Arizona Form 140A 2024-2026

What is the Arizona Form 140A

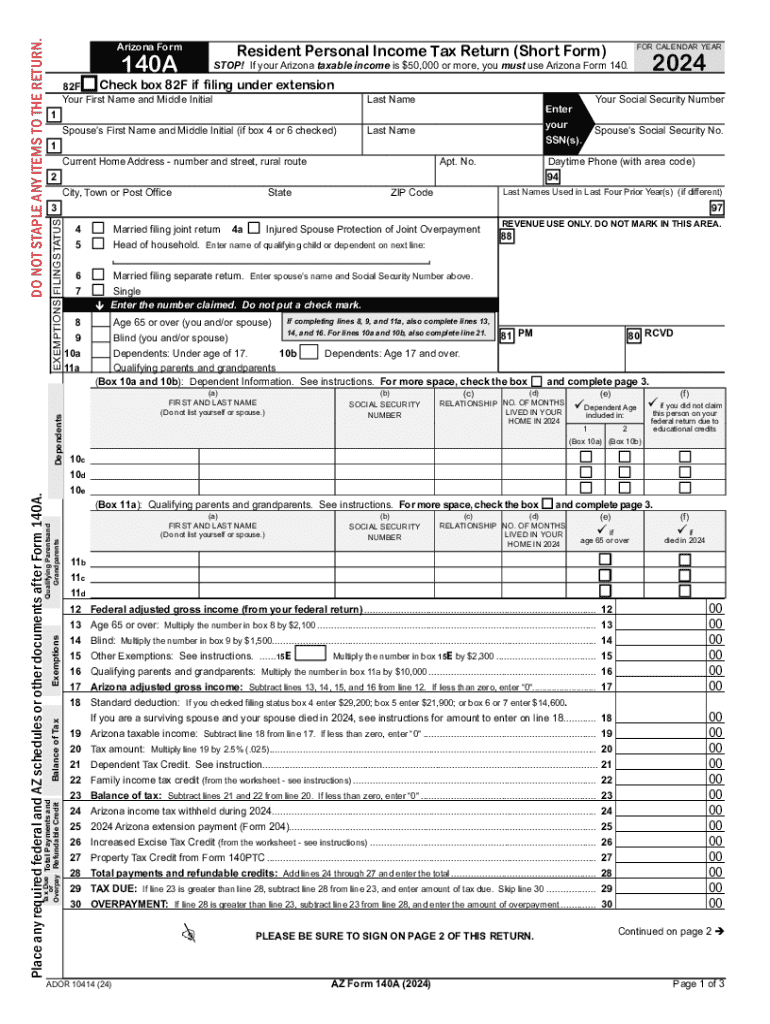

The Arizona Form 140A is a state income tax return form specifically designed for individual taxpayers who are filing their taxes in Arizona. This form is particularly useful for those who meet certain income thresholds and are eligible for a simplified filing process. The 140A form allows taxpayers to report their income, claim deductions, and calculate their tax liability in a straightforward manner.

How to use the Arizona Form 140A

Using the Arizona Form 140A involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by providing personal information, income details, and any applicable deductions. After completing the form, review it for accuracy before submitting it to the Arizona Department of Revenue. It is important to ensure that all information is correct to avoid delays or penalties.

Steps to complete the Arizona Form 140A

To complete the Arizona Form 140A, follow these steps:

- Obtain the form from the Arizona Department of Revenue website or a local tax office.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages and interest.

- Claim any deductions you qualify for, such as standard deductions or specific credits.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Arizona Form 140A. Typically, the deadline for filing your state tax return is April 15 of each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may need to file, which can provide additional time to complete their forms.

Required Documents

When preparing to file the Arizona Form 140A, certain documents are necessary to ensure accurate reporting. Required documents include:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Form Submission Methods

The Arizona Form 140A can be submitted in various ways, providing flexibility for taxpayers. Options include:

- Online submission through the Arizona Department of Revenue’s e-file system.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 140a

Create this form in 5 minutes!

How to create an eSignature for the arizona form 140a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 140A?

The Arizona Form 140A is a simplified tax return form for individuals who meet specific criteria. It allows eligible taxpayers to file their state income tax returns efficiently. Using airSlate SignNow, you can easily eSign and submit your Arizona Form 140A online.

-

How can airSlate SignNow help with the Arizona Form 140A?

airSlate SignNow streamlines the process of completing and submitting the Arizona Form 140A. Our platform allows you to fill out the form digitally, eSign it, and send it securely, saving you time and reducing paperwork. This makes tax season much easier for Arizona residents.

-

Is there a cost associated with using airSlate SignNow for the Arizona Form 140A?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our plans are designed to be cost-effective, ensuring that you can manage your Arizona Form 140A and other documents without breaking the bank. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for the Arizona Form 140A?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for your Arizona Form 140A. These tools enhance your efficiency and ensure that your documents are always accessible and securely stored. You can also track the status of your submissions easily.

-

Can I integrate airSlate SignNow with other software for my Arizona Form 140A?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Arizona Form 140A alongside your other business tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for my Arizona Form 140A?

Using airSlate SignNow for your Arizona Form 140A offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on what matters most—your business. Plus, you can access your documents anytime, anywhere.

-

Is airSlate SignNow secure for submitting the Arizona Form 140A?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Arizona Form 140A and other documents are protected. We use advanced encryption and secure servers to safeguard your information, giving you peace of mind when submitting sensitive tax documents.

Get more for Arizona Form 140A

Find out other Arizona Form 140A

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free