Special Assessment Legal Residence Application Office of 2015-2026

What is the Special Assessment Legal Residence Application Office Of

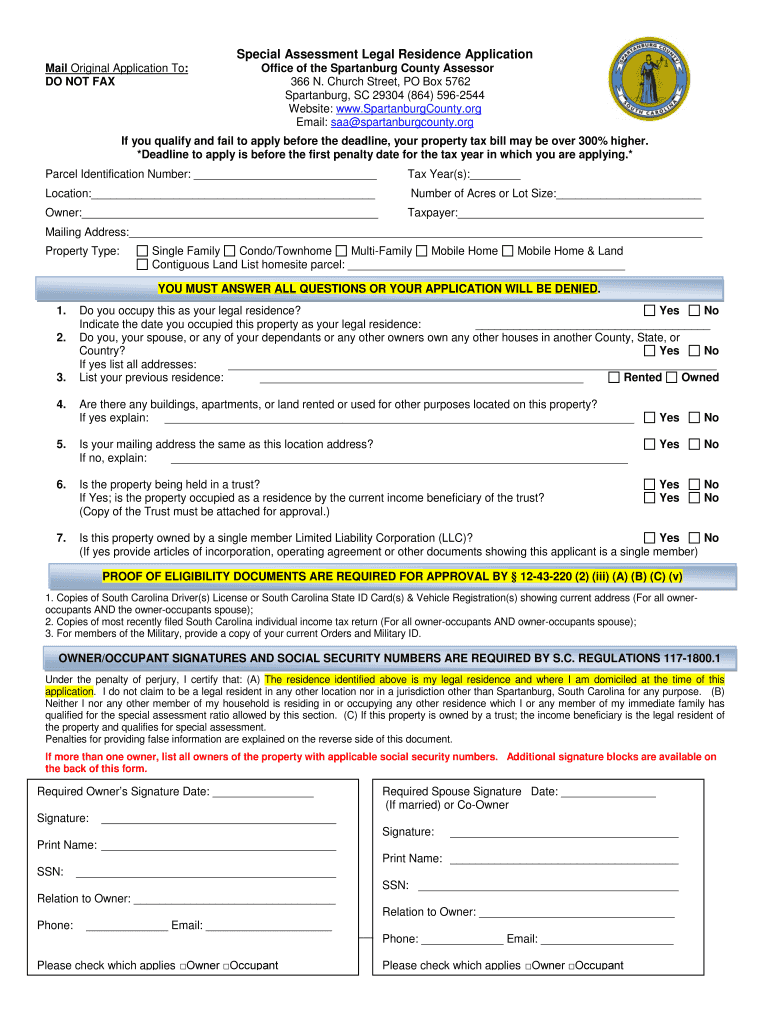

The Special Assessment Legal Residence Application Office Of is a formal document used by residents seeking specific property tax assessments or exemptions. This application is typically utilized by individuals who meet certain eligibility criteria, such as owning a primary residence, to qualify for reduced property tax rates based on their legal residence status. The application process is governed by state regulations, ensuring that applicants provide accurate information regarding their residency and property ownership.

Eligibility Criteria

To successfully complete the Special Assessment Legal Residence Application Office Of, applicants must meet specific eligibility criteria. Generally, applicants must be legal residents of the state where they are applying, own the property in question, and use it as their primary residence. Additional factors, such as age, income level, or disability status, may also influence eligibility. It is essential for applicants to review their state’s guidelines to confirm they meet all necessary requirements before submitting their application.

Steps to complete the Special Assessment Legal Residence Application Office Of

Completing the Special Assessment Legal Residence Application Office Of involves several key steps:

- Gather required documentation, including proof of residency and ownership.

- Review state-specific guidelines to ensure compliance with eligibility criteria.

- Fill out the application form accurately, providing all requested information.

- Submit the application by the specified deadline, either online or via mail.

Following these steps carefully can help streamline the application process and increase the likelihood of approval.

Required Documents

When applying for the Special Assessment Legal Residence Application Office Of, applicants must prepare several important documents. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of property ownership, like a deed or mortgage statement.

- Evidence of residency, which may include utility bills or lease agreements.

- Any additional forms or documents specified by the state’s application guidelines.

Having these documents ready can help ensure a smooth application process.

Form Submission Methods

Applicants can submit the Special Assessment Legal Residence Application Office Of through various methods, depending on their state’s regulations. Common submission methods include:

- Online submission via the state’s official website or designated portal.

- Mailing a hard copy of the completed application to the appropriate office.

- In-person submission at local government offices, such as the county assessor’s office.

Each method has its own advantages, and applicants should choose the one that best suits their needs and circumstances.

Application Process & Approval Time

The application process for the Special Assessment Legal Residence Application Office Of typically involves several stages. After submission, the application will be reviewed by the relevant authorities, who will verify the information provided. The approval time can vary significantly based on the state and the volume of applications received. Generally, applicants can expect to receive a decision within a few weeks to several months. It is advisable to check with local authorities for specific timelines and any potential delays.

Create this form in 5 minutes or less

Find and fill out the correct special assessment legal residence application office of

Create this form in 5 minutes!

How to create an eSignature for the special assessment legal residence application office of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Special Assessment Legal Residence Application Office Of?

The Special Assessment Legal Residence Application Office Of is a program designed to assist homeowners in applying for special assessments on their property taxes. This application can help reduce tax burdens for eligible residents, making it an essential resource for those looking to save on property taxes.

-

How can airSlate SignNow help with the Special Assessment Legal Residence Application Office Of?

airSlate SignNow streamlines the process of completing and submitting the Special Assessment Legal Residence Application Office Of. With our eSigning capabilities, users can easily fill out, sign, and send their applications securely, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for the Special Assessment Legal Residence Application Office Of?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can manage your Special Assessment Legal Residence Application Office Of without breaking the bank.

-

What features does airSlate SignNow provide for the Special Assessment Legal Residence Application Office Of?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the efficiency of submitting the Special Assessment Legal Residence Application Office Of, making the process quicker and more reliable.

-

Are there any benefits to using airSlate SignNow for the Special Assessment Legal Residence Application Office Of?

Using airSlate SignNow for the Special Assessment Legal Residence Application Office Of offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the application process, allowing you to focus on what matters most.

-

Can I integrate airSlate SignNow with other tools for the Special Assessment Legal Residence Application Office Of?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, enhancing your workflow for the Special Assessment Legal Residence Application Office Of. This integration capability allows you to connect with your existing systems for a more streamlined experience.

-

Is airSlate SignNow secure for handling the Special Assessment Legal Residence Application Office Of?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When handling the Special Assessment Legal Residence Application Office Of, you can trust that your information is safe and secure.

Get more for Special Assessment Legal Residence Application Office Of

Find out other Special Assessment Legal Residence Application Office Of

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple