P60 End of Year Certificate Tax Year to 5 April Payroo Training 2023

What is the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

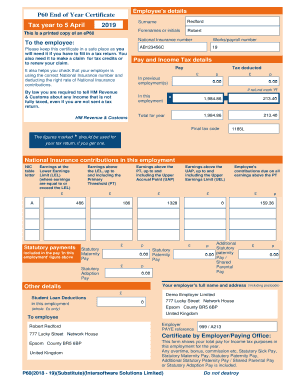

The P60 End Of Year Certificate is an important document issued to employees in the United Kingdom, summarizing their total earnings and tax deductions for the tax year ending on April 5. This certificate provides a comprehensive overview of an employee's income and the taxes paid, which is essential for personal tax returns. Payroo Training offers guidance on how to effectively utilize this certificate for tax purposes, ensuring that users understand its significance in their financial documentation.

How to obtain the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

To obtain the P60 End Of Year Certificate, employees should first ensure that their employer has processed their payroll correctly for the tax year. Employers are required to provide P60 certificates to their employees by May 31 following the end of the tax year. Payroo Training provides resources for both employers and employees on how to access and verify the P60 certificate, including steps to check payroll records and ensure compliance with legal requirements.

Steps to complete the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

Completing the P60 involves several key steps. First, employers must gather all relevant payroll data for the tax year, including total earnings and tax deductions for each employee. Next, they should use payroll software, like Payroo, to generate the P60 certificates accurately. After generating the certificates, employers must distribute them to employees by the deadline. Payroo Training offers detailed instructions on each of these steps to ensure accuracy and compliance.

Key elements of the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

The P60 certificate includes several critical elements: the employee's name, National Insurance number, total earnings for the year, total tax deducted, and the employer's details. Understanding these components is vital for both employees and employers. Payroo Training emphasizes the importance of reviewing each element for accuracy, as discrepancies can lead to tax issues or delays in filing.

Legal use of the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

The P60 is legally required for employees in the UK and serves as proof of income and tax contributions. It is essential for completing personal tax returns and can be requested by tax authorities if needed. Payroo Training outlines the legal obligations of employers in issuing P60 certificates and the rights of employees to receive this documentation, ensuring compliance with tax regulations.

Examples of using the P60 End Of Year Certificate Tax Year To 5 April Payroo Training

Employees can use the P60 certificate in various scenarios, such as applying for loans, mortgages, or other financial services that require proof of income. Additionally, it can be used when filing tax returns to ensure that all income and tax payments are accurately reported. Payroo Training provides examples of how to leverage the P60 effectively in these situations, highlighting its importance in financial planning.

Create this form in 5 minutes or less

Find and fill out the correct p60 end of year certificate tax year to 5 april payroo training

Create this form in 5 minutes!

How to create an eSignature for the p60 end of year certificate tax year to 5 april payroo training

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the P60 End Of Year Certificate Tax Year To 5 April Payroo Training?

The P60 End Of Year Certificate Tax Year To 5 April Payroo Training is designed to help users understand how to generate and manage P60 certificates effectively. This training covers essential aspects of payroll processing and tax reporting, ensuring compliance with UK tax regulations.

-

How can the P60 End Of Year Certificate Tax Year To 5 April Payroo Training benefit my business?

By participating in the P60 End Of Year Certificate Tax Year To 5 April Payroo Training, businesses can streamline their payroll processes and ensure accurate tax reporting. This training equips users with the knowledge to avoid common pitfalls and enhance overall efficiency in managing employee tax documents.

-

What features are included in the P60 End Of Year Certificate Tax Year To 5 April Payroo Training?

The P60 End Of Year Certificate Tax Year To 5 April Payroo Training includes comprehensive modules on generating P60 certificates, understanding tax codes, and filing requirements. Participants will also receive practical tips and best practices for using Payroo effectively in their payroll operations.

-

Is there a cost associated with the P60 End Of Year Certificate Tax Year To 5 April Payroo Training?

Yes, there is a fee for the P60 End Of Year Certificate Tax Year To 5 April Payroo Training, which varies based on the training format and duration. Investing in this training can lead to signNow savings by reducing errors and ensuring compliance with tax regulations.

-

How long does the P60 End Of Year Certificate Tax Year To 5 April Payroo Training take?

The duration of the P60 End Of Year Certificate Tax Year To 5 April Payroo Training typically ranges from a few hours to a full day, depending on the depth of the content covered. This flexible scheduling allows participants to choose a time that best fits their needs.

-

Can I integrate Payroo with other software for managing P60 certificates?

Yes, Payroo offers integration capabilities with various accounting and payroll software, making it easier to manage P60 certificates. This integration ensures that your payroll data is synchronized across platforms, enhancing accuracy and efficiency.

-

Who should attend the P60 End Of Year Certificate Tax Year To 5 April Payroo Training?

The P60 End Of Year Certificate Tax Year To 5 April Payroo Training is ideal for payroll administrators, HR professionals, and business owners who handle payroll processing. Anyone involved in managing employee tax documentation will benefit from this training.

Get more for P60 End Of Year Certificate Tax Year To 5 April Payroo Training

- Request for change of information verification habdsite

- Online fillable forms to unlock rrsp in bc

- Owcp 957 fillable form 5476319

- Affidavit support and consent parental travel permit form

- Tmh doctors note form

- Ocbc bank malaysia berhad 295400 w ocbc home loan form

- Personal debt agreement template form

- Personal finance agreement template form

Find out other P60 End Of Year Certificate Tax Year To 5 April Payroo Training

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later