Irs Stop 6525 Form

What is the Irs Stop 6525

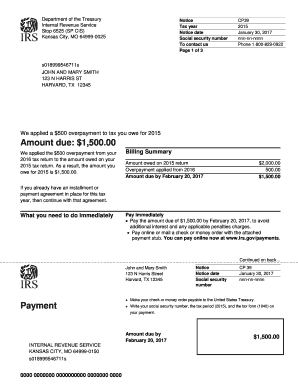

The IRS Stop 6525 is a specific notice issued by the Internal Revenue Service that indicates a taxpayer's account has been flagged for potential issues related to tax compliance. This notice typically arises from discrepancies in reported income, missing tax returns, or other compliance-related concerns. Understanding the implications of this notice is crucial for taxpayers, as it can affect their tax obligations and financial standing.

How to use the Irs Stop 6525

Using the IRS Stop 6525 involves a careful review of the notice and taking appropriate actions to address the concerns raised. Taxpayers should start by thoroughly reading the notice to understand the specific issues cited. It may require gathering relevant documentation, such as tax returns, income statements, or correspondence with the IRS. Responding promptly and accurately to the notice is essential to resolve the matter efficiently.

Steps to complete the Irs Stop 6525

Completing the necessary actions related to the IRS Stop 6525 involves several key steps:

- Review the notice carefully to identify the specific issues.

- Gather all relevant documentation that supports your tax filings.

- Prepare a written response addressing the concerns outlined in the notice.

- Submit your response to the IRS by the deadline indicated in the notice.

- Keep a copy of your response and any supporting documents for your records.

Legal use of the Irs Stop 6525

The IRS Stop 6525 serves as a formal communication from the IRS, and responding to it is a legal obligation for taxpayers. Ignoring the notice can lead to further penalties, including additional fines or enforcement actions. It is important to treat this notice seriously and to seek professional advice if necessary to ensure compliance with IRS regulations.

Required Documents

When addressing the IRS Stop 6525, certain documents may be required to support your case. These documents can include:

- Copies of tax returns for the years in question.

- W-2 forms or 1099 forms that report income.

- Any correspondence previously sent to or received from the IRS.

- Proof of payments made, if applicable.

Filing Deadlines / Important Dates

Each IRS Stop 6525 notice will specify important deadlines that must be adhered to for a timely response. These deadlines are critical to avoid additional penalties or complications. Taxpayers should mark these dates on their calendars and ensure that all necessary documentation is submitted well in advance of the due date to allow for any unforeseen issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs stop 6525

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Irs Stop 6525 and how does it relate to airSlate SignNow?

Irs Stop 6525 refers to a notice issued by the IRS regarding tax issues. With airSlate SignNow, you can easily manage and eSign documents related to your tax filings, ensuring that you stay compliant and organized when addressing Irs Stop 6525 notices.

-

How can airSlate SignNow help me resolve issues related to Irs Stop 6525?

airSlate SignNow provides a streamlined process for signing and sending documents that may be required to address Irs Stop 6525 notices. By using our platform, you can quickly gather necessary signatures and submit your documents to the IRS, reducing the time and stress involved in compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, our plans are designed to provide cost-effective solutions for managing documents, including those related to Irs Stop 6525.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time tracking. These tools are particularly useful for managing documents associated with Irs Stop 6525, ensuring that you can efficiently handle your tax-related paperwork.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is especially beneficial when dealing with Irs Stop 6525, as you can connect your document management processes with accounting or tax software for seamless operations.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those concerning Irs Stop 6525, provides numerous benefits. You gain efficiency, security, and compliance, allowing you to focus on your business while ensuring that your tax documents are handled correctly.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your sensitive tax documents, including those related to Irs Stop 6525, are protected throughout the signing and submission process.

Get more for Irs Stop 6525

- Jury instruction theft or embezzlement by bank employee form

- Fcc form 159

- Attorney affirmation form

- Attorney affirmation new york cle credit for form

- Aboriginal site recording form

- Aboriginal site recording form environment nsw gov

- Dwc form 027 designation of insurance carriers austin representative

- Resurvey license application nevada state health division state health nv form

Find out other Irs Stop 6525

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF