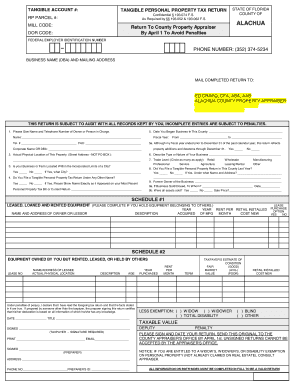

ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl Form

What is the ACPA 405 Tangible Personal Property Tax Return?

The ACPA 405 Tangible Personal Property Tax Return is a form used in Florida for reporting tangible personal property owned by businesses. This form is essential for ensuring compliance with state tax laws, as it helps local governments assess property taxes on items such as equipment, furniture, and machinery. Proper completion of the ACPA 405 is crucial for accurate tax assessments and to avoid potential penalties.

Steps to Complete the ACPA 405 Tangible Personal Property Tax Return

Completing the ACPA 405 involves several key steps:

- Gather necessary documentation, including purchase invoices and asset lists.

- Fill out the form with accurate descriptions of all tangible personal property owned as of January first of the tax year.

- Calculate the total value of the property based on the acquisition cost or market value.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate county property appraiser by the specified deadline.

Legal Use of the ACPA 405 Tangible Personal Property Tax Return

The ACPA 405 serves a legal purpose in the taxation process. It is required by Florida law for businesses to report their tangible personal property. Failure to file this return can result in penalties, including additional taxes and interest. It is important for businesses to understand their legal obligations regarding this form to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the ACPA 405 are critical for compliance. Typically, the form must be submitted by April fifteenth of each year. However, extensions may be available under certain circumstances. Businesses should be aware of these dates to ensure timely submission and avoid penalties associated with late filings.

Required Documents for the ACPA 405 Tangible Personal Property Tax Return

To complete the ACPA 405, businesses need to gather specific documents:

- Purchase invoices for all tangible personal property.

- Asset lists detailing the type and value of property owned.

- Previous tax returns, if applicable, for reference.

Having these documents ready can streamline the completion process and ensure accurate reporting.

Examples of Using the ACPA 405 Tangible Personal Property Tax Return

Businesses across various sectors utilize the ACPA 405 to report their tangible personal property. For instance:

- A retail store reports inventory and display fixtures.

- A manufacturing company lists machinery and equipment used in production.

- A service provider includes office furniture and computers.

These examples illustrate the diverse applications of the ACPA 405 in different business contexts.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the acpa 405 tangible personal property tax return acpafl

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

The ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl is a specific tax form used in Florida for reporting tangible personal property. This form is essential for businesses to accurately declare their assets and comply with state tax regulations. Understanding this form can help businesses avoid penalties and ensure proper tax assessment.

-

How can airSlate SignNow assist with the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl. With its user-friendly interface, you can streamline the document management process, ensuring that your tax return is completed accurately and submitted on time. This saves you time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl. You can choose from monthly or annual subscriptions, with options that include various features to enhance your document workflow. This ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl. These features help ensure that your documents are completed efficiently and securely. Additionally, you can easily collaborate with team members during the process.

-

Are there any integrations available with airSlate SignNow for the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl. This includes integrations with popular accounting software and cloud storage solutions, allowing for a more streamlined workflow. These integrations help you keep all your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

Using airSlate SignNow for the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can signNowly speed up the tax return process. Additionally, it helps ensure compliance with state regulations.

-

Is airSlate SignNow secure for handling the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl. This ensures that your sensitive information remains confidential and secure throughout the signing process. You can trust that your data is safe with us.

Get more for ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl

- Mhs outpatient medical claim form ntuc income

- Report of honoraria for agency to complete jcope jcope ny form

- Imm 5839 e form

- South carolina lost mortgage satisfaction form

- Bidcontract approval form

- Final decree of divorce form mississippi

- Sign over parental rights forms mississippi

- Software development service agreement template form

Find out other ACPA 405 TANGIBLE PERSONAL PROPERTY TAX RETURN Acpafl

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form