Form 941 Rev March 2024

What is the Form 941 Rev March

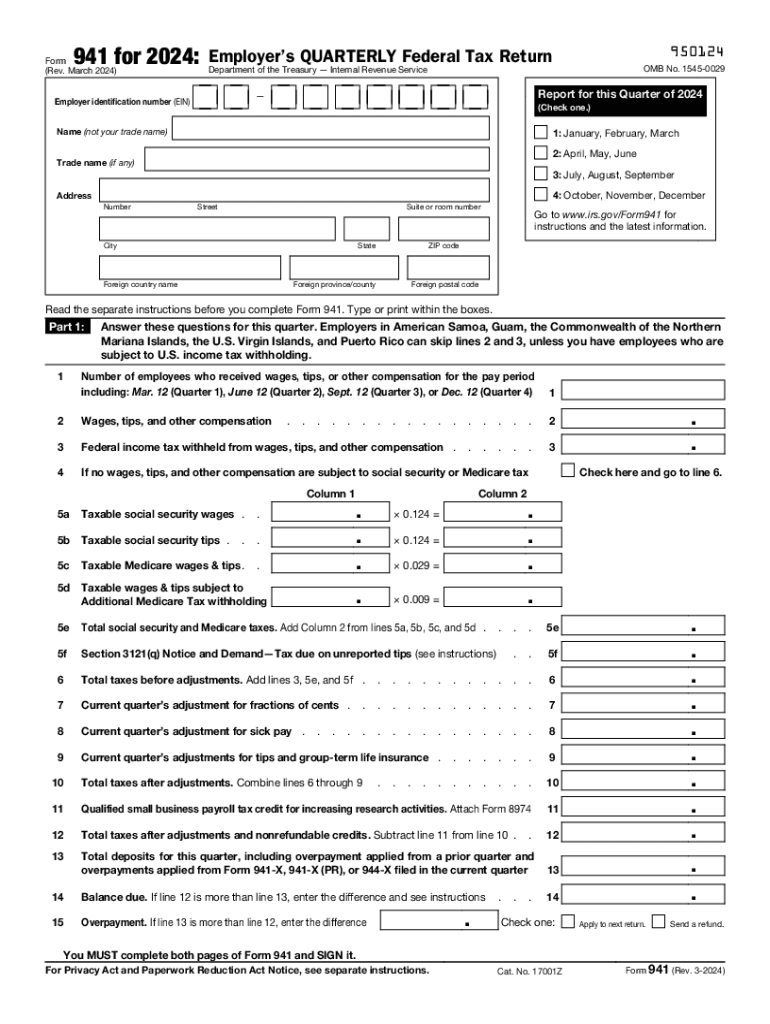

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report payroll taxes. This form is filed quarterly and provides the Internal Revenue Service (IRS) with information about the wages paid to employees, the taxes withheld, and the employer's share of Social Security and Medicare taxes. The Form 941 Rev March is the most current version, reflecting any updates or changes mandated by the IRS.

How to use the Form 941 Rev March

Employers use the Form 941 to report the total amount of wages paid to employees, the federal income tax withheld, and the Social Security and Medicare taxes due. To use the form effectively, employers must gather all relevant payroll information for the quarter, including gross wages, tips, and other compensation. The form also requires employers to calculate their tax liabilities accurately and report any adjustments for prior quarters. It is essential to ensure that all information is complete and accurate to avoid penalties.

Steps to complete the Form 941 Rev March

Completing the Form 941 involves several key steps:

- Gather payroll records for the quarter, including total wages and tips.

- Calculate the total federal income tax withheld from employee wages.

- Determine the employer and employee portions of Social Security and Medicare taxes.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the form for completeness and accuracy before submission.

Following these steps helps ensure compliance with IRS regulations and minimizes the risk of errors.

Filing Deadlines / Important Dates

Employers must file the Form 941 quarterly, with specific deadlines for each quarter. The due dates are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

It is crucial for employers to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941. The form can be filed electronically through the IRS e-file system, which is often the fastest and most efficient method. Alternatively, employers may choose to mail the completed form to the appropriate IRS address based on their location. In-person submission is generally not an option for Form 941, as the IRS encourages electronic filing for quicker processing.

Penalties for Non-Compliance

Failure to file the Form 941 on time or inaccuracies in reporting can result in significant penalties. The IRS imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if the form is filed more than 60 days late, the minimum penalty may be the lesser of $435 or 100 percent of the tax due. Timely and accurate filing is essential to avoid these financial consequences.

IRS Guidelines

The IRS provides detailed guidelines for completing and filing the Form 941. Employers should refer to the IRS instructions for the form, which outline the requirements for reporting wages, calculating taxes, and making adjustments. These guidelines also include information on how to handle specific situations, such as claiming tax credits or reporting employee tips. Staying informed about IRS updates ensures compliance and helps employers navigate the filing process effectively.

Quick guide on how to complete form 941 rev march

Complete Form 941 Rev March effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers a flawless eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form 941 Rev March on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Form 941 Rev March without stress

- Find Form 941 Rev March and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 941 Rev March and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 rev march

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 941?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. The term '941' often refers to IRS Form 941, which is used for reporting payroll taxes. By using airSlate SignNow, businesses can streamline the process of signing and submitting Form 941, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for businesses dealing with 941 forms?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses, including those that frequently handle 941 forms. The cost-effective solutions ensure that you can manage your document signing needs without breaking the bank. For specific pricing details, it's best to visit our website or contact our sales team.

-

What features does airSlate SignNow offer for managing 941 documents?

airSlate SignNow provides a range of features designed to simplify the management of 941 documents. These include customizable templates, secure storage, and real-time tracking of document status. With these tools, businesses can efficiently handle their payroll tax filings and ensure timely submissions.

-

Can airSlate SignNow integrate with other software for 941 form management?

Yes, airSlate SignNow offers seamless integrations with various software applications that can assist in managing 941 forms. This includes accounting software and payroll systems, allowing for a more streamlined workflow. Integrating these tools can enhance your efficiency and accuracy when dealing with payroll tax documents.

-

What are the benefits of using airSlate SignNow for 941 form eSigning?

Using airSlate SignNow for eSigning 941 forms provides numerous benefits, including increased speed and reduced paperwork. The platform ensures that your documents are signed securely and stored safely, which helps in maintaining compliance. Additionally, the user-friendly interface makes it easy for all team members to adopt and use effectively.

-

Is airSlate SignNow secure for signing sensitive 941 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your sensitive 941 documents. This ensures that your data remains confidential and secure throughout the signing process. You can trust airSlate SignNow to handle your important payroll tax documents with the utmost care.

-

How can airSlate SignNow help with the timely submission of 941 forms?

airSlate SignNow helps ensure the timely submission of 941 forms by streamlining the signing process. With features like reminders and notifications, you can keep track of pending signatures and deadlines. This proactive approach minimizes the risk of late submissions and potential penalties.

Get more for Form 941 Rev March

- Standard form 85 revised december

- Classroom maintenance checklist form

- Crc application form

- State of arizona travel policy table of contents form

- Automotive complaint form office of the attorney general ag ky

- Ust monthly walkthrough inspection form

- Application for special registration plates form vr 164

- Tc 95 608 form

Find out other Form 941 Rev March

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors