Automated Clearing House ACH Transfer Authorization Form

What is the Automated Clearing House ACH Transfer Authorization

The Automated Clearing House (ACH) Transfer Authorization is a financial document that allows individuals and businesses to authorize electronic transfers of funds between bank accounts. This process is commonly used for direct deposits, bill payments, and other electronic transactions. By completing this authorization, the account holder provides permission for a specified amount to be withdrawn or deposited from their account on a recurring or one-time basis.

How to use the Automated Clearing House ACH Transfer Authorization

Using the ACH Transfer Authorization involves several straightforward steps. First, the account holder must fill out the authorization form, providing essential information such as bank account details, the amount to be transferred, and the frequency of the transfer. Once completed, the form should be signed and submitted to the initiating party, such as an employer or service provider. It is crucial to ensure that all information is accurate to avoid any delays or errors in processing the transfer.

Steps to complete the Automated Clearing House ACH Transfer Authorization

Completing the ACH Transfer Authorization requires careful attention to detail. Follow these steps:

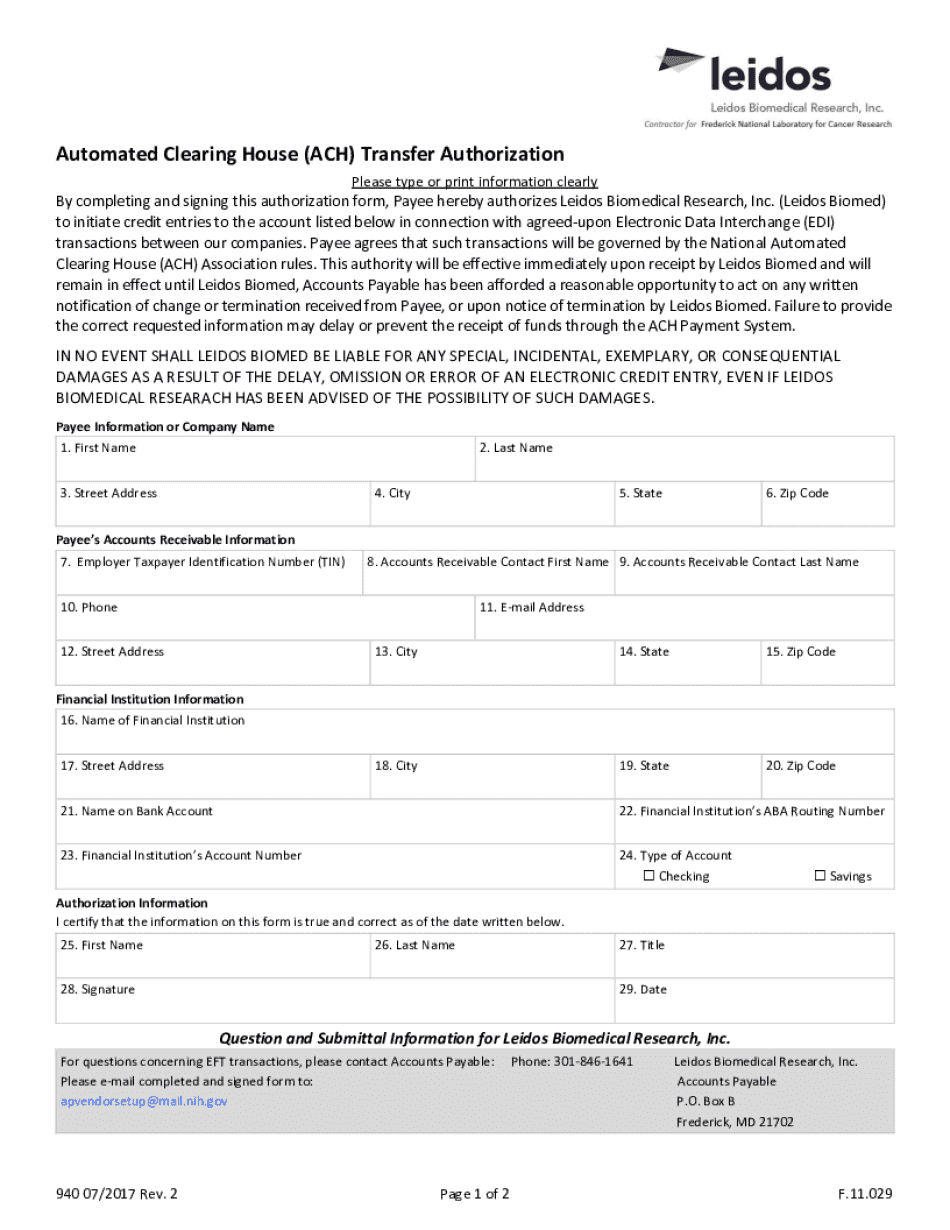

- Obtain the ACH Transfer Authorization form from the relevant party.

- Fill in your personal information, including your name, address, and bank account details.

- Specify the amount to be transferred and the frequency (e.g., weekly, monthly).

- Review the information for accuracy.

- Sign and date the form to confirm your authorization.

- Submit the completed form to the initiating party via the preferred method (e.g., email, fax, or mail).

Key elements of the Automated Clearing House ACH Transfer Authorization

Several key elements must be included in the ACH Transfer Authorization to ensure it is valid and effective:

- Account Information: The bank account number and routing number must be clearly stated.

- Authorization Statement: A clear statement granting permission for the transfer.

- Transfer Amount: The specific amount to be transferred, whether it is a fixed amount or variable.

- Frequency of Transfer: Indication of whether the transfer is one-time or recurring.

- Signature: The account holder's signature is required to validate the authorization.

Legal use of the Automated Clearing House ACH Transfer Authorization

The ACH Transfer Authorization is governed by federal regulations that ensure the security and privacy of electronic transactions. The National Automated Clearing House Association (NACHA) oversees the rules for ACH transactions, which require that all parties involved adhere to strict compliance standards. This includes obtaining proper authorization from the account holder and ensuring that all transactions are processed securely. Failure to comply with these regulations can result in penalties and legal repercussions.

Examples of using the Automated Clearing House ACH Transfer Authorization

There are various practical applications for the ACH Transfer Authorization, including:

- Direct Deposit: Employers use ACH authorizations to deposit employee salaries directly into their bank accounts.

- Recurring Payments: Utility companies often require ACH authorizations for automatic bill payments.

- Loan Payments: Borrowers can authorize lenders to withdraw monthly payments directly from their accounts.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the automated clearing house ach transfer authorization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Automated Clearing House ACH Transfer Authorization?

Automated Clearing House ACH Transfer Authorization is a process that allows businesses to electronically authorize payments and transfers through the ACH network. This method streamlines transactions, making it easier for companies to manage their finances efficiently and securely.

-

How does airSlate SignNow facilitate Automated Clearing House ACH Transfer Authorization?

airSlate SignNow simplifies the Automated Clearing House ACH Transfer Authorization process by providing an intuitive platform for eSigning and managing documents. Users can easily create, send, and track authorization forms, ensuring compliance and reducing paperwork.

-

What are the benefits of using Automated Clearing House ACH Transfer Authorization?

Using Automated Clearing House ACH Transfer Authorization offers numerous benefits, including faster transaction processing, reduced costs associated with paper checks, and enhanced security. It also improves cash flow management and provides a clear audit trail for all transactions.

-

Is there a cost associated with Automated Clearing House ACH Transfer Authorization through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for Automated Clearing House ACH Transfer Authorization, but it is designed to be cost-effective. Pricing plans vary based on features and usage, allowing businesses to choose a plan that fits their needs and budget.

-

Can I integrate Automated Clearing House ACH Transfer Authorization with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to incorporate Automated Clearing House ACH Transfer Authorization into your existing workflows. This enhances efficiency and ensures that all your financial processes are interconnected.

-

What types of businesses can benefit from Automated Clearing House ACH Transfer Authorization?

Any business that processes payments can benefit from Automated Clearing House ACH Transfer Authorization. This includes small businesses, large enterprises, and non-profits looking to streamline their payment processes and improve cash flow management.

-

How secure is the Automated Clearing House ACH Transfer Authorization process?

The Automated Clearing House ACH Transfer Authorization process through airSlate SignNow is highly secure. The platform employs advanced encryption and security protocols to protect sensitive financial information, ensuring that your transactions are safe and compliant.

Get more for Automated Clearing House ACH Transfer Authorization

Find out other Automated Clearing House ACH Transfer Authorization

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe