If Your Arizona Taxable Income is $50,000 or More, You Must Use Arizona Form 140 2023

Understanding Arizona Form 140

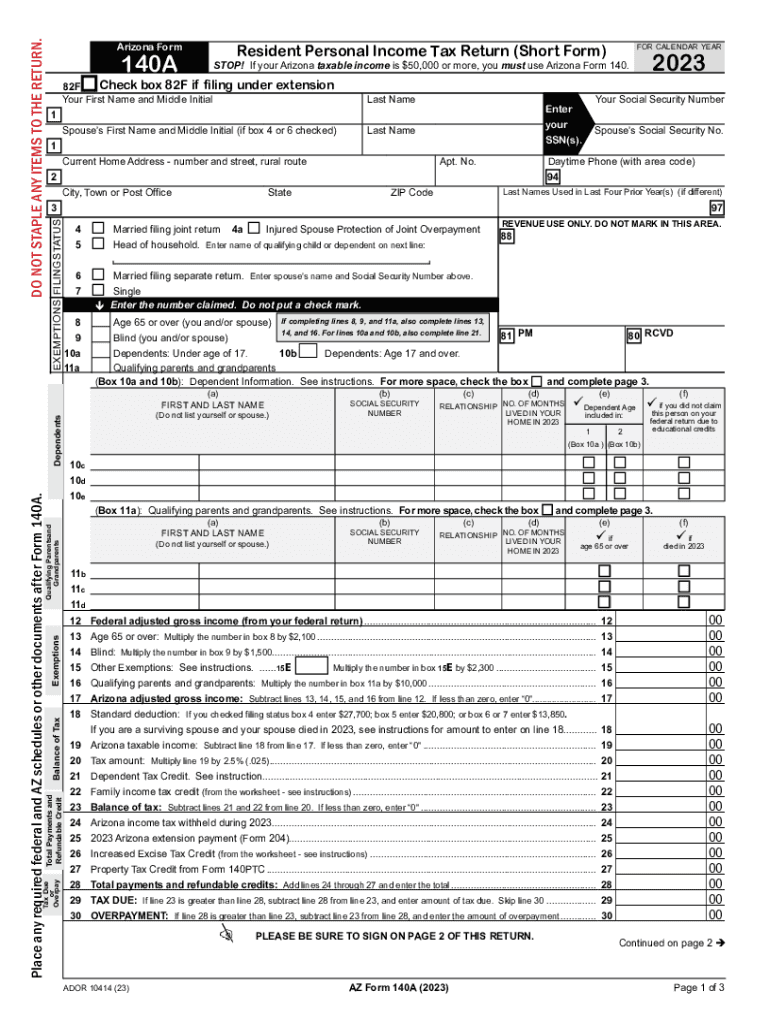

The Arizona Form 140 is a crucial document for individuals whose taxable income is $50,000 or more. This form is specifically designed for residents of Arizona to report their income and calculate their state tax obligations. It is important to note that this form is distinct from other tax forms used in the state, such as Form 140A or Form 140EZ, which cater to different income levels or filing statuses. The primary purpose of Form 140 is to ensure compliance with Arizona tax laws while accurately reflecting the taxpayer's financial situation.

Steps to Complete Arizona Form 140

Completing Arizona Form 140 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the personal information section, providing your name, address, and Social Security number. Then, report your total income from all sources, including wages, interest, and dividends. After calculating your total income, apply any applicable deductions and credits to determine your taxable income. Finally, calculate your tax liability based on the state's tax rates and complete the form by signing and dating it.

Obtaining Arizona Form 140

Arizona Form 140 can be easily obtained through various channels. The form is available on the Arizona Department of Revenue's official website, where you can download and print it. Additionally, many tax preparation offices and libraries in Arizona provide physical copies of the form. If you prefer a digital option, tax software often includes Arizona Form 140 as part of their filing process, allowing for a seamless experience in preparing and submitting your taxes.

Required Documents for Arizona Form 140

To successfully complete Arizona Form 140, you will need several key documents. These include your W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of other income sources. You should also gather records of any deductions you plan to claim, such as mortgage interest statements, property tax receipts, and charitable donation receipts. Having these documents on hand will streamline the process and help ensure that your tax return is accurate and complete.

Filing Deadlines for Arizona Form 140

Filing deadlines for Arizona Form 140 are important to keep in mind to avoid penalties and interest. Typically, the deadline for filing your state tax return is the same as the federal deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the Arizona Department of Revenue's website for any updates or changes to the filing deadlines, especially in light of any special circumstances that may arise.

Penalties for Non-Compliance with Arizona Form 140

Failure to file Arizona Form 140 or inaccuracies in your submission can result in significant penalties. If you do not file your return by the deadline, you may incur late filing fees, which can accumulate over time. Additionally, if the Arizona Department of Revenue determines that you have underreported your income or claimed improper deductions, you may face further penalties, including interest on unpaid taxes. It is essential to ensure that your filing is accurate and submitted on time to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct if your arizona taxable income is 50000 or more you must use arizona form 140

Create this form in 5 minutes!

How to create an eSignature for the if your arizona taxable income is 50000 or more you must use arizona form 140

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Form 140 and who needs to use it?

Arizona Form 140 is the individual income tax return form required for residents with a taxable income of $50,000 or more. If your Arizona taxable income is $50,000 or more, you must use Arizona Form 140 to accurately report your income and calculate your tax liability.

-

How does airSlate SignNow help with filing Arizona Form 140?

airSlate SignNow streamlines the process of preparing and signing Arizona Form 140 by allowing users to easily fill out, eSign, and send documents securely. This ensures that if your Arizona taxable income is $50,000 or more, you can efficiently manage your tax filing without hassle.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are an individual or a business, you can find a plan that suits your requirements, especially if your Arizona taxable income is $50,000 or more, as it may influence your document management needs.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features are particularly beneficial if your Arizona taxable income is $50,000 or more, ensuring that your tax documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is especially useful if your Arizona taxable income is $50,000 or more, as you may need to connect with accounting or tax software for seamless document management.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing simplifies the process by providing a user-friendly interface and secure eSigning capabilities. If your Arizona taxable income is $50,000 or more, leveraging these benefits can help you save time and reduce the stress associated with tax preparation.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This is crucial if your Arizona taxable income is $50,000 or more, as you want to ensure that your sensitive tax documents are protected throughout the filing process.

Get more for If Your Arizona Taxable Income Is $50,000 Or More, You Must Use Arizona Form 140

- A 0546 gf immigration diversit et inclusion qubec form

- Formulaire dengagement renseignements gnraux immigration

- Ciao mondobirra castello form

- Imm 5556 e document checklist worker in itscanadatime form

- Imm 5467 e document checklist atlantic intermediate canadaca form

- Flr 6b 2009 2019 form

- Physiotherapy bill format in word 2015 2019

- Rqe fillable 2010 2018 form

Find out other If Your Arizona Taxable Income Is $50,000 Or More, You Must Use Arizona Form 140

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form