Standard Flood Hazard Determination Form

What is the Standard Flood Hazard Determination Form

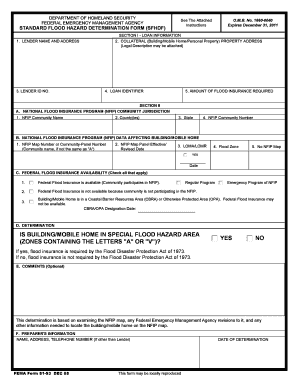

The Standard Flood Hazard Determination Form (SFHDF) is a crucial document used primarily in the United States to assess flood risk for properties. This form is essential for lenders when determining whether a property is located in a Special Flood Hazard Area (SFHA) as defined by the Federal Emergency Management Agency (FEMA). The SFHDF provides a standardized method for evaluating flood zone designations, ensuring that property owners are aware of potential flood risks associated with their real estate investments.

How to use the Standard Flood Hazard Determination Form

Using the Standard Flood Hazard Determination Form involves several key steps. First, the lender or property owner must fill out the form with relevant property details, including the address and parcel number. Once completed, the form is submitted to a qualified flood determination service or FEMA for analysis. The resulting flood zone determination will indicate whether the property is in a high-risk flood area, which may affect insurance requirements and lending decisions. Proper use of the SFHDF ensures compliance with federal regulations and helps protect both lenders and borrowers from unforeseen flood-related liabilities.

Steps to complete the Standard Flood Hazard Determination Form

Completing the Standard Flood Hazard Determination Form requires careful attention to detail. Here are the essential steps:

- Gather property information, including the full address and legal description.

- Enter the data into the SFHDF, ensuring accuracy in all fields.

- Submit the completed form to a flood determination service or FEMA.

- Receive the flood zone determination report, which will specify the property's risk level.

- Review the findings and take necessary actions, such as obtaining flood insurance if required.

Key elements of the Standard Flood Hazard Determination Form

The Standard Flood Hazard Determination Form includes several critical elements that facilitate accurate flood risk assessments. These elements typically consist of:

- Property address and legal description

- Information about the lender and borrower

- Flood zone designation based on FEMA maps

- Effective date of the flood map

- Certification statement confirming the accuracy of the information

These components ensure that all parties involved have a clear understanding of the flood risk associated with the property.

Legal use of the Standard Flood Hazard Determination Form

The legal use of the Standard Flood Hazard Determination Form is governed by federal regulations, particularly those set forth by FEMA and the National Flood Insurance Program (NFIP). Lenders are required to obtain a flood hazard determination for properties located in areas prone to flooding. This legal requirement helps ensure that homeowners are adequately informed about flood risks and are able to secure appropriate insurance coverage. Failure to comply with these regulations may result in penalties for lenders and potential financial loss for property owners.

Examples of using the Standard Flood Hazard Determination Form

There are various scenarios in which the Standard Flood Hazard Determination Form is utilized. For instance:

- A bank processing a mortgage application may require the form to determine if flood insurance is necessary.

- A real estate agent may use the form to inform potential buyers about flood risks associated with a property.

- A homeowner seeking to refinance may need the form to ensure compliance with lending regulations.

These examples illustrate the form's importance in real estate transactions and financial planning.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the standard flood hazard determination form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sfhdf and how does it benefit my business?

sfhdf is a powerful tool that allows businesses to streamline their document signing process. By using airSlate SignNow, you can enhance efficiency, reduce turnaround times, and improve overall productivity. This solution is designed to meet the needs of various industries, making it a versatile choice for any organization.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to fit various budgets. We offer different plans that cater to small businesses and large enterprises alike. By choosing airSlate SignNow, you can find a cost-effective solution that meets your specific needs without compromising on features.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the user experience and ensure that your document signing process is efficient and secure. With sfhdf, you can easily manage all your signing needs in one place.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and enhance productivity by connecting all your tools. The flexibility of sfhdf ensures that you can work within your existing ecosystem without any hassle.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents are protected. With features like encryption and secure access controls, you can trust that your data is safe. Using sfhdf means you can confidently manage your documents without worrying about security bsignNowes.

-

How does airSlate SignNow improve the signing process?

airSlate SignNow simplifies the signing process by allowing users to eSign documents from anywhere, at any time. This convenience leads to faster approvals and reduced delays in business operations. By leveraging sfhdf, you can ensure that your signing process is not only efficient but also user-friendly.

-

What support options are available for airSlate SignNow users?

We offer comprehensive support options for airSlate SignNow users, including live chat, email support, and a detailed knowledge base. Our team is dedicated to helping you resolve any issues quickly and effectively. With sfhdf, you can rest assured that assistance is always available when you need it.

Get more for Standard Flood Hazard Determination Form

- Test form 3a answer key

- Online nm rpd 41109 rev 062010 form

- Lease for a trucking company agreement template form

- Lease to own agreement template form

- Lease to buy agreement template form

- Lease to own business agreement template form

- Lease to own car agreement template form

- Lease to own equipment agreement template form

Find out other Standard Flood Hazard Determination Form

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast