Life Claimant Statement 2022-2026

What is the Life Claimant Statement

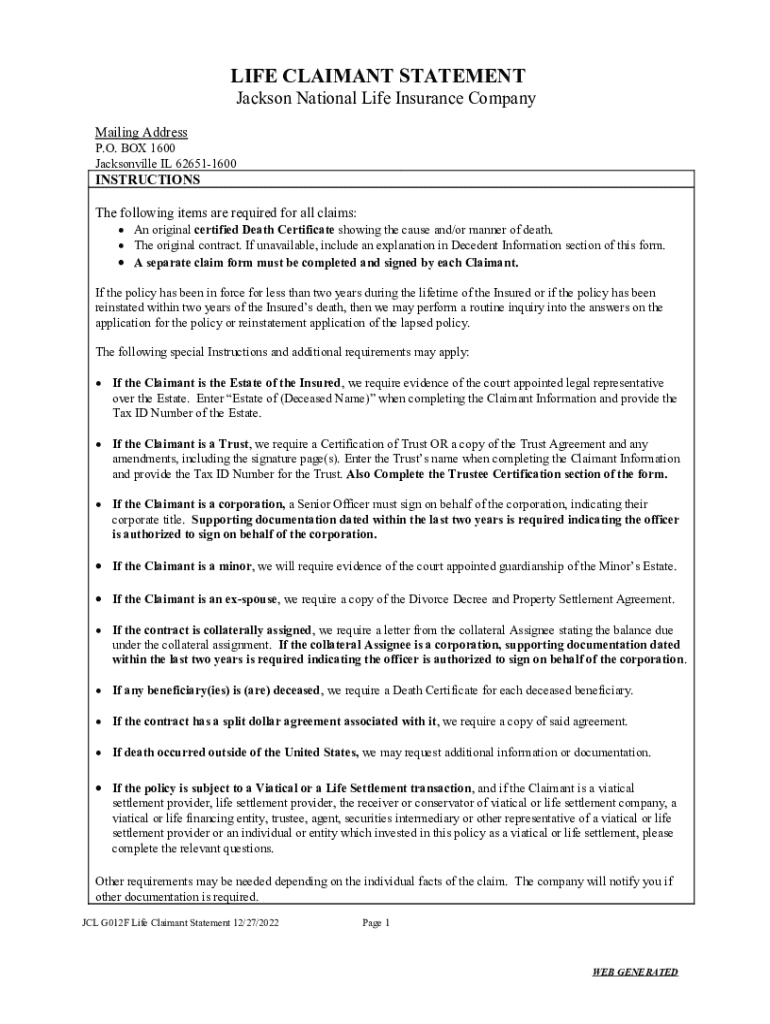

The Life Claimant Statement is a formal document used in the United States to initiate and process claims related to life insurance policies. This statement serves as a declaration by the claimant, providing essential information about the deceased and the circumstances surrounding the claim. It is crucial for ensuring that beneficiaries receive the benefits they are entitled to in a timely manner.

How to use the Life Claimant Statement

Using the Life Claimant Statement involves several steps to ensure accurate and complete submission. Claimants must first gather all necessary information, including the policy number, the deceased's details, and any relevant documentation that supports the claim. Once the statement is filled out, it can be submitted to the insurance company either online, by mail, or in person, depending on the insurer's preferred method.

Steps to complete the Life Claimant Statement

Completing the Life Claimant Statement requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents such as the death certificate and the insurance policy.

- Fill out the statement with accurate information about the deceased and the claimant.

- Review the completed statement for any errors or omissions.

- Submit the statement along with any required documents to the insurance company.

Key elements of the Life Claimant Statement

The Life Claimant Statement includes several key elements that are essential for processing the claim. These elements typically consist of:

- The claimant's contact information.

- The policy number and the name of the insured.

- The date of death and cause of death.

- Details regarding any beneficiaries and their relationship to the deceased.

Legal use of the Life Claimant Statement

The Life Claimant Statement is a legally binding document that must be completed accurately to avoid potential legal issues. Misrepresentation or failure to disclose relevant information can lead to delays in processing the claim or even denial of benefits. It is important for claimants to understand the legal implications of the information they provide.

Required Documents

When submitting the Life Claimant Statement, certain documents are typically required to support the claim. These may include:

- A certified copy of the death certificate.

- The original life insurance policy or a copy.

- Identification documents for the claimant, such as a driver's license or Social Security card.

- Any additional documentation requested by the insurance company.

Form Submission Methods

The Life Claimant Statement can be submitted through various methods, depending on the insurance provider's policies. Common submission methods include:

- Online submission through the insurance company's website.

- Mailing the completed statement and documents to the designated address.

- In-person submission at a local insurance office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life claimant statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Life Claimant Statement?

A Life Claimant Statement is a document required by insurance companies to process life insurance claims. It gathers essential information about the deceased and the claimant, ensuring a smooth claims process. Understanding this document is crucial for anyone looking to file a claim.

-

How does airSlate SignNow simplify the Life Claimant Statement process?

airSlate SignNow streamlines the Life Claimant Statement process by allowing users to easily create, send, and eSign documents online. This eliminates the need for physical paperwork and speeds up the claims process. With its user-friendly interface, you can manage your documents efficiently.

-

What are the pricing options for using airSlate SignNow for Life Claimant Statements?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you're a small business or a large enterprise, you can find a plan that suits your budget while efficiently managing Life Claimant Statements. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing Life Claimant Statements?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing Life Claimant Statements. This includes CRM systems, document management tools, and more. These integrations help streamline your processes and improve efficiency.

-

What features does airSlate SignNow offer for Life Claimant Statements?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for Life Claimant Statements. These features ensure that your documents are completed accurately and efficiently. Additionally, you can store and manage all your documents in one secure location.

-

How secure is the information in my Life Claimant Statement when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your Life Claimant Statement and other sensitive documents. You can trust that your information is safe and secure throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for Life Claimant Statements?

Using airSlate SignNow for Life Claimant Statements offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. By digitizing the claims process, you can save time and resources while ensuring a smoother experience for all parties involved.

Get more for Life Claimant Statement

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497325664 form

- South carolina landlord form

- South carolina law form

- Sc improper form

- Letter from tenant to landlord about insufficient notice of rent increase south carolina form

- Letter tenant increase 497325669 form

- Sc increase rent 497325670 form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant south carolina form

Find out other Life Claimant Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors