Form 13844 Rev 2 2024

What is the Form 13844 IRS Gov Form?

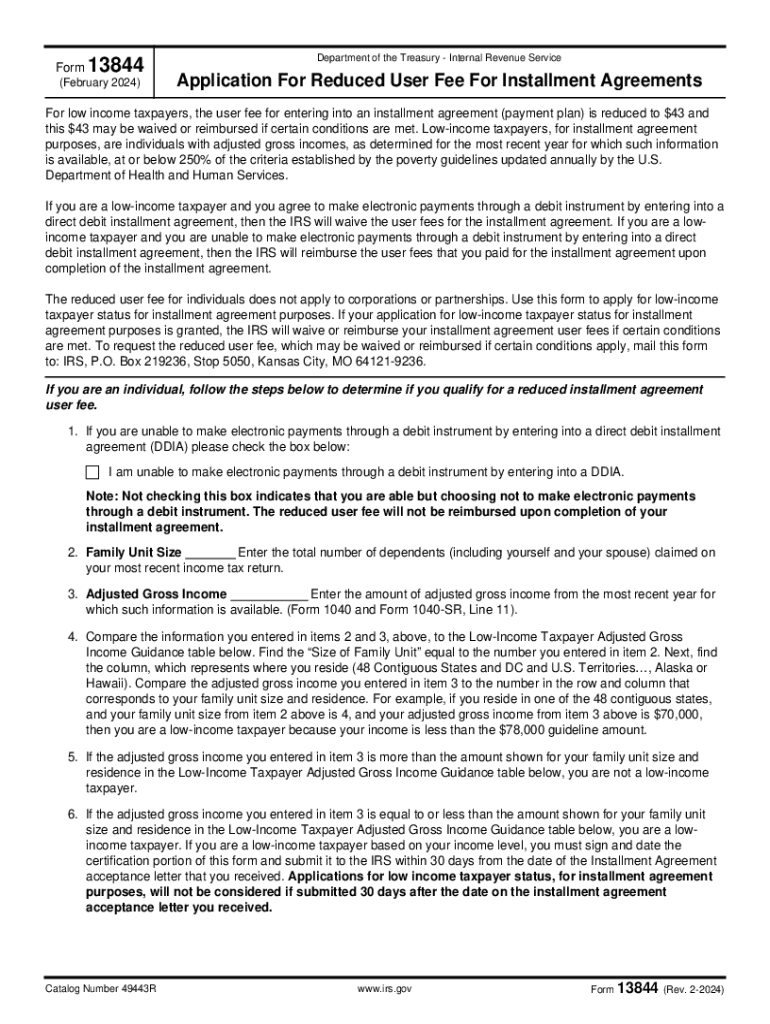

The Form 13844, also known as the IRS application for reduced user fee, is a document used by taxpayers to request a reduction in the user fee associated with certain IRS applications. This form is particularly relevant for individuals who may face financial hardship or other qualifying circumstances that warrant a fee reduction. The Internal Revenue Service (IRS) provides this form to ensure that taxpayers have access to necessary services without the burden of high costs.

How to Use the Form 13844 IRS Gov Form

To effectively use the Form 13844, individuals must first determine their eligibility for a reduced user fee. This involves reviewing the criteria set by the IRS, which may include financial hardship or specific situations that justify a fee waiver. Once eligibility is confirmed, taxpayers can fill out the form, providing accurate information regarding their financial status and the specific application for which they seek a fee reduction. It is essential to follow the instructions carefully to ensure the application is processed smoothly.

Steps to Complete the Form 13844 IRS Gov Form

Completing the Form 13844 involves several key steps:

- Gather necessary financial documentation to support your request.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and truthful.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required documentation to the appropriate IRS address.

Eligibility Criteria for the Form 13844 IRS Gov Form

Eligibility for the Form 13844 is primarily based on the applicant's financial situation. Taxpayers must demonstrate that they are experiencing financial hardship or meet specific criteria outlined by the IRS. Common factors that may qualify an individual for a reduced user fee include low income, unemployment, or other significant financial burdens. It is important to provide adequate documentation to support the claim when submitting the form.

Required Documents for the Form 13844 IRS Gov Form

When submitting the Form 13844, applicants must include certain documents to substantiate their request for a fee reduction. These may include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of unemployment or other financial hardships.

- Any other relevant financial statements that demonstrate the need for a reduced fee.

Providing comprehensive documentation helps the IRS evaluate the request more effectively.

Form Submission Methods for the Form 13844 IRS Gov Form

The Form 13844 can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form to the designated IRS address, which is specified in the instructions. Alternatively, some applicants may have the option to submit the form electronically, depending on the specific application for which they are requesting a fee reduction. It is advisable to check the latest IRS guidelines for the most current submission methods.

Quick guide on how to complete form 13844 rev 2

Complete Form 13844 Rev 2 effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form 13844 Rev 2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to edit and eSign Form 13844 Rev 2 with ease

- Find Form 13844 Rev 2 and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere moments and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Edit and eSign Form 13844 Rev 2 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13844 rev 2

Create this form in 5 minutes!

How to create an eSignature for the form 13844 rev 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 13844 irsgovform and how can airSlate SignNow help?

The 13844 irsgovform is a specific IRS form that businesses may need to complete for tax purposes. airSlate SignNow simplifies the process by allowing users to easily fill out, sign, and send this form electronically, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for the 13844 irsgovform?

airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you require for managing the 13844 irsgovform, you can choose a plan that fits your budget while still providing a cost-effective solution.

-

What features does airSlate SignNow offer for managing the 13844 irsgovform?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for handling the 13844 irsgovform. These tools enhance productivity and ensure that your documents are processed efficiently.

-

Can I integrate airSlate SignNow with other software for the 13844 irsgovform?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage the 13844 irsgovform alongside your existing tools. This flexibility allows for a seamless workflow and improved document management.

-

What are the benefits of using airSlate SignNow for the 13844 irsgovform?

Using airSlate SignNow for the 13844 irsgovform provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, streamlining your business processes.

-

Is airSlate SignNow user-friendly for completing the 13844 irsgovform?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 13844 irsgovform. The intuitive interface allows users to navigate the platform effortlessly, even if they are not tech-savvy.

-

How does airSlate SignNow ensure the security of the 13844 irsgovform?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your documents, including the 13844 irsgovform. This commitment to security ensures that your sensitive information remains confidential and secure.

Get more for Form 13844 Rev 2

Find out other Form 13844 Rev 2

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement