New Zealand Superannuation Application 2020

What is the New Zealand Superannuation Application

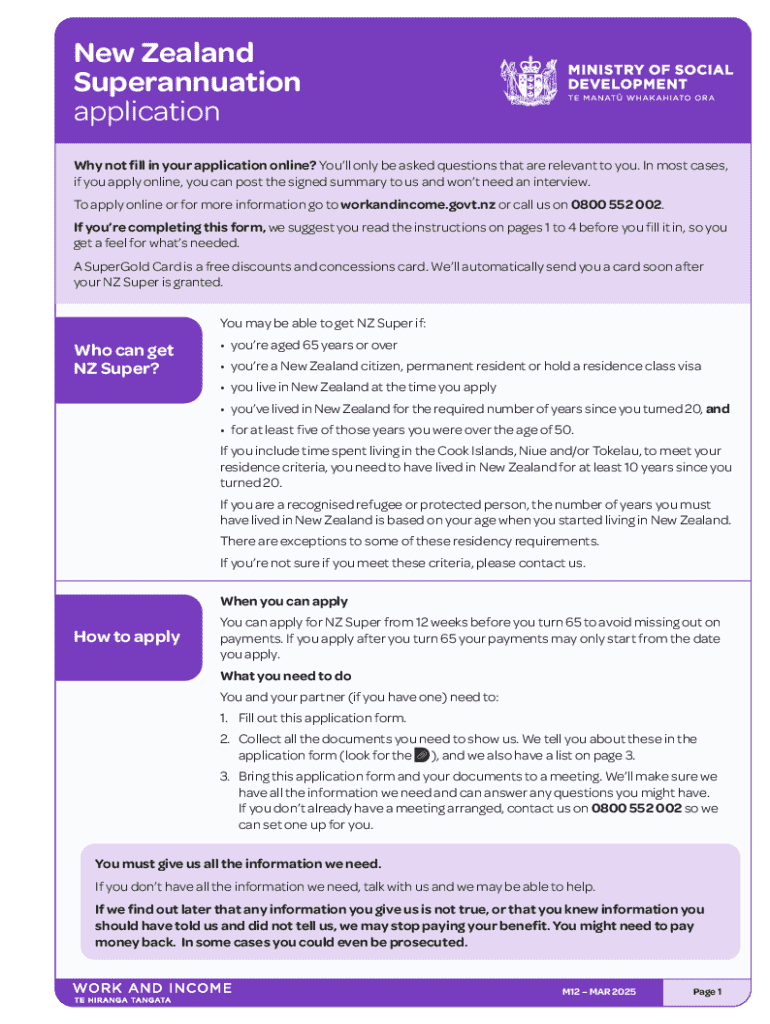

The New Zealand Superannuation Application is a formal request for government-funded retirement support available to eligible residents of New Zealand. This application allows individuals to access financial assistance during their retirement years, ensuring a basic standard of living. The program is designed to support citizens and residents aged sixty-five and older, providing them with a stable income source funded by the government. Understanding the specifics of this application is crucial for anyone approaching retirement age or considering their financial future in New Zealand.

Eligibility Criteria

To qualify for the New Zealand Superannuation, applicants must meet specific criteria. Key eligibility requirements include:

- Age: Applicants must be at least sixty-five years old.

- Residency: Individuals must be New Zealand citizens or permanent residents.

- Duration of residency: Applicants must have lived in New Zealand for at least ten years since turning twenty.

- Income and asset tests: While there are no strict income limits, having excessive assets may affect the level of support received.

Steps to Complete the New Zealand Superannuation Application

Completing the New Zealand Superannuation Application involves several straightforward steps:

- Gather necessary documents, including proof of identity and residency.

- Fill out the application form accurately, ensuring all required fields are complete.

- Submit the application either online or via mail, depending on your preference.

- Await confirmation from the government regarding the status of your application.

Required Documents

When applying for the New Zealand Superannuation, certain documents are essential to support your application. These typically include:

- A valid form of identification, such as a passport or driver's license.

- Proof of residency status, like a residency certificate or utility bills.

- Any relevant financial documents that may be requested to assess eligibility.

Form Submission Methods

The New Zealand Superannuation Application can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission via the official government website, which is often the quickest option.

- Mailing a completed paper application to the designated government office.

- In-person submission at local government offices, where assistance may be available.

Application Process & Approval Time

The application process for the New Zealand Superannuation typically involves several stages, and the approval time can vary. After submission, the government reviews the application, which may take several weeks. Factors that influence the approval time include:

- The completeness of the application and documentation submitted.

- The current volume of applications being processed.

- Any additional information or verification that may be required.

Handy tips for filling out New Zealand Superannuation Application online

Quick steps to complete and e-sign New Zealand Superannuation Application online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant service for maximum straightforwardness. Use signNow to electronically sign and send out New Zealand Superannuation Application for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct new zealand superannuation application

Create this form in 5 minutes!

How to create an eSignature for the new zealand superannuation application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Zealand Superannuation Application process?

The New Zealand Superannuation Application process involves submitting your application online through the official government portal. You will need to provide personal information, including your age and residency status. Once submitted, you can track the status of your application easily.

-

How can airSlate SignNow assist with the New Zealand Superannuation Application?

airSlate SignNow simplifies the New Zealand Superannuation Application by allowing you to eSign necessary documents securely and efficiently. Our platform ensures that all your documents are legally binding and easily accessible. This streamlines the application process, saving you time and effort.

-

What are the costs associated with using airSlate SignNow for the New Zealand Superannuation Application?

airSlate SignNow offers a cost-effective solution for managing your New Zealand Superannuation Application. Pricing plans are flexible and cater to different needs, ensuring you only pay for what you use. You can choose from monthly or annual subscriptions, making it budget-friendly.

-

What features does airSlate SignNow provide for the New Zealand Superannuation Application?

airSlate SignNow provides a range of features for the New Zealand Superannuation Application, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience and ensure that your application is processed smoothly. Additionally, you can collaborate with others in real-time.

-

Are there any benefits to using airSlate SignNow for my New Zealand Superannuation Application?

Using airSlate SignNow for your New Zealand Superannuation Application offers numerous benefits, such as increased efficiency and reduced paperwork. You can complete your application from anywhere, at any time, using any device. This convenience helps you stay organized and focused on your retirement planning.

-

Can I integrate airSlate SignNow with other tools for my New Zealand Superannuation Application?

Yes, airSlate SignNow can be integrated with various tools and applications to enhance your New Zealand Superannuation Application process. This includes CRM systems, cloud storage services, and more. These integrations help streamline your workflow and keep all your documents in one place.

-

Is airSlate SignNow secure for handling my New Zealand Superannuation Application?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your New Zealand Superannuation Application and personal information are protected. We use advanced encryption and security protocols to safeguard your data, giving you peace of mind throughout the application process.

Get more for New Zealand Superannuation Application

Find out other New Zealand Superannuation Application

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later