Corporate Income Tax HighlightsArizona Department of Revenue AZDOR 2021

Understanding Corporate Income Tax Highlights

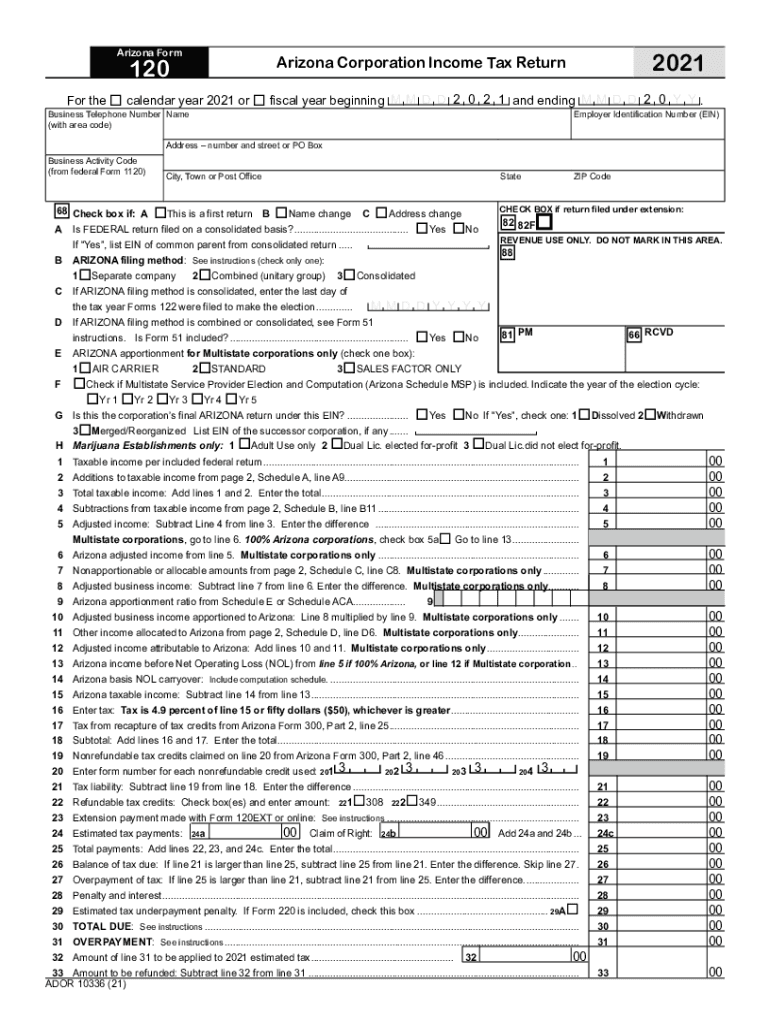

The Corporate Income Tax Highlights from the Arizona Department of Revenue (AZDOR) provide essential information for businesses operating in Arizona. This tax is imposed on the income of corporations, and understanding its nuances is crucial for compliance and financial planning. Key aspects include tax rates, deductions, and credits that can significantly affect a corporation's tax liability. Corporations must be aware of the specific requirements that apply to their business structure, as well as any recent changes in legislation that may impact their tax obligations.

Steps to Complete Corporate Income Tax Filings

Completing the Corporate Income Tax filing involves several important steps. First, businesses need to gather their financial records, including income statements and balance sheets. Next, they should determine their taxable income by calculating total revenue and subtracting allowable deductions. After calculating the tax owed, corporations must fill out the appropriate tax forms provided by the AZDOR. It is important to ensure that all information is accurate and that the forms are submitted by the designated deadlines to avoid penalties.

Key Elements of Corporate Income Tax Regulations

Understanding the key elements of corporate income tax regulations is vital for compliance. These elements include the applicable tax rates, which can vary based on the corporation's income level, as well as any available tax credits and deductions. Corporations may also need to consider specific rules regarding the allocation of income and expenses, especially for those operating in multiple states. Staying informed about these elements helps businesses optimize their tax strategies and ensure adherence to state laws.

Filing Deadlines and Important Dates

Corporations must be aware of important filing deadlines to maintain compliance with AZDOR regulations. Typically, the corporate income tax return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April 15. Additionally, estimated tax payments may be required throughout the year, with specific due dates that must be adhered to in order to avoid interest and penalties.

Required Documents for Corporate Income Tax Filing

When filing Corporate Income Tax, businesses must prepare and submit several key documents. These typically include the completed tax return form, supporting financial statements, and any schedules that detail deductions or credits claimed. Corporations may also need to provide documentation of estimated tax payments made during the year. Having all required documents organized and ready for submission can streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with corporate income tax regulations can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits by the AZDOR. In severe cases, non-compliance can lead to legal action against the corporation. It is crucial for businesses to understand these penalties and take proactive measures to ensure timely and accurate filings to avoid unnecessary financial repercussions.

Eligibility Criteria for Corporate Income Tax Filings

Eligibility criteria for corporate income tax filings in Arizona typically include the nature of the business entity and its income level. Corporations must be registered with the AZDOR and meet specific thresholds for taxable income to be subject to the corporate income tax. Additionally, certain exemptions may apply depending on the type of business activities conducted. Understanding these criteria helps corporations determine their tax obligations and ensure compliance with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct corporate income tax highlightsarizona department of revenue azdor

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax highlightsarizona department of revenue azdor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Corporate Income Tax Highlights from the Arizona Department of Revenue (AZDOR)?

The Corporate Income Tax Highlights from the Arizona Department of Revenue (AZDOR) include key information on tax rates, deductions, and credits available to businesses. Understanding these highlights can help companies optimize their tax obligations and ensure compliance. For detailed insights, businesses should refer to the AZDOR's official resources.

-

How can airSlate SignNow help with Corporate Income Tax documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to Corporate Income Tax. By using our platform, businesses can ensure that all necessary tax forms are completed and submitted efficiently. This reduces the risk of errors and helps maintain compliance with the Arizona Department of Revenue (AZDOR).

-

What features does airSlate SignNow offer for corporate tax filings?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for corporate tax filings. These tools help businesses manage their Corporate Income Tax documents effectively. Additionally, our platform integrates seamlessly with various accounting software to enhance productivity.

-

Is airSlate SignNow cost-effective for small businesses handling Corporate Income Tax?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their Corporate Income Tax needs. Our pricing plans are flexible and cater to different business sizes, ensuring that even small enterprises can access essential eSigning features. This affordability helps businesses save on administrative costs while staying compliant with the Arizona Department of Revenue (AZDOR).

-

Can airSlate SignNow integrate with accounting software for Corporate Income Tax purposes?

Absolutely! airSlate SignNow integrates with various accounting software, making it easier for businesses to manage their Corporate Income Tax documentation. This integration allows for seamless data transfer and ensures that all tax-related documents are readily accessible. By using our platform, businesses can enhance their efficiency and compliance with the Arizona Department of Revenue (AZDOR).

-

What benefits does airSlate SignNow provide for corporate tax compliance?

airSlate SignNow offers numerous benefits for corporate tax compliance, including secure document storage, easy access to eSigned documents, and automated reminders for filing deadlines. These features help businesses stay organized and ensure they meet their Corporate Income Tax obligations on time. Compliance with the Arizona Department of Revenue (AZDOR) becomes simpler with our user-friendly platform.

-

How does airSlate SignNow ensure the security of Corporate Income Tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive Corporate Income Tax documents. Our platform employs advanced encryption and secure cloud storage to protect all data. This commitment to security helps businesses feel confident that their documents are safe while complying with the Arizona Department of Revenue (AZDOR).

Get more for Corporate Income Tax HighlightsArizona Department Of Revenue AZDOR

- State form 56317

- The self employment assistance program seap individual services plan the self employment assistance program seap individual form

- Peach state cadillac ampamp lasalle club past events form

- Get the membership form bcallaway countyb democrats pdffiller

- Skm55821100717000 form

- Calla varner scholarship application form

- Authorization for release of employment scusd form

- Dispute resolving board drb review request form

Find out other Corporate Income Tax HighlightsArizona Department Of Revenue AZDOR

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself