Impuesto Sobre La Renta De Las Personas Fsicas Retenciones 2021-2026

What is the Impuesto Sobre La Renta De Las Personas Físicas Retenciones

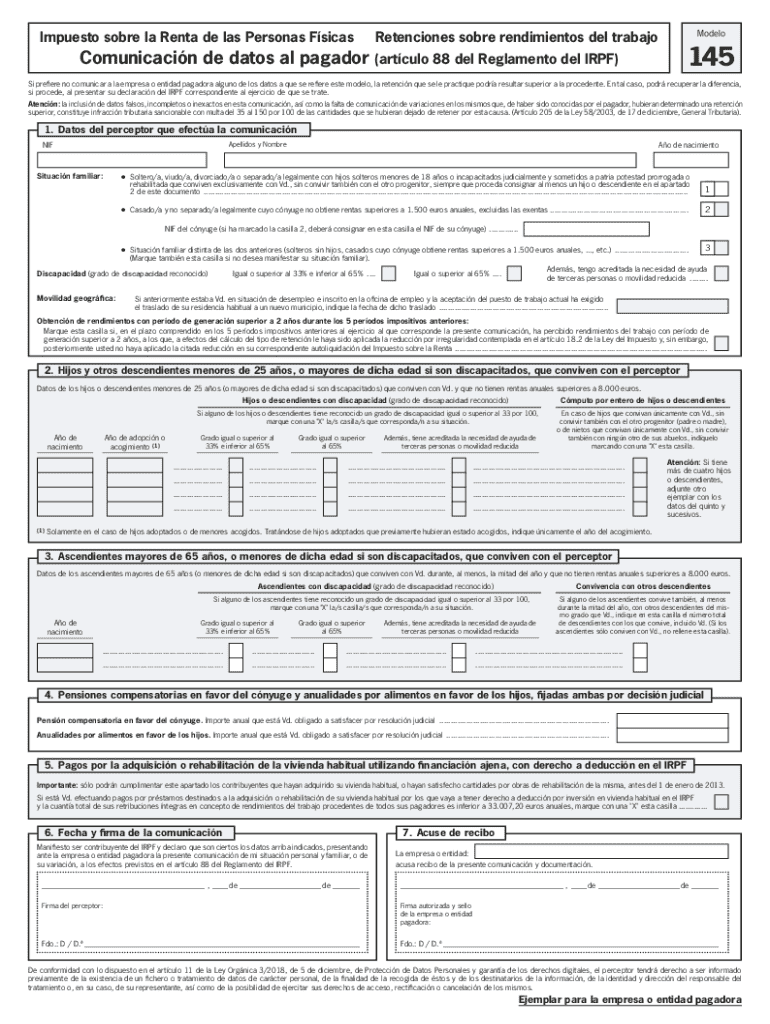

The Impuesto Sobre La Renta De Las Personas Físicas Retenciones, often referred to as IRPF Retenciones, is a tax mechanism applied to individuals in the United States who earn income. This tax is designed to withhold a portion of an individual's earnings at the source, ensuring that taxes are collected progressively throughout the year rather than in a lump sum at the end of the tax year. The amount withheld depends on various factors, including the individual's income level, filing status, and any applicable deductions or credits.

Steps to complete the Impuesto Sobre La Renta De Las Personas Físicas Retenciones

Completing the IRPF Retenciones involves several key steps. First, individuals must gather necessary financial documents, such as W-2 forms, which report annual wages and the taxes withheld. Next, individuals should determine their filing status, as this will influence the tax rate applied. After calculating total income and deductions, individuals can fill out the relevant tax forms, ensuring all information is accurate and complete. Finally, individuals must submit their forms to the appropriate tax authority by the designated deadline to avoid penalties.

Required Documents

To properly complete the Impuesto Sobre La Renta De Las Personas Físicas Retenciones, individuals must prepare several essential documents. These typically include:

- W-2 forms from employers, detailing income and tax withholding

- 1099 forms for other income sources, such as freelance work or interest

- Proof of deductions, such as receipts for medical expenses or charitable donations

- Previous year’s tax return for reference

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for the Impuesto Sobre La Renta De Las Personas Físicas Retenciones. These guidelines outline the withholding rates based on income brackets and filing statuses. It is crucial for individuals to stay updated on any changes to tax laws that may affect their withholding amounts. The IRS also offers resources and tools, such as the withholding calculator, to assist taxpayers in determining the appropriate amount to withhold from their earnings.

Penalties for Non-Compliance

Failure to comply with the requirements of the Impuesto Sobre La Renta De Las Personas Físicas Retenciones can result in significant penalties. These penalties may include fines for late filings, interest on unpaid taxes, and additional charges for underpayment. It is essential for individuals to understand their obligations and ensure timely and accurate submissions to avoid these financial repercussions.

Eligibility Criteria

Eligibility for the Impuesto Sobre La Renta De Las Personas Físicas Retenciones primarily depends on an individual's income level and filing status. Generally, all individuals earning income in the U.S. are subject to this withholding tax. However, certain exemptions may apply based on age, income thresholds, or specific tax credits. Understanding these criteria is vital for individuals to ensure proper compliance with tax obligations.

Handy tips for filling out Impuesto Sobre La Renta De Las Personas Fsicas Retenciones online

Quick steps to complete and e-sign Impuesto Sobre La Renta De Las Personas Fsicas Retenciones online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Gain access to a GDPR and HIPAA compliant service for maximum straightforwardness. Use signNow to e-sign and send out Impuesto Sobre La Renta De Las Personas Fsicas Retenciones for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct impuesto sobre la renta de las personas fsicas retenciones

Create this form in 5 minutes!

How to create an eSignature for the impuesto sobre la renta de las personas fsicas retenciones

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones?

The Impuesto Sobre La Renta De Las Personas Fsicas Retenciones refers to the income tax withholding for individuals. It is a tax that employers are required to deduct from employees' salaries and remit to the tax authorities. Understanding this tax is crucial for compliance and financial planning.

-

How can airSlate SignNow help with Impuesto Sobre La Renta De Las Personas Fsicas Retenciones?

airSlate SignNow simplifies the process of managing documents related to the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones. With our eSigning capabilities, you can easily send, sign, and store tax-related documents securely, ensuring compliance and efficiency in your operations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing documents related to the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones. These features streamline the document management process, making it easier to handle tax-related paperwork.

-

Is airSlate SignNow cost-effective for small businesses dealing with Impuesto Sobre La Renta De Las Personas Fsicas Retenciones?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones. Our pricing plans are flexible and provide great value, ensuring that you can manage your tax documents without breaking the bank.

-

Can airSlate SignNow integrate with accounting software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, which is essential for managing the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones. This integration allows for efficient data transfer and helps maintain accurate records for tax compliance.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones, offers numerous benefits. These include enhanced security, reduced processing time, and improved collaboration among team members, all of which contribute to a more efficient tax management process.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information related to the Impuesto Sobre La Renta De Las Personas Fsicas Retenciones. Our platform ensures that your documents are safe from unauthorized access and data bsignNowes.

Get more for Impuesto Sobre La Renta De Las Personas Fsicas Retenciones

Find out other Impuesto Sobre La Renta De Las Personas Fsicas Retenciones

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF