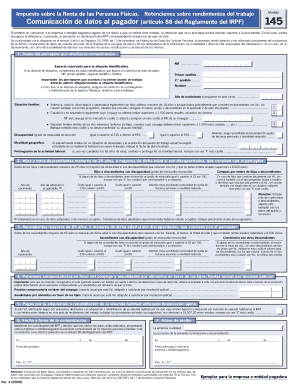

Modelo 145 2008

What is the Modelo 145

The Modelo 145 is a tax form used in the United States for reporting specific financial information to the Internal Revenue Service (IRS). This form is often utilized by individuals to communicate their income details, particularly when it comes to withholding tax allowances. It plays a critical role in ensuring that the correct amount of tax is withheld from an individual's paycheck, which can help prevent underpayment or overpayment of taxes throughout the year.

How to use the Modelo 145

Using the Modelo 145 involves filling out the form accurately to reflect your financial situation. Taxpayers typically complete this form to inform their employer about their tax withholding preferences. It is essential to provide accurate information regarding your filing status, number of dependents, and any additional withholding requests. Once filled out, the form should be submitted to your employer, who will then use it to adjust your payroll tax withholdings accordingly.

Steps to complete the Modelo 145

Completing the Modelo 145 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Social Security number, filing status, and number of dependents.

- Fill out the personal information section at the top of the form.

- Indicate your filing status and the number of allowances you wish to claim.

- Provide any additional withholding amounts if desired.

- Review the form for accuracy before submitting it to your employer.

Legal use of the Modelo 145

The Modelo 145 is legally recognized by the IRS and must be used in compliance with federal tax laws. It is essential for taxpayers to ensure that the information reported on the form is truthful and accurate. Misrepresentation or errors can lead to penalties or issues with tax compliance. Employers are required to keep this form on file for their records and to ensure that they are withholding the correct amount of taxes from employee paychecks.

Filing Deadlines / Important Dates

Filing deadlines for the Modelo 145 can vary based on individual circumstances. Generally, it should be submitted to your employer at the start of your employment or whenever there is a change in your financial situation that affects your withholding. It is advisable to review your withholding at least once a year or whenever significant life changes occur, such as marriage or the birth of a child.

Required Documents

To complete the Modelo 145, you will need several documents, including:

- Your Social Security card or number.

- Proof of income, such as pay stubs or tax returns from previous years.

- Information about any dependents, including their Social Security numbers.

Who Issues the Form

The Modelo 145 is issued by the IRS. It is important for taxpayers to ensure they are using the most current version of the form, as tax laws and regulations can change. Employers are responsible for providing this form to their employees and ensuring it is completed accurately for proper tax withholding.

Create this form in 5 minutes or less

Find and fill out the correct modelo 145 78042736

Create this form in 5 minutes!

How to create an eSignature for the modelo 145 78042736

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Modelo 145 and how does it relate to airSlate SignNow?

Modelo 145 is a tax form used in Spain for income tax declaration. airSlate SignNow allows users to easily eSign and send Modelo 145 documents securely, streamlining the process for both individuals and businesses.

-

How can airSlate SignNow help me with filling out Modelo 145?

With airSlate SignNow, you can upload your Modelo 145 form, fill it out electronically, and eSign it with ease. This eliminates the need for printing and scanning, making the process faster and more efficient.

-

Is airSlate SignNow a cost-effective solution for managing Modelo 145?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. By using our platform for Modelo 145, you can save on printing and mailing costs while ensuring compliance and security.

-

What features does airSlate SignNow offer for handling Modelo 145?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features enhance the management of Modelo 145, ensuring that you can handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other applications for Modelo 145?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Modelo 145 alongside other business tools. This integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for Modelo 145?

Using airSlate SignNow for Modelo 145 offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are handled efficiently and securely, giving you peace of mind.

-

Is it easy to get started with airSlate SignNow for Modelo 145?

Yes, getting started with airSlate SignNow is simple. You can sign up for a free trial, and our user-friendly interface will guide you through the process of managing your Modelo 145 documents effortlessly.

Get more for Modelo 145

- Adlro amended form

- Affidavit in support of motion for leave to proceed on appeal in forma pauperis courts state hi

- State of hawai i courts state hi form

- Administrative driver s license revocation office adlro courts state hi form

- Set order courts form

- Hawaii form reconsider license

- Edp ss form

- Application for amended ignition interlock permit courts state hi form

Find out other Modelo 145

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple