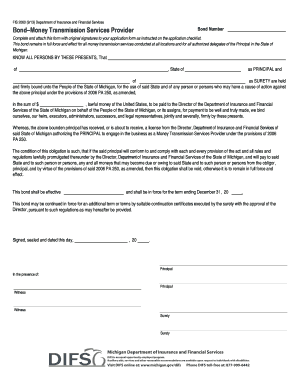

Michigan Fis 2060 Form

What is the Michigan Fis 2060 Form

The Michigan Fis 2060 Form is a state-specific document used primarily for tax purposes. It serves as a means for individuals and businesses to report their financial information to the Michigan Department of Treasury. This form is essential for those who need to declare their income, deductions, and credits accurately, ensuring compliance with Michigan tax laws.

How to use the Michigan Fis 2060 Form

To use the Michigan Fis 2060 Form effectively, individuals must first gather all necessary financial documents, including income statements, deduction records, and any relevant tax credit information. The form is designed to capture detailed financial data, so it is important to fill it out completely and accurately. Once completed, the form can be submitted electronically or via mail, depending on the individual's preference.

Steps to complete the Michigan Fis 2060 Form

Completing the Michigan Fis 2060 Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Carefully read the instructions provided with the form to understand each section.

- Fill out personal information, including name, address, and Social Security number.

- Report all income, ensuring to include wages, interest, and any other sources of income.

- Detail deductions and credits applicable to your situation, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Michigan Fis 2060 Form

The legal use of the Michigan Fis 2060 Form is critical for compliance with state tax regulations. Filing this form accurately and on time helps avoid potential penalties and legal issues. It is important to understand the specific requirements for filing, including deadlines and the types of income that must be reported. Failure to comply with these regulations can result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Fis 2060 Form typically align with federal tax deadlines. It is essential to submit the form by April fifteenth of each year to avoid penalties. Additionally, taxpayers should be aware of any extensions or changes in deadlines that may occur due to special circumstances, such as natural disasters or legislative changes.

Required Documents

When preparing to fill out the Michigan Fis 2060 Form, several documents are required to ensure accurate reporting:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant documentation for tax credits

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan fis 2060 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Fis 2060 Form?

The Michigan Fis 2060 Form is a tax form used by businesses in Michigan to report specific financial information. It is essential for ensuring compliance with state tax regulations. Understanding this form is crucial for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the Michigan Fis 2060 Form?

airSlate SignNow simplifies the process of completing and eSigning the Michigan Fis 2060 Form. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. This saves time and reduces the risk of errors during submission.

-

Is there a cost associated with using airSlate SignNow for the Michigan Fis 2060 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that streamline the completion of the Michigan Fis 2060 Form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Michigan Fis 2060 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Michigan Fis 2060 Form. These tools enhance the user experience and ensure that your documents are handled efficiently. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for the Michigan Fis 2060 Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Michigan Fis 2060 Form. This means you can connect with your existing tools for a seamless experience, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the Michigan Fis 2060 Form?

Using airSlate SignNow for the Michigan Fis 2060 Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime. This convenience allows businesses to focus more on their core operations.

-

Is airSlate SignNow compliant with Michigan regulations for the Fis 2060 Form?

Yes, airSlate SignNow is designed to comply with Michigan regulations regarding the Fis 2060 Form. We prioritize legal compliance and ensure that our platform meets all necessary standards. This gives users peace of mind when submitting their forms electronically.

Get more for Michigan Fis 2060 Form

- Ohsu medical records 13299581 form

- Mcdonalds menu printable pdf form

- Mississippi market bulletin form

- Medicines in my home worksheet answers form

- Denton county civil cover sheet form

- Florida department of highway safety and motor vehicles forms

- The minnesota health care directive a planning too form

- Grazing agreement template form

Find out other Michigan Fis 2060 Form

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement