Property Tax Appeals When, How, & Why to Submit Plus a 2020-2026

Understanding Property Tax Appeals

The property tax appeals process allows property owners to contest their property tax assessments. This process is crucial for ensuring that property taxes reflect the true market value of a property. If you believe your property has been overvalued, you have the right to file an appeal. Understanding the reasons for an appeal, such as discrepancies in property assessment or changes in market conditions, is essential for a successful outcome.

Steps to File a Property Tax Appeal

Filing a property tax appeal involves several key steps:

- Review Your Assessment: Obtain your property tax assessment from your local tax authority and verify the details.

- Gather Evidence: Collect supporting documents, such as recent sales data of comparable properties, photographs, and any relevant appraisals.

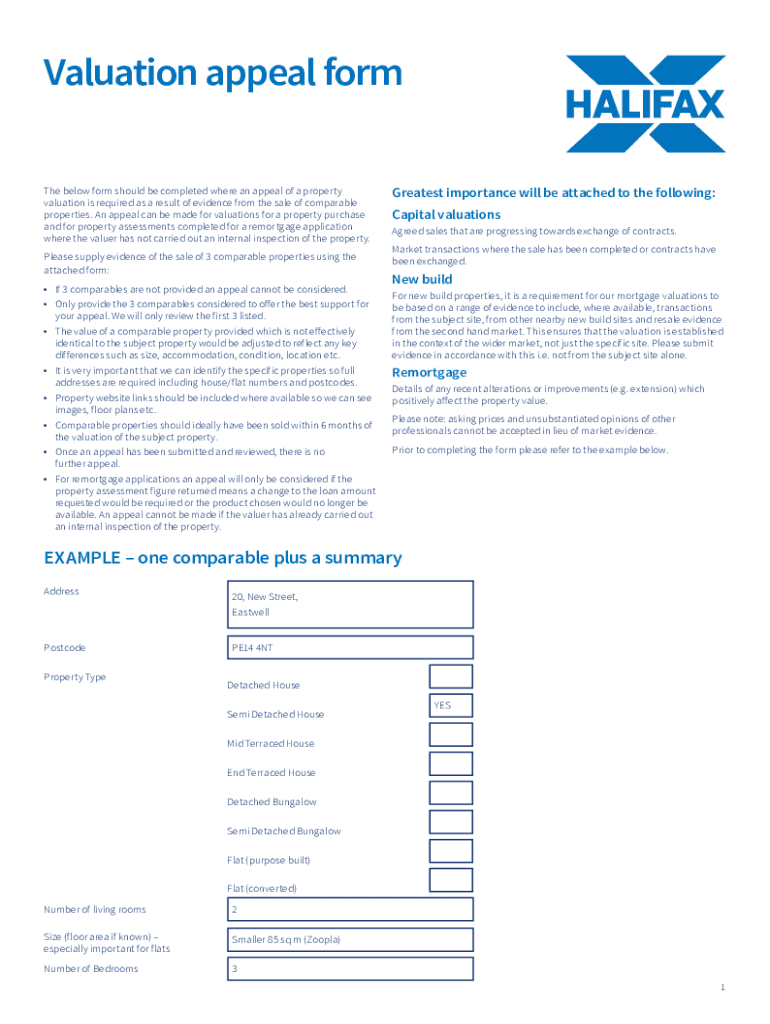

- Complete the Appeal Form: Fill out the required appeal form accurately, ensuring all information is correct.

- Submit Your Appeal: File your appeal with the appropriate local tax authority by the specified deadline.

- Attend the Hearing: Prepare to present your case at a hearing, if required, where you can explain your evidence to the review board.

Required Documents for Property Tax Appeals

When filing a property tax appeal, certain documents are typically required to support your case. These may include:

- Property Tax Assessment Notice: This document outlines the assessed value of your property.

- Comparable Sales Data: Information on similar properties that have recently sold in your area.

- Photographs: Visual evidence of your property’s condition and any discrepancies.

- Appraisals: Professional appraisals that may indicate a different value than the assessed amount.

Filing Deadlines for Property Tax Appeals

Each state has specific deadlines for filing property tax appeals. Generally, these deadlines occur shortly after property tax assessments are mailed out. It is important to be aware of these dates to ensure your appeal is submitted on time. Missing the deadline may result in the inability to contest your assessment for that tax year.

State-Specific Rules for Property Tax Appeals

Property tax appeal processes can vary significantly from state to state. Each state has its own regulations regarding eligibility, required forms, and submission methods. Familiarizing yourself with your state’s specific rules is crucial for a successful appeal. This may include understanding local assessment practices and any unique documentation requirements.

Eligibility Criteria for Property Tax Appeals

To qualify for a property tax appeal, you typically must be the property owner or have legal standing to contest the assessment. Eligibility may also depend on the grounds for appeal, such as overvaluation or incorrect property classification. It is essential to review your local laws to confirm your eligibility before proceeding with the appeal process.

Create this form in 5 minutes or less

Find and fill out the correct property tax appeals when how ampamp why to submit plus a

Create this form in 5 minutes!

How to create an eSignature for the property tax appeals when how ampamp why to submit plus a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Property Tax Appeals and why should I consider submitting one?

Property Tax Appeals are formal requests to contest the assessed value of your property, which can lead to lower tax bills. Understanding Property Tax Appeals When, How, & Why To Submit Plus A is crucial for homeowners looking to save money. By submitting an appeal, you can potentially reduce your property taxes, making it a financially beneficial decision.

-

When is the best time to submit a Property Tax Appeal?

The best time to submit a Property Tax Appeal is typically during the assessment period, which varies by location. Knowing Property Tax Appeals When, How, & Why To Submit Plus A can help you identify the right timeline for your appeal. It's essential to check local deadlines to ensure your appeal is considered.

-

How do I submit a Property Tax Appeal?

Submitting a Property Tax Appeal usually involves filling out a specific form provided by your local tax authority. Understanding Property Tax Appeals When, How, & Why To Submit Plus A can guide you through the process, ensuring you include all necessary documentation and evidence to support your case.

-

What documents do I need for a Property Tax Appeal?

To successfully file a Property Tax Appeal, you typically need your property tax bill, evidence of comparable property values, and any relevant photographs or reports. Knowing Property Tax Appeals When, How, & Why To Submit Plus A will help you gather the right documents to strengthen your appeal. Proper documentation is key to a successful outcome.

-

What are the costs associated with filing a Property Tax Appeal?

The costs of filing a Property Tax Appeal can vary depending on your location and whether you hire a professional. Understanding Property Tax Appeals When, How, & Why To Submit Plus A can help you budget for potential fees, including filing fees or costs for hiring an attorney. Many homeowners find that the potential savings outweigh the costs.

-

What features does airSlate SignNow offer for Property Tax Appeals?

airSlate SignNow offers features like eSigning, document templates, and secure storage, which can streamline the Property Tax Appeal process. Understanding Property Tax Appeals When, How, & Why To Submit Plus A can help you utilize these features effectively. This makes it easier to manage your documents and submit your appeal on time.

-

How can airSlate SignNow benefit me during the Property Tax Appeal process?

Using airSlate SignNow can simplify the Property Tax Appeal process by allowing you to eSign documents quickly and securely. Understanding Property Tax Appeals When, How, & Why To Submit Plus A can enhance your experience by providing a cost-effective solution for managing your appeal paperwork. This efficiency can save you time and reduce stress.

Get more for Property Tax Appeals When, How, & Why To Submit Plus A

Find out other Property Tax Appeals When, How, & Why To Submit Plus A

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document