Fsa 2024-2026

What is the Fsa

The Fsa, or Flexible Spending Account, is a tax-advantaged financial account that allows employees to set aside pre-tax dollars for eligible medical expenses. This account is typically offered by employers as part of a benefits package. The funds contributed to the Fsa can be used for various out-of-pocket health costs, such as copayments, deductibles, and certain medical supplies. By using pre-tax dollars, employees can effectively lower their taxable income, resulting in potential tax savings.

How to use the Fsa

Using the Fsa involves a straightforward process. First, employees must enroll in the Fsa during their employer's open enrollment period. Once enrolled, they can contribute a portion of their salary to the account. To access funds, employees can submit claims for eligible expenses. This can often be done through an online portal or mobile app provided by the Fsa administrator. It is important to keep receipts and documentation for all claims, as these may be required for reimbursement or verification purposes.

Steps to complete the Fsa

Completing the Fsa involves several key steps:

- Review your employer's Fsa plan details, including contribution limits and eligible expenses.

- Select the amount you wish to contribute to your Fsa during open enrollment.

- Keep track of your eligible medical expenses throughout the year.

- Submit claims for reimbursement, ensuring you provide all necessary documentation.

- Monitor your Fsa balance and ensure you use the funds before the plan year ends or any grace period expires.

Key elements of the Fsa

Several key elements define the Fsa:

- Contribution Limits: The IRS sets annual contribution limits for Fsas, which can change from year to year.

- Eligible Expenses: Funds can be used for a wide range of medical expenses, but not all costs qualify.

- Use-It-or-Lose-It Rule: Typically, any unused funds at the end of the plan year may be forfeited, although some plans offer a grace period or a carryover option.

- Employer Contributions: Some employers may contribute to employees' Fsas, enhancing the benefits of the account.

IRS Guidelines

The IRS provides specific guidelines regarding Fsas, including eligibility requirements and the types of expenses that can be reimbursed. It is essential for account holders to familiarize themselves with these guidelines to ensure compliance and maximize benefits. The IRS updates these guidelines periodically, so staying informed about any changes is crucial for effective Fsa management.

Eligibility Criteria

Eligibility for participating in an Fsa typically requires being employed by a company that offers this benefit. Employees must also enroll during the designated open enrollment period. Some plans may have specific eligibility criteria based on employment status or hours worked. Additionally, individuals who are enrolled in a Health Savings Account (HSA) may face restrictions on Fsa participation.

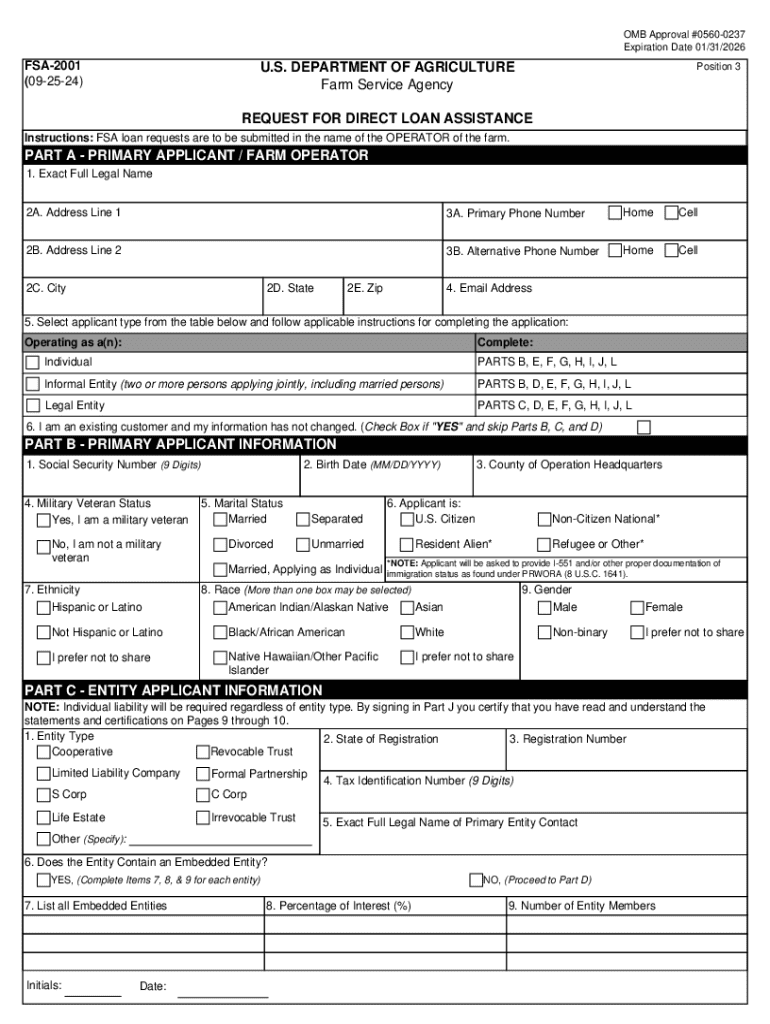

Handy tips for filling out Fsa online

Quick steps to complete and e-sign Fsa online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant service for maximum straightforwardness. Use signNow to e-sign and send out Fsa for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct fsa 771277634

Create this form in 5 minutes!

How to create an eSignature for the fsa 771277634

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Fsa and how does it relate to airSlate SignNow?

Fsa stands for Flexible Spending Account, which allows employees to set aside pre-tax dollars for eligible expenses. airSlate SignNow can help businesses manage Fsa documentation efficiently by providing a secure platform for eSigning and sending necessary forms, ensuring compliance and ease of use.

-

How can airSlate SignNow help with Fsa document management?

airSlate SignNow streamlines Fsa document management by allowing users to create, send, and eSign Fsa-related documents quickly. This reduces paperwork and enhances efficiency, making it easier for employees to manage their Fsa accounts and for HR departments to handle submissions.

-

What are the pricing options for airSlate SignNow for Fsa management?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on Fsa management. Each plan provides access to essential features that simplify the eSigning process, ensuring that businesses can choose a solution that fits their budget while effectively managing Fsa documents.

-

What features does airSlate SignNow offer for Fsa-related processes?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for Fsa-related processes. These features help businesses streamline their operations, reduce errors, and ensure that all Fsa documents are handled efficiently.

-

Can airSlate SignNow integrate with other tools for Fsa management?

Yes, airSlate SignNow offers integrations with various tools and platforms that can enhance Fsa management. By connecting with HR software and accounting systems, businesses can ensure a seamless flow of information, making it easier to manage Fsa accounts and related documentation.

-

What are the benefits of using airSlate SignNow for Fsa documentation?

Using airSlate SignNow for Fsa documentation provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. The platform's user-friendly interface allows employees to easily access and eSign Fsa documents, improving overall satisfaction and compliance.

-

Is airSlate SignNow secure for handling Fsa documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect Fsa documents. Businesses can trust that their sensitive information is safe while using the platform to manage and eSign Fsa-related paperwork.

Get more for Fsa

Find out other Fsa

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation