forms package for an adult with no prior name change virginia

- Name change instructions and forms package for an adult virginia

- Name change minor virginia form

- Name change instructions and forms package for a family virginia

- Virginia application name form

- Va llc name form

- Virginia name change order form

Find out other Eligibility For The DTC

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney