Employee Personal Deduction Authorization Form Client Sheakley 2008

What is the Employee Personal Deduction Authorization Form Client Sheakley

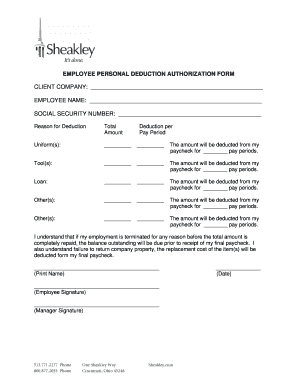

The Employee Personal Deduction Authorization Form Client Sheakley is a crucial document that allows employees to authorize specific personal deductions from their paychecks. This form is particularly important for managing various deductions, such as contributions to retirement plans, health insurance premiums, and other benefits. By completing this form, employees can ensure that their deductions align with their financial goals and compliance requirements.

How to use the Employee Personal Deduction Authorization Form Client Sheakley

Using the Employee Personal Deduction Authorization Form Client Sheakley involves several straightforward steps. First, employees need to obtain the form, which can typically be accessed through their employer or the Sheakley website. Next, employees should carefully fill out the required fields, including personal information and the specific deductions they wish to authorize. Once completed, the form must be submitted to the appropriate department within the organization for processing.

Steps to complete the Employee Personal Deduction Authorization Form Client Sheakley

Completing the Employee Personal Deduction Authorization Form Client Sheakley requires attention to detail. Here are the steps to follow:

- Obtain the form from your employer or the Sheakley website.

- Fill in your personal details, including your name, employee ID, and contact information.

- Specify the deductions you wish to authorize, such as retirement contributions or health insurance premiums.

- Review the form for accuracy to avoid any errors.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your employer’s HR or payroll department.

Key elements of the Employee Personal Deduction Authorization Form Client Sheakley

Several key elements are essential to the Employee Personal Deduction Authorization Form Client Sheakley. These include:

- Employee Information: Personal details such as name, address, and employee ID.

- Deductions Authorized: A clear list of the deductions the employee wishes to authorize.

- Signature: The employee's signature is required to validate the authorization.

- Date: The date of signing is critical for record-keeping purposes.

Legal use of the Employee Personal Deduction Authorization Form Client Sheakley

The legal use of the Employee Personal Deduction Authorization Form Client Sheakley is governed by employment and tax laws in the United States. Employers must ensure that the deductions authorized comply with federal and state regulations. Employees should also be aware of their rights regarding deductions and any potential impacts on their take-home pay. Proper use of this form helps maintain transparency and compliance in payroll practices.

Form Submission Methods

Employees can submit the Employee Personal Deduction Authorization Form Client Sheakley through various methods, depending on their employer's policies. Common submission methods include:

- Online Submission: Many employers offer digital platforms for submitting forms electronically.

- Mail: Employees may send the completed form via postal mail to the HR or payroll department.

- In-Person: Submitting the form in person allows for immediate confirmation of receipt.

Create this form in 5 minutes or less

Find and fill out the correct employee personal deduction authorization form client sheakley

Create this form in 5 minutes!

How to create an eSignature for the employee personal deduction authorization form client sheakley

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee Personal Deduction Authorization Form Client Sheakley?

The Employee Personal Deduction Authorization Form Client Sheakley is a document that allows employees to authorize deductions from their paychecks for various purposes. This form is essential for ensuring compliance with payroll regulations and maintaining accurate records. By using airSlate SignNow, businesses can easily manage and eSign this form, streamlining the process.

-

How does airSlate SignNow simplify the Employee Personal Deduction Authorization Form Client Sheakley process?

airSlate SignNow simplifies the Employee Personal Deduction Authorization Form Client Sheakley process by providing an intuitive platform for document creation, sending, and signing. Users can quickly customize the form, send it to employees for eSignature, and track its status in real-time. This efficiency reduces paperwork and enhances productivity.

-

What are the pricing options for using airSlate SignNow for the Employee Personal Deduction Authorization Form Client Sheakley?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose from monthly or annual subscriptions that provide access to features specifically designed for managing documents like the Employee Personal Deduction Authorization Form Client Sheakley. Contact our sales team for a detailed quote tailored to your requirements.

-

Can I integrate airSlate SignNow with other software for the Employee Personal Deduction Authorization Form Client Sheakley?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the Employee Personal Deduction Authorization Form Client Sheakley. Whether you use HR software, payroll systems, or CRM tools, our platform can connect with them to streamline document management and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Employee Personal Deduction Authorization Form Client Sheakley?

Using airSlate SignNow for the Employee Personal Deduction Authorization Form Client Sheakley provides numerous benefits, including faster processing times, reduced errors, and enhanced security. The platform ensures that all documents are securely stored and easily accessible, allowing for better compliance and record-keeping. Additionally, eSigning eliminates the need for physical paperwork.

-

Is airSlate SignNow secure for handling the Employee Personal Deduction Authorization Form Client Sheakley?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that the Employee Personal Deduction Authorization Form Client Sheakley is handled with the utmost care. Our platform employs advanced encryption and security protocols to protect sensitive information, giving you peace of mind when managing employee documents.

-

How can I get started with airSlate SignNow for the Employee Personal Deduction Authorization Form Client Sheakley?

Getting started with airSlate SignNow for the Employee Personal Deduction Authorization Form Client Sheakley is easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating and sending your forms. Our user-friendly interface and helpful resources will guide you through the process.

Get more for Employee Personal Deduction Authorization Form Client Sheakley

Find out other Employee Personal Deduction Authorization Form Client Sheakley

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form