Transient Occupancy Tax Registration Application 2020

What is the Transient Occupancy Tax Registration Application

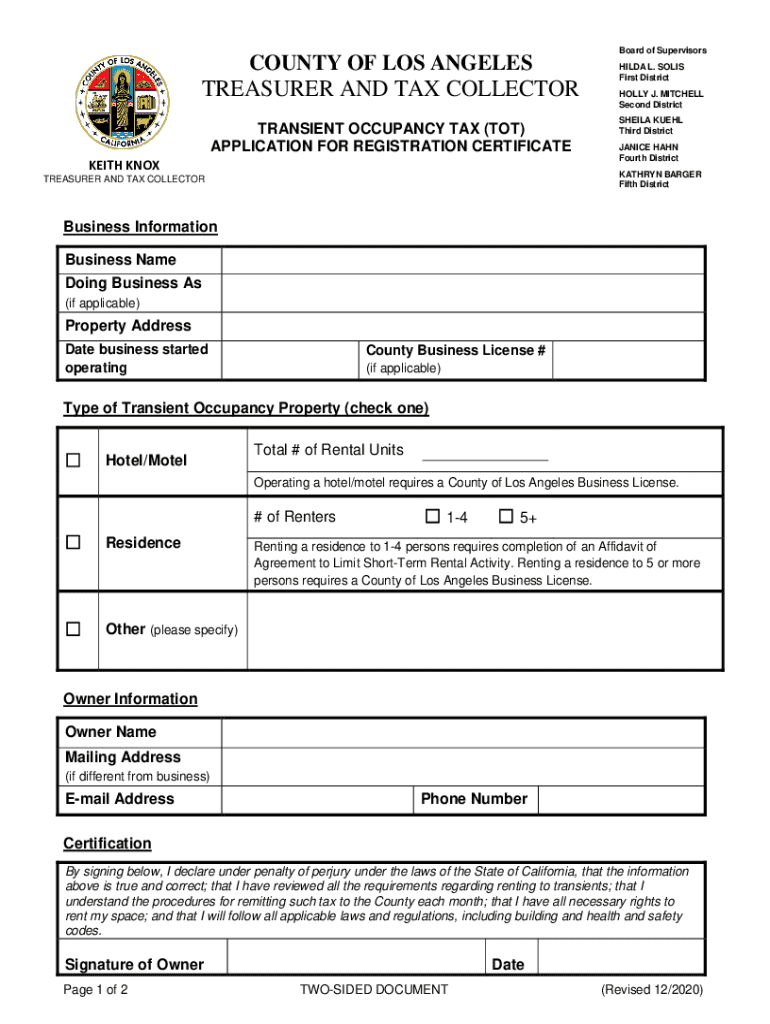

The Transient Occupancy Tax Registration Application is a crucial document for businesses that offer short-term lodging services, such as hotels, motels, and vacation rentals. This application allows property owners and operators to register with local tax authorities to collect and remit transient occupancy taxes, which are levied on guests staying for a limited duration. Understanding this application is essential for compliance with state and local tax regulations, ensuring that businesses operate legally while contributing to local revenue.

Steps to complete the Transient Occupancy Tax Registration Application

Completing the Transient Occupancy Tax Registration Application involves several key steps:

- Gather Required Information: Collect necessary details about your business, including ownership information, property address, and type of lodging offered.

- Access the Application: Obtain the application form from your local tax authority's website or office.

- Fill Out the Form: Carefully complete all sections of the application, ensuring accuracy in the information provided.

- Review for Completeness: Double-check the application for any missing information or errors before submission.

- Submit the Application: Follow the submission guidelines, which may include online submission, mailing the form, or delivering it in person.

Required Documents

When submitting the Transient Occupancy Tax Registration Application, certain documents may be required to support your application. These typically include:

- Proof of ownership or lease agreement for the property.

- Identification documents, such as a driver's license or business license.

- Tax identification number or employer identification number (EIN).

Having these documents ready can facilitate a smoother application process and help avoid delays in approval.

Form Submission Methods

The Transient Occupancy Tax Registration Application can often be submitted through various methods, depending on local regulations:

- Online: Many jurisdictions allow for digital submission through their official websites, providing a quick and efficient way to register.

- By Mail: You may also print the completed application and send it via postal service to the designated tax authority.

- In-Person: Some applicants prefer to submit their forms in person at their local tax office, where they can receive immediate assistance.

Eligibility Criteria

To qualify for the Transient Occupancy Tax Registration Application, businesses must meet specific eligibility criteria. Generally, these include:

- Operating a property that offers lodging for a short-term stay, typically defined as less than thirty days.

- Compliance with local zoning and safety regulations.

- Possessing the necessary business licenses and permits required by local authorities.

Meeting these criteria is essential for successful registration and tax compliance.

Penalties for Non-Compliance

Failure to register for the Transient Occupancy Tax can result in significant penalties. These may include:

- Fines imposed by local tax authorities for late registration or failure to collect taxes.

- Back taxes owed, which can accumulate over time and lead to financial strain.

- Potential legal action or revocation of business licenses for continued non-compliance.

Understanding these penalties emphasizes the importance of timely registration and adherence to tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct transient occupancy tax registration application

Create this form in 5 minutes!

How to create an eSignature for the transient occupancy tax registration application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Transient Occupancy Tax Registration Application?

A Transient Occupancy Tax Registration Application is a form that businesses must complete to register for collecting taxes on short-term rentals. This application ensures compliance with local tax regulations and helps streamline the tax collection process for transient accommodations.

-

How can airSlate SignNow assist with the Transient Occupancy Tax Registration Application?

airSlate SignNow provides an easy-to-use platform for completing and eSigning your Transient Occupancy Tax Registration Application. With our solution, you can quickly fill out the necessary forms, obtain signatures, and submit your application efficiently, saving you time and effort.

-

What are the costs associated with using airSlate SignNow for the application?

airSlate SignNow offers a cost-effective solution for managing your Transient Occupancy Tax Registration Application. Pricing plans are designed to fit various business needs, ensuring you only pay for the features you require, making it an affordable choice for businesses of all sizes.

-

What features does airSlate SignNow offer for managing tax applications?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all tailored to streamline your Transient Occupancy Tax Registration Application process. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for my tax applications?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to connect your Transient Occupancy Tax Registration Application process with your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for tax registration?

Using airSlate SignNow for your Transient Occupancy Tax Registration Application provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the entire process, allowing you to focus on your business while ensuring that your tax obligations are met.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Transient Occupancy Tax Registration Application and other sensitive documents are protected. We utilize advanced encryption and security protocols to safeguard your information throughout the signing and submission process.

Get more for Transient Occupancy Tax Registration Application

Find out other Transient Occupancy Tax Registration Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors