Lacountypropertytax 2015

Understanding Lacountypropertytax

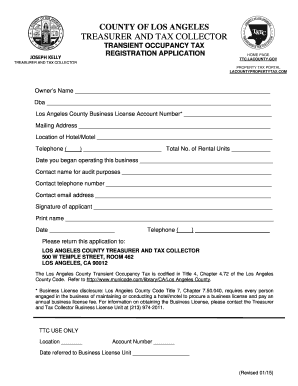

The lacountypropertytax refers to property taxes assessed by the Los Angeles County Tax Collector. This tax is levied on real estate properties within the county and is a primary source of funding for local services, including schools, public safety, and infrastructure. Property taxes are calculated based on the assessed value of the property, which is determined by the county assessor's office. Understanding this tax is essential for property owners in Los Angeles County to ensure compliance and proper financial planning.

Steps to Complete the Lacountypropertytax

Completing the lacountypropertytax involves several key steps. First, property owners should gather relevant information, including the property address and the assessed value. Next, they need to determine the applicable tax rate, which can vary based on the property's location and use. After calculating the tax amount, property owners can proceed to fill out the necessary forms, ensuring all information is accurate. Finally, submitting the completed forms either online or via mail is essential to meet deadlines and avoid penalties.

How to Obtain the Lacountypropertytax Information

Property owners can obtain information regarding the lacountypropertytax through the Los Angeles County Tax Collector's official website. This site provides access to property tax records, payment options, and important updates related to tax collection. Additionally, property owners can contact the tax collector's office directly for assistance with specific inquiries or to resolve any issues related to their property taxes.

Required Documents for Lacountypropertytax

When dealing with the lacountypropertytax, certain documents are necessary to ensure a smooth process. These typically include the property deed, previous tax statements, and any relevant identification documents. If applying for exemptions or reductions, additional paperwork may be required, such as proof of income or residency. Having these documents ready can help expedite the process and ensure compliance with local regulations.

Penalties for Non-Compliance with Lacountypropertytax

Failure to comply with the lacountypropertytax regulations can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential liens against the property. In severe cases, non-compliance can lead to foreclosure proceedings. It is crucial for property owners to stay informed about their tax obligations and to make timely payments to avoid these consequences.

Eligibility Criteria for Lacountypropertytax Exemptions

Certain property owners may qualify for exemptions from the lacountypropertytax. Eligibility criteria often include age, disability status, or financial hardship. For example, senior citizens or disabled individuals may be eligible for property tax assistance programs. Additionally, properties used for specific purposes, such as non-profit organizations, may also qualify for exemptions. Understanding these criteria can help property owners take advantage of available benefits.

Create this form in 5 minutes or less

Find and fill out the correct lacountypropertytax

Create this form in 5 minutes!

How to create an eSignature for the lacountypropertytax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is lacountypropertytax and how does it work?

LACountyPropertyTax refers to the property tax system in Los Angeles County, which is managed by the county government. It involves assessing property values and determining tax rates based on those assessments. Understanding lacountypropertytax is essential for property owners to ensure they are paying the correct amount and taking advantage of any available exemptions.

-

How can airSlate SignNow help with lacountypropertytax documents?

AirSlate SignNow streamlines the process of signing and sending documents related to lacountypropertytax. With our easy-to-use platform, you can quickly eSign tax forms, appeals, and other necessary documents, ensuring that your submissions are timely and secure. This efficiency can save you time and reduce the stress associated with property tax management.

-

What are the pricing options for using airSlate SignNow for lacountypropertytax?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for managing lacountypropertytax documents. Whether you are a small business or a large enterprise, our plans provide access to essential features without breaking the bank. You can choose a plan that best fits your budget and document signing requirements.

-

What features does airSlate SignNow offer for lacountypropertytax management?

AirSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking, which are particularly useful for managing lacountypropertytax documents. These tools enhance your workflow, allowing you to handle multiple tax-related documents efficiently. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other tools for lacountypropertytax?

Yes, airSlate SignNow offers seamless integrations with various applications that can assist in managing lacountypropertytax. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect with these tools to streamline your document workflow. This integration capability enhances productivity and ensures that all your tax-related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for lacountypropertytax?

Using airSlate SignNow for lacountypropertytax provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents quickly, reducing the time spent on manual processes. Additionally, the secure storage of documents ensures that your sensitive tax information is protected.

-

Is airSlate SignNow compliant with lacountypropertytax regulations?

Absolutely! AirSlate SignNow is designed to comply with all relevant regulations regarding electronic signatures, including those applicable to lacountypropertytax. Our platform adheres to industry standards, ensuring that your signed documents are legally binding and recognized by government entities. This compliance gives you peace of mind when managing your property tax documents.

Get more for Lacountypropertytax

- Quitclaim deed from corporation to corporation alabama form

- Warranty deed from corporation to corporation alabama form

- Quitclaim deed from corporation to two individuals alabama form

- Warranty deed from corporation to two individuals alabama form

- Warranty deed from individual to a trust alabama form

- Warranty deed from husband and wife to a trust alabama form

- Warranty deed from husband to himself and wife alabama form

- Alabama husband wife form

Find out other Lacountypropertytax

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile