EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI 2014-2026

What is the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

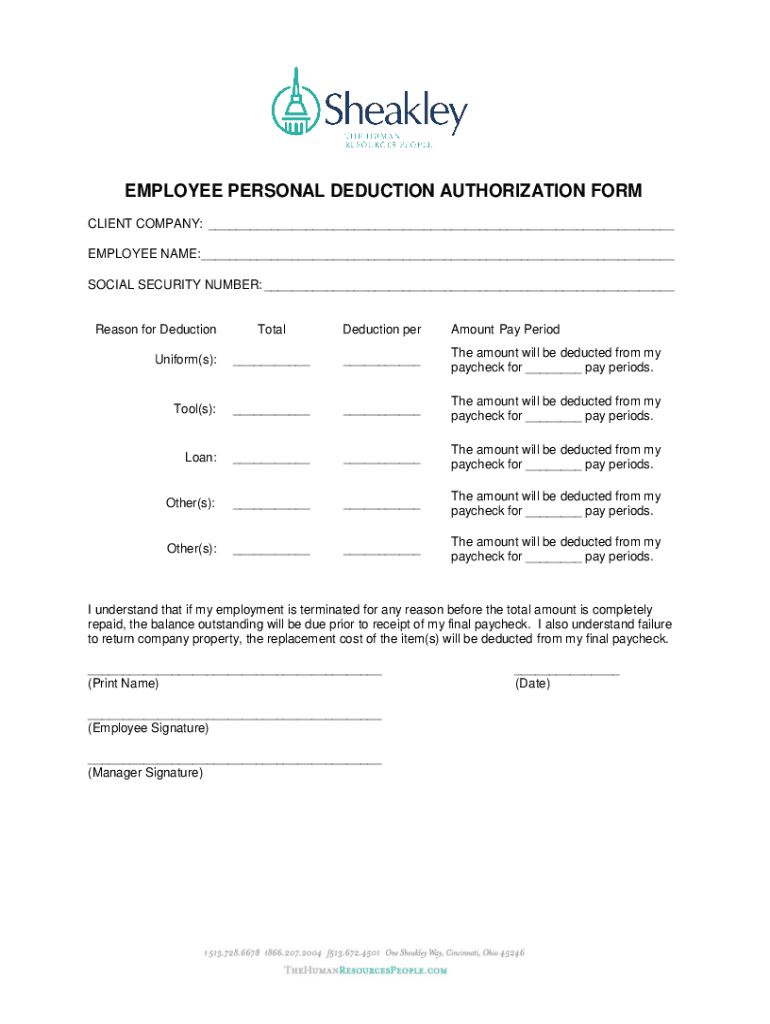

The EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI is a critical document used by employees to authorize specific deductions from their paychecks. This form ensures that the employer can withhold the correct amounts for various purposes, such as contributions to retirement plans, health insurance premiums, or other benefits. By completing this form, employees provide clear instructions on how they want their earnings to be allocated, which helps in maintaining accurate payroll records.

How to use the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

To effectively use the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI, employees should first obtain the form from their employer or the company's human resources department. Once in possession of the form, employees need to fill out their personal information, including name, employee ID, and the specific deductions they wish to authorize. After completing the form, it should be submitted to the appropriate HR personnel for processing. This ensures that the requested deductions will be reflected in the next payroll cycle.

Steps to complete the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

Completing the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI involves several straightforward steps:

- Obtain the form from your employer or HR department.

- Fill in your personal details, such as your full name and employee identification number.

- Specify the deductions you wish to authorize, including amounts and frequency.

- Review the completed form for accuracy.

- Sign and date the form to validate your authorization.

- Submit the form to your HR department or payroll administrator.

Key elements of the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

Several key elements are essential to the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI. These include:

- Employee Information: Personal details such as name, address, and employee ID.

- Deductions Authorized: Clear indication of the types and amounts of deductions.

- Signature: The employee's signature is required to confirm the authorization.

- Date: The date when the authorization is signed.

Legal use of the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

The EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI is legally binding once signed by the employee. It serves as a formal agreement between the employee and employer regarding payroll deductions. Employers must adhere to the instructions provided in the form to ensure compliance with labor laws and regulations. Mismanagement of deductions can lead to legal repercussions, making it crucial for both parties to maintain accurate records and follow the agreed-upon terms.

Form Submission Methods

The EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online Submission: Many companies allow employees to submit forms electronically through a secure HR portal.

- Mail: Employees may also send the completed form via postal mail to the HR department.

- In-Person: Submitting the form directly to HR or payroll representatives is another option.

Create this form in 5 minutes or less

Find and fill out the correct employee personal deduction authorization form cli

Create this form in 5 minutes!

How to create an eSignature for the employee personal deduction authorization form cli

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

The EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI is a digital document that allows employees to authorize deductions from their paychecks for various purposes. This form simplifies the process of managing personal deductions, ensuring compliance and accuracy in payroll processing.

-

How does airSlate SignNow facilitate the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

airSlate SignNow streamlines the creation and signing of the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI by providing an intuitive platform for document management. Users can easily customize the form, send it for eSignature, and track its status in real-time, enhancing efficiency.

-

What are the pricing options for using airSlate SignNow with the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes access to features that support the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow provide for the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

Key features of airSlate SignNow for the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI include customizable templates, secure eSignature capabilities, and automated workflows. These features help businesses manage their documentation efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the functionality of the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI. This allows for better data management and streamlined processes across your business tools.

-

What are the benefits of using airSlate SignNow for the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

Using airSlate SignNow for the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows businesses to manage deductions quickly and accurately, improving overall payroll processes.

-

Is airSlate SignNow secure for handling the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI. With encryption and secure access controls, you can trust that your sensitive information is safe.

Get more for EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

Find out other EMPLOYEE PERSONAL DEDUCTION AUTHORIZATION FORM CLI

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online