Arizona Form 120 2024-2026

What is the Arizona Form 120

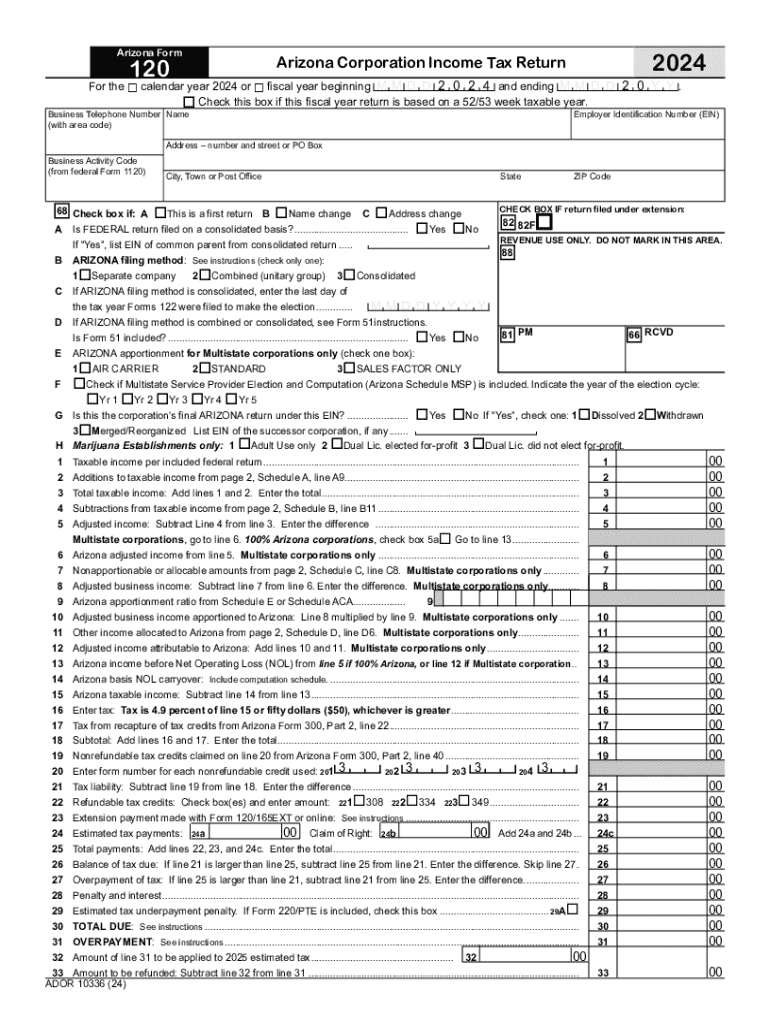

The Arizona Form 120 is a crucial tax document used by corporations operating within the state. This form is primarily utilized for filing corporate income tax returns, allowing businesses to report their income, deductions, and credits accurately. It is essential for ensuring compliance with Arizona tax laws and for calculating the amount of tax owed to the state. The form is designed for various types of corporations, including C corporations and S corporations, and serves as a means for these entities to fulfill their tax obligations.

How to use the Arizona Form 120

Using the Arizona Form 120 involves several key steps. First, businesses must gather all necessary financial information, including income statements, balance sheets, and any relevant deductions or credits. Next, the form must be filled out accurately, ensuring that all sections are completed according to the instructions provided by the Arizona Department of Revenue. Once completed, the form can be submitted either electronically or by mail, depending on the preference of the business. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Arizona Form 120

Completing the Arizona Form 120 requires careful attention to detail. The following steps outline the process:

- Gather financial documents: Collect all relevant financial records, including income statements and expense reports.

- Fill out the form: Begin by entering basic information about the corporation, such as its name, address, and federal employer identification number (FEIN).

- Report income: Accurately report all sources of income, including sales revenue and other earnings.

- Claim deductions: List all allowable deductions to reduce taxable income, such as operating expenses and depreciation.

- Calculate tax owed: Use the appropriate tax rate to determine the total tax liability based on the net income reported.

- Review and submit: Double-check all entries for accuracy before submitting the form electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 120 are critical to avoid penalties. Typically, corporations must file their returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year, this means the due date is April 15. Extensions may be available, but it is essential to file for an extension before the original deadline to avoid late penalties.

Required Documents

To complete the Arizona Form 120, several documents are required. These include:

- Financial statements, such as income statements and balance sheets.

- Records of all income sources and expenses incurred during the tax year.

- Documentation for any tax credits or deductions being claimed.

- Previous year's tax return, if applicable, for reference.

Form Submission Methods

The Arizona Form 120 can be submitted through multiple methods. Businesses have the option to file electronically using the Arizona Department of Revenue's online portal, which provides a streamlined process. Alternatively, the form can be printed and mailed to the appropriate address specified by the department. In-person submissions may also be possible at designated state offices, although electronic filing is generally encouraged for efficiency.

Create this form in 5 minutes or less

Find and fill out the correct arizona form 120

Create this form in 5 minutes!

How to create an eSignature for the arizona form 120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 120?

The Arizona Form 120 is a crucial document used for various business and tax purposes in Arizona. It is essential for businesses to understand its requirements to ensure compliance with state regulations. airSlate SignNow simplifies the process of completing and submitting the Arizona Form 120 electronically.

-

How can airSlate SignNow help with the Arizona Form 120?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the Arizona Form 120. With its intuitive interface, users can quickly navigate through the form, ensuring all necessary information is accurately captured. This streamlines the submission process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the Arizona Form 120?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for those specifically needing to manage the Arizona Form 120. Users can choose from monthly or annual subscriptions, ensuring they only pay for what they need. Additionally, a free trial is available to explore the features before committing.

-

Are there any integrations available for the Arizona Form 120 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the workflow for managing the Arizona Form 120. Users can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This integration capability ensures that all relevant documents are easily accessible.

-

What features does airSlate SignNow offer for completing the Arizona Form 120?

airSlate SignNow offers a range of features designed to simplify the completion of the Arizona Form 120. These include customizable templates, electronic signatures, and real-time collaboration tools. These features help ensure that the form is completed accurately and efficiently.

-

Can I track the status of my Arizona Form 120 submission with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow users to monitor the status of their Arizona Form 120 submissions. This feature ensures that you are always informed about where your document is in the signing process, enhancing transparency and accountability.

-

Is airSlate SignNow secure for handling the Arizona Form 120?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Arizona Form 120. The platform employs advanced encryption and security protocols to protect sensitive information. Users can confidently eSign and submit their documents knowing their data is secure.

Get more for Arizona Form 120

Find out other Arizona Form 120

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors